In 2025, cryptocurrencies remain one of the most promising tools for generating passive income. With the rising popularity of decentralized finance (DeFi) and the development of crypto exchanges, investors have gained access to a wide range of ways to put their assets to work. From staking and deposits to complex structured products, the opportunities for earning are becoming increasingly diverse. This article provides a detailed overview of the best crypto exchanges offering passive income tools, based on current market data and trends. It is tailored for users seeking reliable and profitable solutions.

In 2025, cryptocurrencies remain one of the most promising tools for generating passive income. With the rising popularity of decentralized finance (DeFi) and the development of crypto exchanges, investors have gained access to a wide range of ways to put their assets to work. From staking and deposits to complex structured products, the opportunities for earning are becoming increasingly diverse. This article provides a detailed overview of the best crypto exchanges offering passive income tools, based on current market data and trends. It is tailored for users seeking reliable and profitable solutions.

Why Is Passive Income on Crypto Exchanges So Popular?

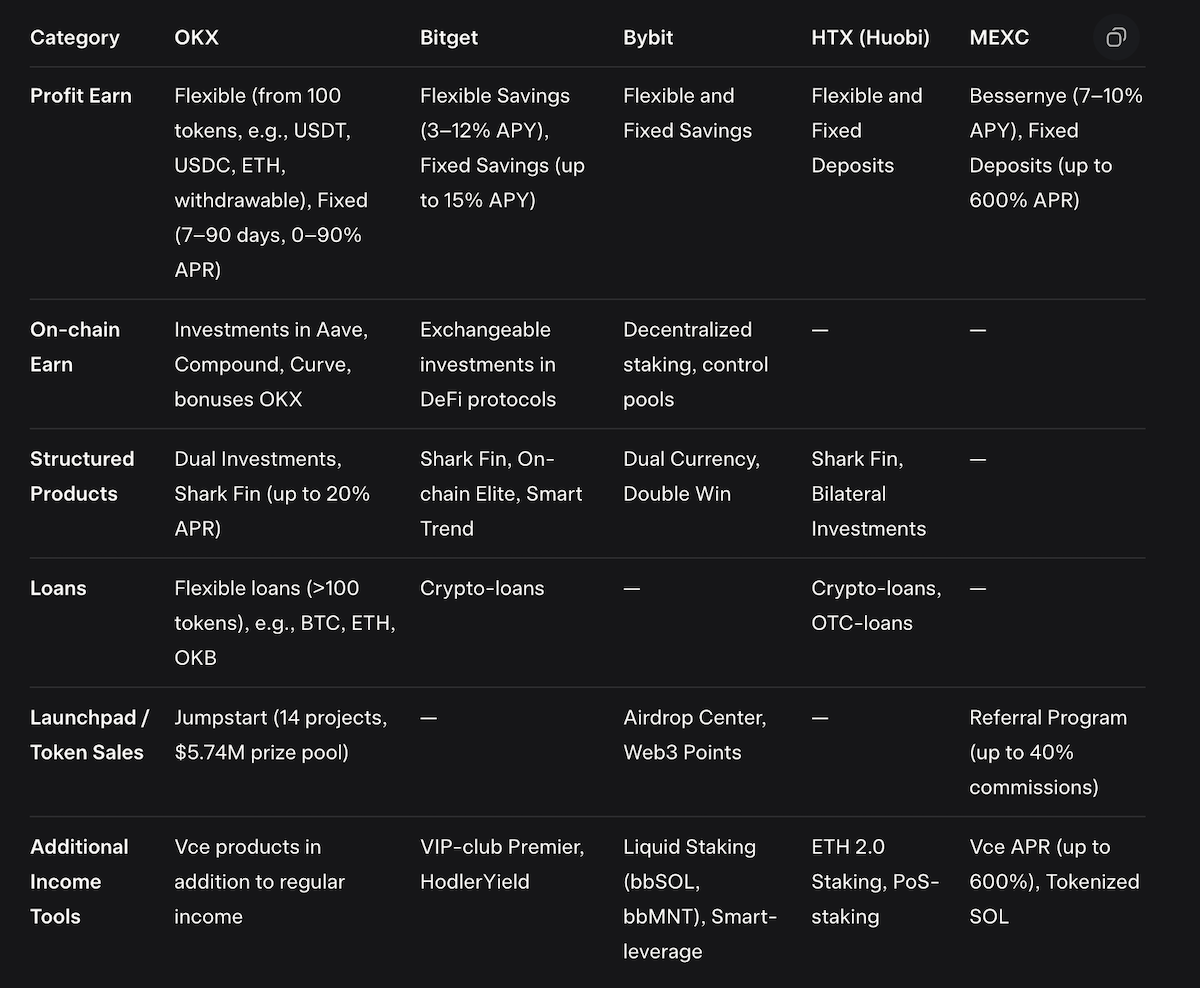

Passive income on crypto exchanges attracts both beginners and experienced investors due to its low entry threshold, flexibility, and potentially high returns. Unlike traditional bank deposits, crypto exchanges offer annual percentage rates (APR) ranging from 3% to hundreds of percent for certain products. However, high returns come with risks: asset volatility, smart contract vulnerabilities, and market factors require careful analysis. We will explore the tools offered by five leading platforms— OKX, Bitget, Bybit, HTX и MEXC —to help you choose the best option for your goals.

