If you look up mining on Wikipedia, you'll see that it comes from English and means "extraction" of valuable minerals. In the case of cryptocurrency, mining refers to the process of extracting digital currency. Although the term "mining" was originally used for the mining industry, such as mining for gold, it's now commonly used to describe the process of mining Bitcoin and other cryptocurrencies. This may be because Bitcoin was often compared to gold due to its scarcity and value. However, the process of mining digital currency is fundamentally different from mining precious metals and has nothing to do with it.

In cryptocurrency, mining involves securing and ensuring the integrity of the blockchain network by creating blocks of data. The rewards received by miners in the form of cryptocurrency for creating blocks is a secondary function that serves more as a motivation and is not necessary for the functioning of the cryptocurrency. The payment for mining is determined by the cryptocurrency code during its creation and can vary widely depending on the developer's wishes. The method of cryptocurrency mining can also vary greatly from project to project. Therefore, we'll delve into each method of mining in more detail to give you a complete understanding of what cryptocurrency mining is really all about.

What is Premine?

First, let's consider when cryptocurrency mining can occur without any equipment at all.

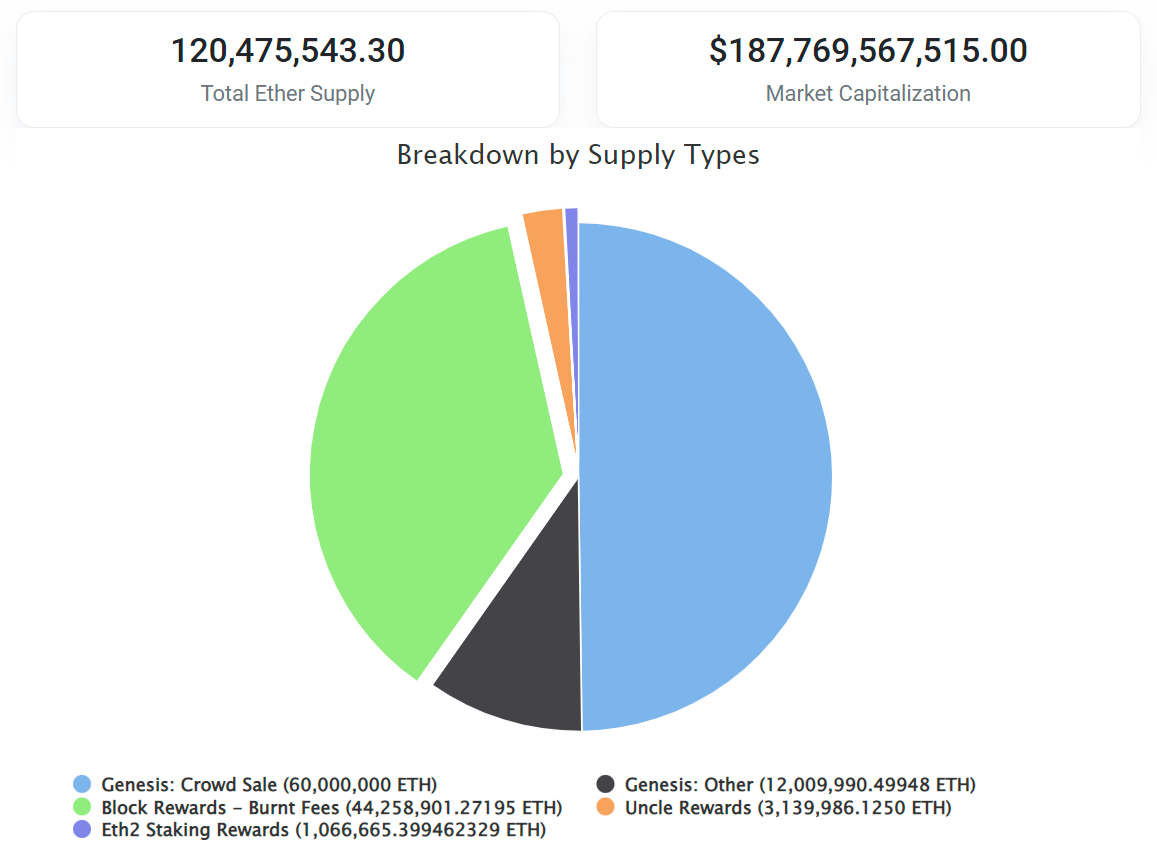

Pre-mine is used by cryptocurrency developers quite often as it allows them to put some portion of the entire cryptocurrency or even the whole cryptocurrency on the developers' wallet during the launch in the so-called Genesis block. The Genesis block or the zero data block is where any blockchain-based cryptocurrency starts operating. For example, Bitcoin is a cryptocurrency without pre-mine, while Ethereum used a pre-mine of 72 million ETH coins, 12 million of which were given to the developers and 60 million were distributed to investors in the initial coin offering (ICO). 72 million ETH coins is a very significant amount, as miners have received just over 44 million ETH since the mining of this cryptocurrency started in 2015.

Ethereum Coin Distribution as of March 2023

Some cryptocurrency developers use pre-mine to put a portion of the total cryptocurrency or the entire currency on the developers' wallet at the launch of the so-called Genesis block. The Genesis block, or the first block of data, starts any blockchain-based cryptocurrency. For example, Bitcoin is a cryptocurrency without pre-mine, while Ethereum used a pre-mine of 72 million ETH coins, with 12 million going to developers and 60 million being distributed to investors through an initial coin offering (ICO). 72 million ETH coins are a significant amount, as miners have received just over 44 million ETH since the cryptocurrency was launched in 2015.

