Peer-to-peer trading, also known as P2P, is the most profitable way to buy and sell cryptocurrency. Transactions are available 24/7, and you can buy coins without commissions for amounts from 1,000 to 1,000,000 rubles. However, the P2P sphere attracts the attention of scammers who use various schemes to deceive users. Before starting work on P2P platforms, it is recommended to familiarize yourself with common fraud methods in this area. We will also try to tell you how not to fall for scammers and not to take risks with Peer to Peer exchange using the example of the most popular ByBit platform.

Peer-to-peer trading, also known as P2P, is the most profitable way to buy and sell cryptocurrency. Transactions are available 24/7, and you can buy coins without commissions for amounts from 1,000 to 1,000,000 rubles. However, the P2P sphere attracts the attention of scammers who use various schemes to deceive users. Before starting work on P2P platforms, it is recommended to familiarize yourself with common fraud methods in this area. We will also try to tell you how not to fall for scammers and not to take risks with Peer to Peer exchange using the example of the most popular ByBit platform.

How Scammers Trick Users on P2P

Fake checks and fake messages

One of the simplest but most effective methods of fraud on P2P platforms is to violate the terms of the transaction. The fraudster creates an attractive offer to buy cryptocurrency at an inflated rate, which is significantly higher than the market rate. This attracts sellers, and they often lose their vigilance at the sight of such a profitable opportunity.

The fraudster then transfers the conversation to a third-party messenger, where he sends the seller a fake check supposedly about payment and asks to transfer him cryptocurrency as soon as possible or confirm the transaction on the platform. However, this wallet belongs to the fraudster himself, and the platform does not have access to it to block the transaction. When the victim realizes that she has been deceived, she contacts the platform support for help, but it is no longer possible to return the funds.

It is possible to forge not only a screenshot of the transfer, but even an SMS from the bank. Therefore, it is important to make sure that the funds are received in the banking application.

Triangle diagram

Even for experienced traders, one of the scariest scenarios is a scam known as a “triangle” or “triangle.” The name comes from the fact that the scheme involves two victims. Here’s how it works:

- The fraudster places two ads: one on a P2P platform to buy a certain amount of cryptocurrency, and the second, for example, on Avito, to sell some goods, say, a bicycle.

- On the P2P platform, he finds a seller who is willing to sell cryptocurrency at the price offered by the fraudster. The seller gives the fraudster his bank card details to transfer rubles as payment.

- Meanwhile, on Avito, there is also a buyer interested in purchasing a bicycle. The fraudster gives this buyer the card number of the trader from the P2P platform and asks to make an advance payment for the goods.

- The buyer from Avito transfers money to the specified card, but never receives the promised bicycle.

- The trader on the P2P platform sees the money being received on his card and believes that the purchase is complete, so he sends the coins to the fraudster's wallet.

- The fraudster receives the cryptocurrency, and the trader faces serious problems: the buyer of the bike contacts the police, believing himself to be a victim of fraud. Formally, it turns out that the trader received the payment, but did not send the goods, which makes him a suspect in fraud.

There are different variations of the triangle scheme. For example, the scammer can place both ads on the same P2P platform: one for buying, one for selling. Or the ads can be placed on different platforms, or the scammer can manipulate the other user into opening and paying for the order at the right time. As a result, the seller of the cryptocurrency receives two identical orders: one is paid, and the other is not yet paid. The seller sends the cryptocurrency to the scammer, thinking that the transaction is complete.

In each of these situations, the same scam is used: both victims are connected, and one of them is subsequently prosecuted, despite being the victim of the scam.

Money laundering

A laundromat, similar to the "triangle" scheme, is a fraudulent scheme for laundering illegally obtained funds through cryptocurrency. Fraudsters use the money stolen from victims to purchase digital assets. In this case, the seller of the cryptocurrency, not knowing anything about the origin of these funds, actually acts as an intermediary ("drop") helping to legalize the stolen money, and may be under suspicion from law enforcement agencies.

Fake P2P sites

Despite numerous warnings about the risks of phishing and fake sites, many users continue to fall for promises of quick money. Fraudsters actively use bot accounts to send links to exchangers in thematic groups of Telegram and other messengers. These links lead to:

- Clone sites of popular P2P platforms;

- Phishing resources that imitate non-existent P2P services.