OKX: A Leader in Passive Income Tools

OKX — is one of the most versatile platforms for passive income. All tools are conveniently grouped in the "Earn" section, making navigation user-friendly, even for beginners. The platform offers flexible and fixed deposits, DeFi investments, structured products, and access to token sales.

OKX Passive Income Tools

- Simple Earn. Flexible Term: Invest from 100 tokens (USDT, USDC, ETH, etc.) and earn hourly profits. Funds can be withdrawn anytime without lockup. Fixed Term: Lock assets for 7–90 days with daily accruals and payouts at the end of the term. APR varies by asset. Advantages: Low entry threshold, no fees, transparent rates. Risks: Returns are not guaranteed; force majeure events may apply (see "Terms of Service").

- On-Chain Earn. Invest in vetted DeFi protocols (Aave, Compound, Curve) via OKX’s interface. High returns through liquidity pool diversification and platform bonuses. Risks: Smart contract vulnerabilities and DeFi protocol volatility.

- Structured Products. Dual Investments: Convert assets at a set rate with guaranteed returns. Shark Fin: Returns depend on asset price (e.g., 0.75–20% APR for BTC) with partial capital protection. Risks: Low APR in low-volatility markets; potential losses in extreme conditions.

- Loans. Flexible loans backed by over 100 tokens (BTC, ETH, OKB). Instant approval, floating APR, no penalties for early repayment.

- Jumpstart. Access to token sales (IDO/IEO) with high return potential. Requires OKB staking and platform activity. Stats: 14 projects, $5.74B in applications, 2.6M views. Risks: High volatility of new tokens, limited allocations.

Which OKX Product to Choose?

- Beginners: Flexible Simple Earn for simplicity and liquidity.

- Conservative Investors: On-Chain Earn or Shark Fin for diversification.

- Aggressive Investors: Jumpstart or Dual Investments for high potential.

- Liquidity Seekers: Flexible loans.

Why OKX? OKX stands out for its low entry threshold (from 100 tokens), transparent terms, and wide range of tools, including token sale access.

Bitget: Flexibility and Exclusive Solutions

Bitget caters to users of all experience levels, offering both simple and advanced passive income products with a focus on security and high returns.

Bitget Passive Income Tools

- Flexible Savings. Hourly or daily interest accrual, withdrawals without loss of profits, transparent rates, no hidden fees.

- On-chain Earn и On-chain Elite. Investments in DeFi protocols with daily payouts. On-Chain Elite offers enhanced returns for aggressive strategies. Advantages: Principal protection, high returns.

- HodlerYield. Support for WEETH, USDE, and BGSOL tokens for long-term holding with income.

- Shark Fin. Structured product with guaranteed capital and market-dependent returns.

- Smart Trend. Earn on market rises or falls with automated position management.

- Dual Currency Investments. Invest in two coins without capital protection but with high potential returns.

- Premier VIP Club. Exclusive products and recommendations for large investors.

- Wealth Management. Tailored portfolios for steady growth, ideal for VIP clients.

- Crypto Loans and Premier Loans. Flexible borrowing against assets, fast processing, and fund protection.

Which Bitget Product to Choose?

- Beginners: Flexible Savings for simplicity.

- Conservative Investors: Shark Fin or On-Chain Earn.

- Long-Term Holders: HodlerYield.

- VIP Clients: Premier or Wealth Management.

- Liquidity Seekers: Crypto Loans.

Why Bitget? Bitget offers diverse products, including exclusive solutions for large investors, with a focus on flexibility and security.

Bybit: Versatility and Web3 Integration

Bybit combines traditional and Web3 tools for passive income, catering to all investor types.

Bybit Passive Income Tools

- Savings and Staking. Flexible Savings: 3–12% APY, withdraw anytime. Fixed Savings: Up to 15% APY, 7–90 days, minimum 10 USDT. Staking: Participation in PoS networks (ETH Relativity, ADA, DOT) with flexible or fixed terms. Liquid Staking: Tokenized assets (e.g., bbSOL) with preserved liquidity.

- Dual Strategies. Dual Currency: Select asset pairs and strike prices for high APY potential. Double Win: Hybrid of deposits and options with capital protection.