Developers typically keep a portion of the pre-mine, while the remaining pre-mined coins go towards paying investors who invested before the coin's launch via an ICO or initial exchange offering (IEO), paying for advertising, or distributing them among fans who follow the project and receive a portion of the pre-mine through an airdrop.

Some may argue that this is not mining at all, but if the method ultimately leads to a block being recorded on the blockchain, albeit a zero block, and cryptocurrency appearing in your balance, then such methods can also be considered as cryptocurrency mining. Therefore, in our opinion, pre-mine is also a form of cryptocurrency mining, although it does not reflect the established definition of mining that you may read or hear. And all participants in this process (developers, investors, airdrop recipients) can also be formally called miners.

POW, POS, and POC mining.

If we have already talked about pre-mining, then the mining itself can also be divided into several categories.

The first type of mining is POW (Proof-of-Work), which is the classic cryptocurrency mining using CPU, GPU, ASIC, or FPGA, where all these devices perform work to find a block to be recorded in the blockchain. More specifically, what a mining rig does during mining can be read in this article: What does a computer do when mining cryptocurrencies in simple words. For effective POW mining, miners buy expensive and modern equipment to increase their hash rate in the network. The higher the hash rate compared to all miners, the more reward you receive for mining. The most famous cryptocurrency with POW mining is Bitcoin.

The second most popular type of mining is POS (Proof-of-Stake), in which high-performance equipment and a lot of electricity are not required, but a regular server is enough. But at the same time, you need to buy a certain amount of cryptocurrency and launch software (a node or validator) to maintain the network's operation. In this case, the deposit or staking of the cryptocurrency serves the same purpose as the hash rate for regular mining, i.e., the more you invest in POS mining of cryptocurrencies, the more income you will get. The most famous cryptocurrency with POS mining is Ethereum.

The third type of cryptocurrency mining is POC (Proof-of-Capacity). It is used in Burst, Chia, Storj projects, but it is far behind the first two options in popularity. Free space on HDD or SSD disks is used as proof of stake, i.e., POC is closer to POW mining, where you also need to constantly buy new equipment to compete with other miners.

The list of types of mining on POW, POS, and POC is not limited, as there are several different ways of mining cryptocurrency, but they are extremely rare and used in little-known projects.