Exchangers of this kind are distinguished by greatly underestimated or overestimated rates, which creates the illusion of the opportunity to earn money on arbitrage. To begin with, fraudsters can allow their victims to successfully conduct several arbitrage transactions between different exchanges and exchangers, recommending profitable combinations. Then they persuade users to increase the volume of transactions, and when the rates become high, the exchanger stops responding. The victims are left without their funds, and the fraudsters switch their attention to new potential clients.

Forgery of seller names

Sometimes scammers create fake accounts on P2P platforms, copying the names and nicknames of well-known and reliable merchants — professional market participants working with large volumes of cryptocurrency. They transfer transaction communication to third-party messengers, such as Telegram, Avito or WhatsApp. Users who have previously successfully cooperated with real merchants do not notice the catch and fulfill their obligations under the transaction — transfer coins or rubles. However, after receiving the funds, the scammer disappears, stopping all communication. When the victim contacts the platform for support, it turns out that the platform cannot help in any way, since the transaction was carried out outside their control.

Remember that evidence of fraud collected outside the platform (for example, screenshots of correspondence or receipts for payment to third-party accounts) is not accepted by the P2P platform support service to consider your case. Therefore, it is strongly recommended not to switch to other services to discuss issues related to P2P transactions.

Phishing AML services

A new method of stealing cryptocurrency from P2P platform users has recently emerged. The scammer contacts the seller and offers to buy coins, but sets a condition: the cryptocurrency must pass a purity check, and the sale is only possible from a non-custodial wallet.

The seller, hoping to quickly complete the transaction, sends the coins to the specified non-custodial wallet. Then the scammer asks to check the wallet through the AML service, claiming that he only needs “clean” coins. To do this, he provides a link to a fake website of a popular AML service. To use this service, the seller needs to connect his wallet, although no known AML service requires such actions - it is enough to specify the wallet address.

By connecting your wallet to such a site, you inadvertently give the attackers full control over your funds. All assets in your wallet will be immediately stolen. Moreover, any future replenishments will also be at risk. Thus, connecting to such a fraudulent resource means transferring your entire wallet balance into the hands of criminals.

Use only trusted services for AML verification, such as AmlBot. Never connect your non-custodial wallet to AML services, as this is not required to verify your funds. On normal services, you can check the cryptocurrency simply by entering the wallet address.

Fishing scheme

When a seller decides to sell cryptocurrency, they notice an attractive offer to buy at a favorable rate, agree to the terms and provide payment details. However, an incomplete amount is credited to the account, and it turns out that during the transaction the rate has changed to a much less favorable one.

The fact is that the fraudster has time to change the offer price while the seller is distracted or in a hurry. The scheme is based on a trick: the fraudster lures the victim with an attractive rate, and then quickly changes it during the transaction.

To avoid such troubles, it is important to closely monitor the transaction rate both in the ad itself and in the transaction details. Some platforms set limits on acceptable rate fluctuations (for example, no more/less than 10% of the market value of the coin), which helps protect users from sudden price changes.