- Advanced Solutions. Combines spot, futures, and staking. Smart Leverage for automated leverage management. Wealth Management for tailored portfolios.

- Liquidity and On-Chain Farming. Liquidity mining in AMM pools and decentralized staking via On-Chain Earn.

- Special Offers. Discounted Purchases: DCA strategies with bonuses. Airdrop Center: Free tokens for completing tasks. Web3 Points: Earn points for activity, redeemable for rewards.

Which Bybit Product to Choose?

- Conservative Investors: Fixed Savings, Wealth Management.

- Moderate Investors: Flexible Savings, Liquid Staking.

- Aggressive Investors: Double Win, Liquidity Mining.

- DeFi Enthusiasts: On-Chain Earn, Airdrop Center.

Why Bybit? Bybit excels with Web3 integration, tokenized staking, and a broad range of automated strategies.

HTX: Reliability and Tradition

HTX — one of the oldest exchanges, offers time-tested passive income tools focused on stability.

HTX Passive Income Tools

- Flexible and Fixed Deposits. Flexible: Daily payouts, free withdrawals. Fixed: Terms from 1 week, fixed APY.

- Shark Fin. Floating returns with partial capital protection.

- ETH 2.0 Staking. Support for Ethereum with automated payouts.

- PoS Staking. Flexible or fixed (30–90 days) staking for PoS coins.

- Dual Currency Investments. Earn from the movement of two coins, high returns with conversion risks.

- Loans. Crypto loans for margin trading; OTC loans for large clients.

Which HTX Product to Choose?

- Liquidity Seekers: Flexible Deposits.

- Stability Seekers: Fixed Deposits, Shark Fin.

- Ethereum Fans: ETH 2.0 Staking.

- Large Investors: OTC Loans.

Why HTX? Its reliability and proven products make it ideal for conservative investors.

MEXC: High Returns and Simplicity

MEXC stands out with short-term products offering extremely high APRs and flexibility.

MEXC Passive Income Tools

- Fixed Savings. Short terms (2–7 days) with APRs up to 600% (USDC, TON, TGT). Daily or end-of-term payouts.

- Perpetual Savings. Up to 10% APY (Ethena USDe, USDD, USDC), withdraw anytime.

- SOL Staking. Tokenized SOL (MXSOL, ~7.35% APY), flexible redemption.

- Referral Program. Up to 40% of trading fees from invited users.

Which MEXC Product to Choose?

- Beginners: Fixed Savings for quick returns.

- Liquidity Seekers: Perpetual Savings.

- Solana Fans: SOL Staking.

- Bloggers/Influencers: Referral Program.

Why MEXC? Extremely high APRs and simplicity make it attractive for short-term investments.

How to Choose the Best Exchange for Passive Income?

- Define Goals and Risk Tolerance. Low Risk: OKX (Flexible Earn, Shark Fin), Bitget (On-Chain Earn), HTX (Flexible Deposits). High Potential: MEXC (Fixed Savings), OKX (Jumpstart), Bybit (Double Win).

Liquidity: Bybit (Flexible Savings), MEXC (Perpetual Savings). - Consider Entry Thresholds: OKX and MEXC offer low entry points (from 100 tokens or 10 USDT). Bitget and Bybit suit larger investors with VIP products.

- Assess Risks: Asset volatility, smart contract vulnerabilities, and force majeure events can impact returns. Review platform terms and projects (especially for Jumpstart and DeFi) before investing.

Conclusion: OKX Leads for Passive Income

OKX stands out as the top choice due to its wide range of tools, low entry threshold, transparent terms, and unique features like Jumpstart. Bitget and Bybit offer flexibility and Web3 integration, HTX provides reliability, and MEXC delivers extremely high returns for short-term investments. The best platform depends on your goals: OKX and MEXC suit beginners with simple products, Bybit and Bitget cater to experienced investors with advanced strategies, and HTX appeals to conservative investors.

Start earning passive income today! Choose a platform, review its terms, and let your crypto assets work for you.

Other interesting materials on the topic of crypto exchanges

- Top crypto exchange Binance is losing its leadership

- How to Safely Farm Points for Airdrop on Electra Decentralized Exchange

- MEXC Exchange Introduces Zero Trading Fees on Some Coins Paired with USDT

- Exchange Token Comparison: Benefits of Owning GateToken (GT)

- An Islamic account under Sharia law on the Bybit crypto exchange

- ByVotes - a new service from the ByBit exchange for passive income

- Licensed crypto Exchanges in the UAE

- BingX Exchange Launches First Launchpool

- The most profitable referral ID (code) for registration on the Binance exchange for spot and futures trading

- Choosing a cryptocurrency exchange for trading bitcoin futures

If you're interested in more content like this, be sure to subscribe to our Telegram channel for additional insights and updates.