Much more often, you can find various variations of POW and POS mining. For example, the TONcoin project was originally designed for POS mining, but in the first year of existence, it could also be obtained using video cards for POW mining.

Bitcoin mining

As an example of cryptocurrency mining, let's consider Bitcoin mining, as the first and most popular cryptocurrency in the world. As we have already mentioned, Bitcoin mining is based on the POW consensus, which means that computer equipment searches for hash sums to meet certain conditions and obtain permission to write a block of data in the blockchain. As a reward for writing a block (finding the required hash sum), 6.25 bitcoins are credited to the miner's wallet. The reward for mining BTC decreases every 4 years (or every 210,000 blocks) by exactly half. The process of reducing the reward is called Bitcoin halving (halving - a literal translation of division in half). At the beginning of Bitcoin's existence in 2009, the reward for a block was 50 BTC, and the first halving occurred in 2012 when the reward decreased from 50 to 25 bitcoins. In 2020, the last third halving took place, and the next one will be in 2024 when the reward for a Bitcoin block will already be 3.125 BTC. Due to the constant reduction in the reward for mining, by 2032 (the sixth halving), miners will have extracted 99% of all bitcoins, and by 2140, all 100% of bitcoins in the amount of 21 million coins will be mined.

After the last bitcoin is found, mining may not seem to end. Since a fee in bitcoins is required to transfer BTC from one wallet to another. The transaction fee does not expire but is paid to miners along with the reward for finding a block. Thus, in the future, when payment for blocks ends or becomes insignificant, miners will receive a reward only from the commissions in the Bitcoin network.

For other cryptocurrencies, a similar mechanism is used for paying miners for blocks plus a commission with minor variations. For example, some of the commissions may be burned rather than transferred to miners.

Since Bitcoin is the first cryptocurrency, it has gone through all the stages of POW mining development from CPU to ASIC devices gradually. You can try to mine Bitcoin on a CPU, graphics card, FPGA, or ASIC, but you can practically earn only if you use the latest generation of ASICs. In all other cases, the hashrate on the SHA-256 algorithm will be so small that you won't even be able to pay for electricity costs. In this case, it is recommended to buy Bitcoin instead of experimenting with outdated BTC mining equipment.

Mining on processors (CPU)

The first POW mining was available for X86 AMD and Intel processors, as the CPU mining process could be launched immediately in the Bitcoin Core wallet, which appeared together with Bitcoin itself. Since simple algorithms are used during cryptocurrency mining, they can easily be calculated even on the simplest cores. Because of this, over time, mining on CPUs remained only for specialized mining algorithms (RandomX, GhostRider), which were originally developed for CPU mining using specific X86 platform functions. All other algorithms are much more efficiently processed using graphics cards, which contain several thousand computational blocks instead of several dozen in central processors. In addition to built-in miners in wallets, there are also independent programs for CPU mining, which are usually more efficient. Also, Windows or Linux operating systems are required for CPU mining.

Mining on video cards (GPU)

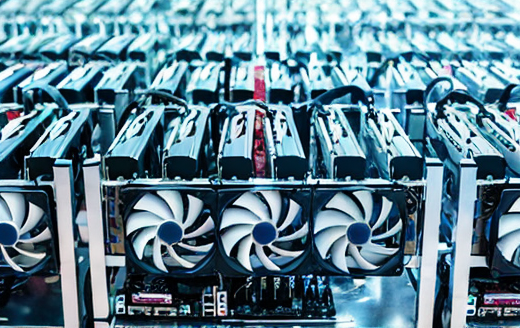

Mining on video cards is currently the most popular and widespread way of mining cryptocurrencies. While specialized ASIC miners exist for popular mining algorithms like SHA-256 and scrypt, many other algorithms for which creating an ASIC miner is not economically feasible, video cards are used as a universal option. Specialized software called miners is required for mining on video cards, which supports a specific model of video card and algorithm. Like mining on CPUs, mining on video cards will not work without using an operating system and special drivers from AMD or Nvidia.