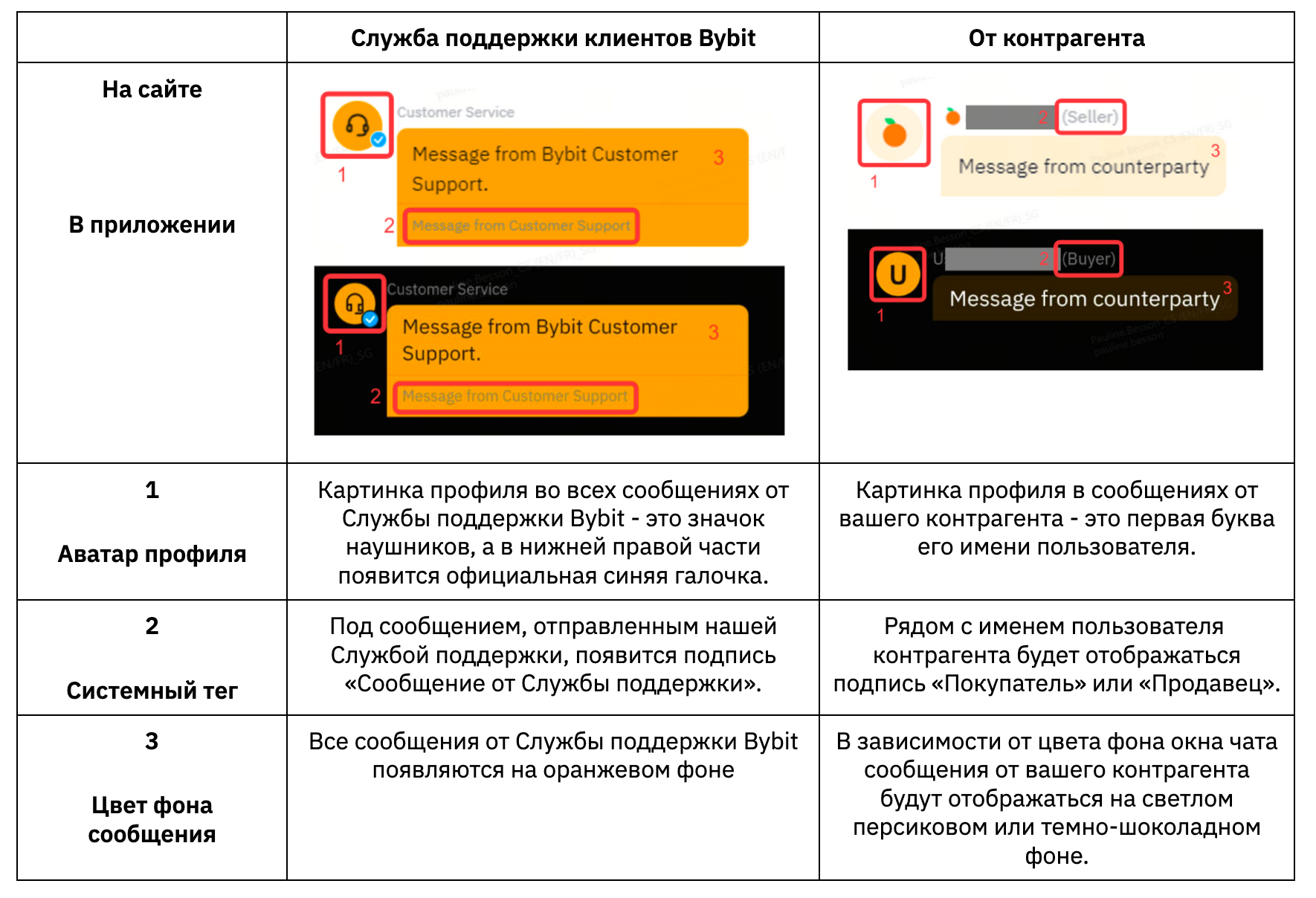

Fake messages from P2P platform support service

Fraudsters create clones of P2P platform support accounts in Telegram that are visually similar to the originals, or send emails from email addresses similar to the official ones. Their goal is to get the user's funds once or completely take over their account on the platform.

In one of the options, fraudsters can ask a P2P trader to send them money under the pretext of verification. In another, they can request an access code to link a web account to a Telegram bot, again hiding behind the need for verification.

If the interaction occurs via email, fraudsters can send a phishing link to a fake platform site, where the user will enter their real login details. Having seized access, the attackers will transfer all the funds and disappear.

It is recommended to carefully check the email address and Telegram account from which the correspondence is being sent, because the real support service rarely initiates contact first.

Another example of a fraudulent scheme: during an exchange on the platform, attackers, pretending to be support service representatives, can convince the cryptocurrency seller to transfer funds without waiting for fiat to arrive. It is important to carefully study the source of the messages and make sure that it is really the administrator.

Examples of what messages from the support service and from the seller look like when making an exchange on the ByBit P2P market:

Double Deals

A cryptocurrency seller is attracted by two offers to buy for the same amount, both using the same payment system. The seller then receives the amount in fiat, and the first buyer claims to have made the payment. The seller sends him the cryptocurrency.