Mining with ASICs

An ASIC Miner is a complete device that works out-of-the-box with minimal configuration options. Usually, ASIC setup refers to specifying the payout wallet and pool address. Due to their simplicity in setup and installation, ASIC miners are commonly used in industrial cryptocurrency mining. The main drawbacks of such mining devices are their ability to only work with a single mining algorithm and high noise levels. The narrow specialization of ASIC miners for a specific mining algorithm allows them to be much more energy-efficient than graphics cards and processors..

FPGA mining

Mining on FPGA or programmable logic devices is similar to mining on graphics cards, as FPGAs can be reprogrammed for any algorithm. However, due to the high cost of such a solution and difficulties in creating specialized firmware, these solutions have not gained widespread use.

Mining on SSD and HDD

Mining on SSD and HDD is used in cryptocurrencies with proof-of-stake consensus. The advantage of such mining is the ease of scalability (multiple HDDs can be connected to a single computer) and low energy consumption.

Mining Algorithm

A mining algorithm is a hash function used to transform an array of data into an encrypted string. Encryption occurs according to a specific algorithm, of which there are a huge number, such as SHA-256 for Bitcoin or Dagger-Hashimoto for Ethereum POW. In cryptocurrency mining, several algorithms are often used for sequential encryption, and by changing the order, different mining algorithm names are obtained, such as Equihash and Cryptonight.

Mining pool

A website or software that combines multiple miners into one shared node to increase the overall hashrate, allowing them to compete with larger miners and other pools for block discovery and reward. Learn more about mining pools in the article How to choose a cryptocurrency mining pool

Operating systems for mining

Operating System or OS is an essential component for any GPU or CPU mining rig, without which the computer simply won't function. For mining, both regular home operating systems (Windows, Linux, MacOS) and specialized ones created specifically for miners are used. More details on choosing an OS for mining can be found in another article: Choosing OS for mining cryptocurrencies on video cards