Soon, the second buyer also claims to have made the payment, but the money does not actually arrive. The seller refuses to send the cryptocurrency, but the second buyer presents a screenshot, supposedly confirming the transfer of fiat. In reality, these buyers are acting together: the first fraudster receives the cryptocurrency thanks to the payment made by the second "honest" buyer. The seller finds himself in a difficult position, since he actually transferred the cryptocurrency to the wrong person who made the payment.

To prevent such fraud, it is recommended to additionally ask buyers for supporting documents: payment information, phone number or bank card number.

Error transaction

The attacker may try to cancel the completed transaction to get their money back. To do this, they contact the bank or payment system through which the payment was made, and sometimes Binance technical support. The fraudster claims that the transfer was made by mistake or that their account was hacked. If they manage to cancel the payment, they keep both the received cryptocurrency and the returned money.

When conducting P2P transactions, it is recommended to take screenshots of all transactions, especially for large amounts. It is also useful to request a receipt and its screenshot from the counterparty. These materials will help in case of disputes and will become evidence in proceedings.

How to avoid getting scammed when exchanging cryptocurrency using P2P?

It is impossible to completely avoid the risk of fraud in P2P transactions with cryptocurrencies, as in any other areas. However, it is quite possible to minimize the likelihood of becoming a victim. To do this, it is enough to follow simple recommendations and not succumb to the temptation of easy money:

- Always negotiate with counterparties only through the built-in chat of the P2P platform. Avoid switching to third-party messengers, even if you are persistently asked to do so.

- Never connect your wallet to unfamiliar AML services, especially if this is the initiative of the cryptocurrency buyer.

- Check the reputation of the counterparty on the P2P platform: pay attention to the number of transactions they have made and the percentage of successful closures.

- Do not trust strangers who write personal messages in messengers and offer “too profitable” arbitrage schemes, recommend using little-known exchangers or P2P platforms.

- Compliance with these rules will help reduce risks and secure your financial transactions.

- Do not deal with sellers whose exchange rates are much more favorable than most others. It is very likely that such a seller will be a fraudster.

List of popular P2P sites

- ByBit P2P

- OKX P2P

- Binance P2P

- KuCoin P2P

- BingX P2P

- MEXC P2P

- Telegram P2P - the Telegram crypto wallet has its own P2P market.

Which P2P market to choose?

We recommend using P2P platforms of the largest cryptocurrency exchanges, such as ByBit P2P.

Bybit offers a convenient and secure P2P platform for buying and selling cryptocurrency. It allows users to directly trade digital assets with each other under agreed terms, bypassing intermediaries and avoiding fees. The platform offers over 570 payment methods and over 60 local currencies, providing flexibility and convenience for users.

Bybit P2P platform is equipped with a state-of-the-art security system, including artificial intelligence and strict risk control measures. Users can set their own trading conditions regarding price and payment methods, and enjoy 24/7 support.

The main advantages of Bybit P2P:

- No transaction fees (0%).

- A variety of payment methods - over 570 options.

- 24/7 support and a high level of security.

- The ability to independently determine the terms of transactions.

- Availability on computers and mobile devices.

- In addition, Bybit is one of the leading crypto exchanges by trading volume and offers a wide range of instruments for trading over 300 cryptocurrencies and derivatives.

Bybit offers a number of mechanisms and approaches to ensure user security:

- Rating and Reviews: Users can assess the credibility of potential trading partners based on their ratings and reviews on the platform. This helps make informed decisions when choosing a counterparty.

- Escrow Service: Bybit uses an escrow service that temporarily locks cryptocurrency during a transaction. This increases the security of transactions, protecting the interests of both the buyer and the seller.

- Customer Support: In case of disputes or problems, users can contact Bybit's customer support, which will help resolve conflicts.

- Counterparty Verification: It is recommended to carefully study the profile, rating, transaction history, and reviews of the counterparty before entering into a transaction. Particular attention should be paid to new users or those with a small number of transactions.

- Request for data verification: Do not hesitate to ask the counterparty to provide additional information or confirm their data if you have any doubts. This will help ensure the reliability of the transaction.

- Cautious attitude to requirements: It is important to remain calm and not succumb to pressure from the counterparty requiring urgent action. Each stage of the transaction should be carefully analyzed to avoid fraudulent schemes.

These measures help ensure safety and confidence when conducting P2P transactions on the Bybit platform.