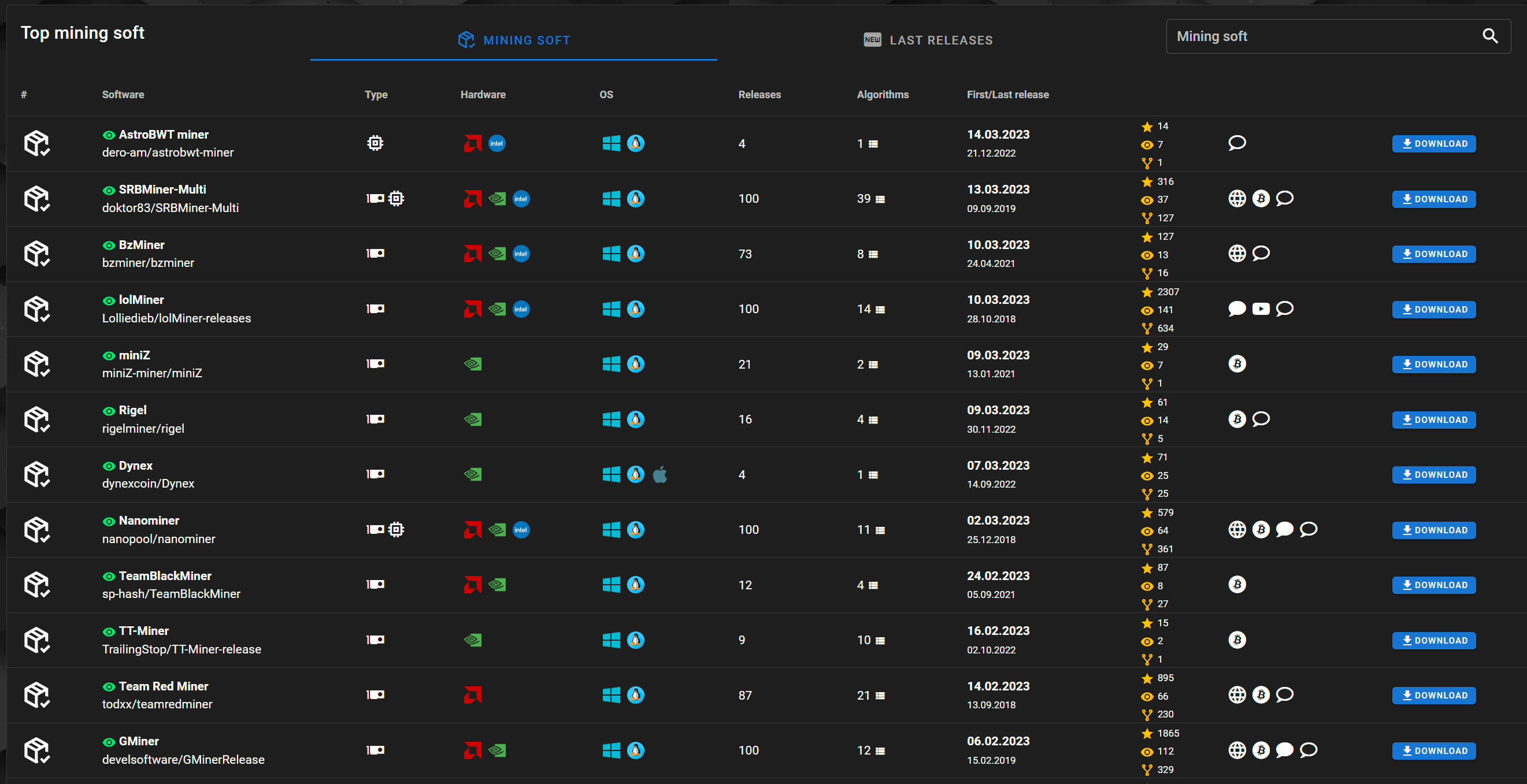

Mining software (wallets, miners, drivers)

In addition to the operating system, other software is also required, such as drivers for internet access, drivers for graphics cards, mining software, and cryptocurrency wallets. You can find a suitable miner for your hardware and cryptocurrency on the Profit-mine.com website.

For beginners, it is better to use "lightweight" multi-currency wallets or crypto exchanges as wallets. Wallets can be software or hardware. The level of protection is significantly higher for hardware wallets, but to use them, you must first purchase them from a trusted supplier or on the company's official website. Examples of hardware wallets are Ledger, SafePal, TrustWalle. Examples of software wallets are Metamask, Electrum, Coinomi, and MEW Wallet. Instead of wallets, you can use crypto exchanges, through which you can not only exchange your assets but also withdraw the earnings from mining to your bank card. Examples of crypto exchanges include Binance, Bybit, Huobi, MEXC. For the latter two, it is not mandatory to send documents for verification.

What is a mining farm and a mining rig

Many people confuse the concepts of a mining rig and a mining farm. To avoid falling victim to this confusion, remember that a mining rig is a single device (a computer with graphics cards), whereas a farm is a location where several mining rigs or ASICs are placed.

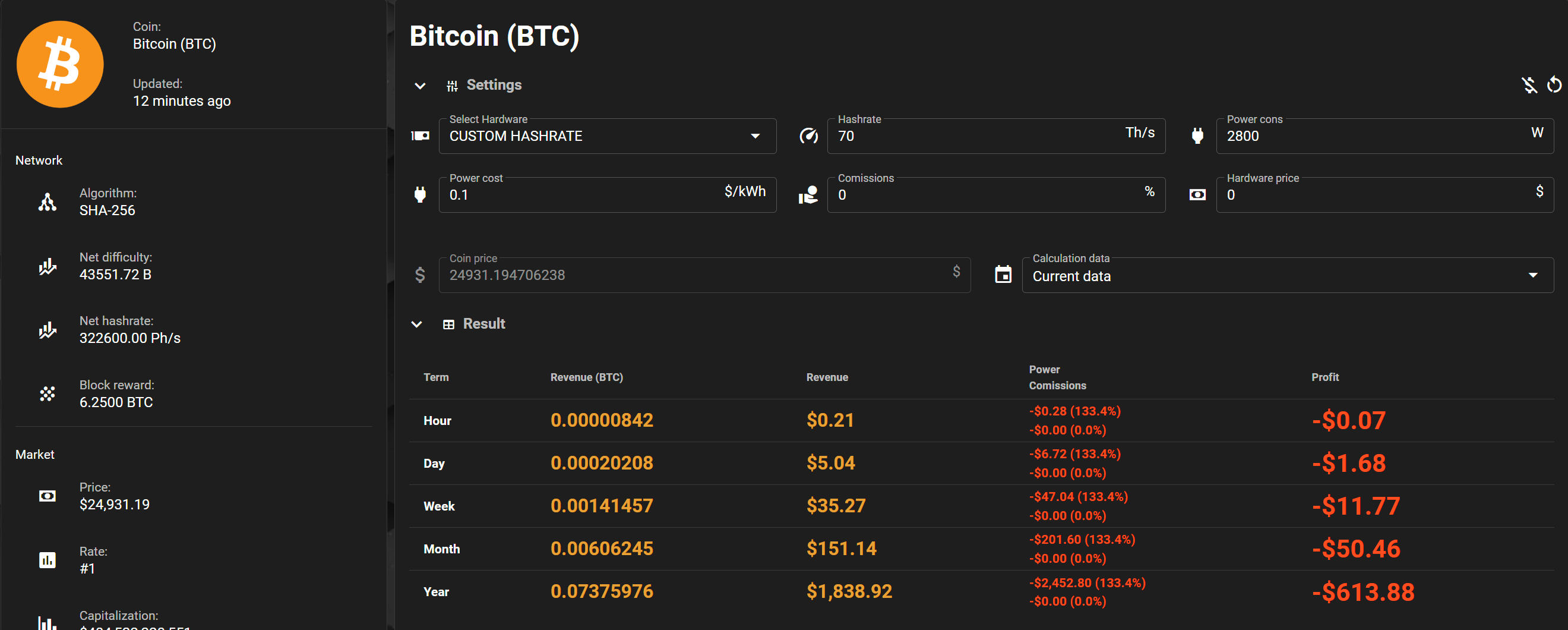

Mining calculator, income calculation

To conclude, we have probably left the most important point for those who have decided to venture into cryptocurrency mining on their own, as calculating the economic feasibility of purchasing mining equipment is the first thing to consider. Calculating the equipment's payback period is not complicated - you need to know the price of the equipment, the price of electricity, and the coin's value. Next, you need to find out the block time for the chosen coin to mine, the number of coins in the block, the overall network hashrate, and your equipment's hashrate.

The formula for calculating payback period is:

S = VT1440*Z/H, where

V - Block size

T - Block time

1440 - Number of minutes in a day

H - Network hashrate

Z - Your hashrate

S - Number of coins

You can substitute your own data and get the number of coins, which you then multiply by their price. From this sum, subtract your expenses on electricity and other associated costs.

To save time on calculating the payback period for each cryptocurrency that interests you, you can easily find specialized mining calculator services online that will do everything for you in a matter of seconds. All you need to do is select your graphics card, processor, or ASIC model. Profit-mine.com is one of the best online mining profitability calculators, especially since it is completely free and has a clear and beautiful interface.

Conclusion: Mining cryptocurrencies may seem complex and difficult at first glance, but once you understand the terminology and spend some time experimenting with setting up your computer to work with a mining pool and wallet, you will see that mining cryptocurrencies is not actually difficult, especially if you have experience with building personal computers and installing operating systems and software on them.