The cryptocurrency market continues to evolve at an unprecedented pace, offering traders increasingly sophisticated tools for analysis and asset management. In 2025, the spotlight is on platforms that not only help traders track market trends but also enable data-driven decisions through blockchain insights, market sentiment analysis, and technical tools. We've compiled a list of key tools to help you stay ahead in the world of crypto trading.

The cryptocurrency market continues to evolve at an unprecedented pace, offering traders increasingly sophisticated tools for analysis and asset management. In 2025, the spotlight is on platforms that not only help traders track market trends but also enable data-driven decisions through blockchain insights, market sentiment analysis, and technical tools. We've compiled a list of key tools to help you stay ahead in the world of crypto trading.

Trading Platforms

To succeed in trading, choosing a reliable platform is essential. In 2025, Binance, Bybit, and OKX remain the leaders. Binance stands out with its low fees and support for a wide range of altcoins, while Bybit and OKX are the best choices for traders from Russia.

Tools for Technical Analysis and Charting

Technical analysis helps traders predict price movements based on historical data and patterns. In 2025, the following tools dominate this category:

- TradingView: The most popular charting platform, offering over 10 chart types, more than 100 built-in indicators, and 90+ drawing tools. A free version is available, with premium subscriptions starting at $14.95 per month. Social features allow users to share ideas and forecasts.

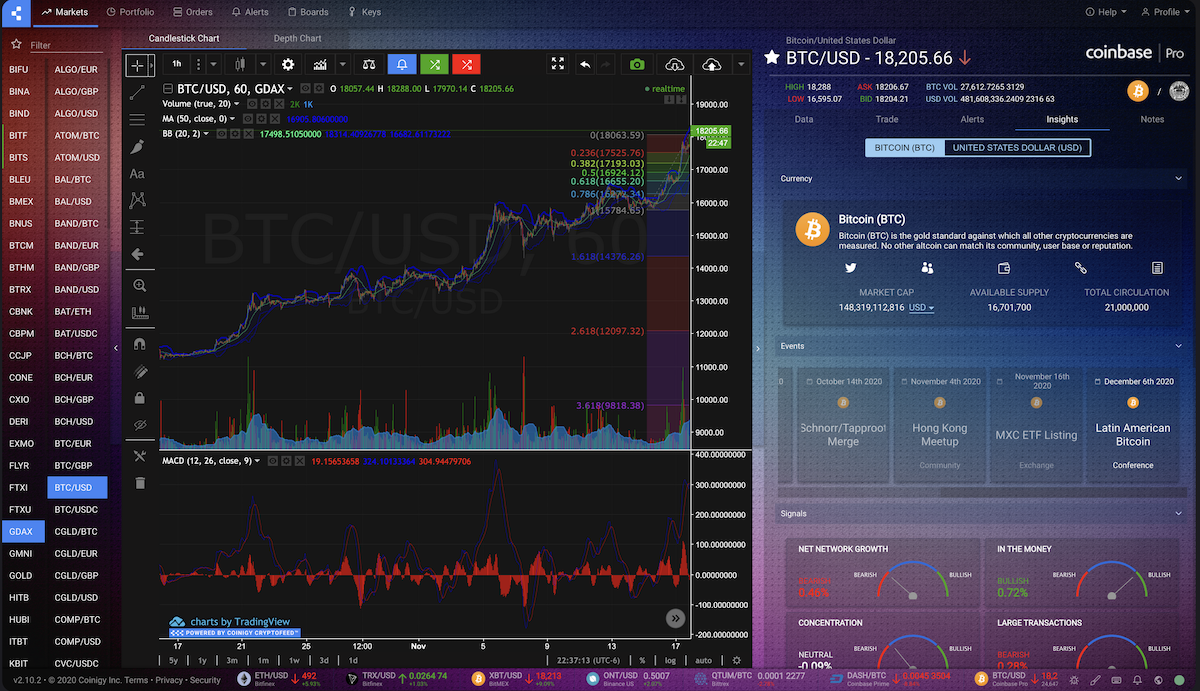

- Coinigy: Integrates with over 45 exchanges, providing advanced charting and portfolio management. Plans start at $15 per month, making it ideal for traders operating across multiple platforms.

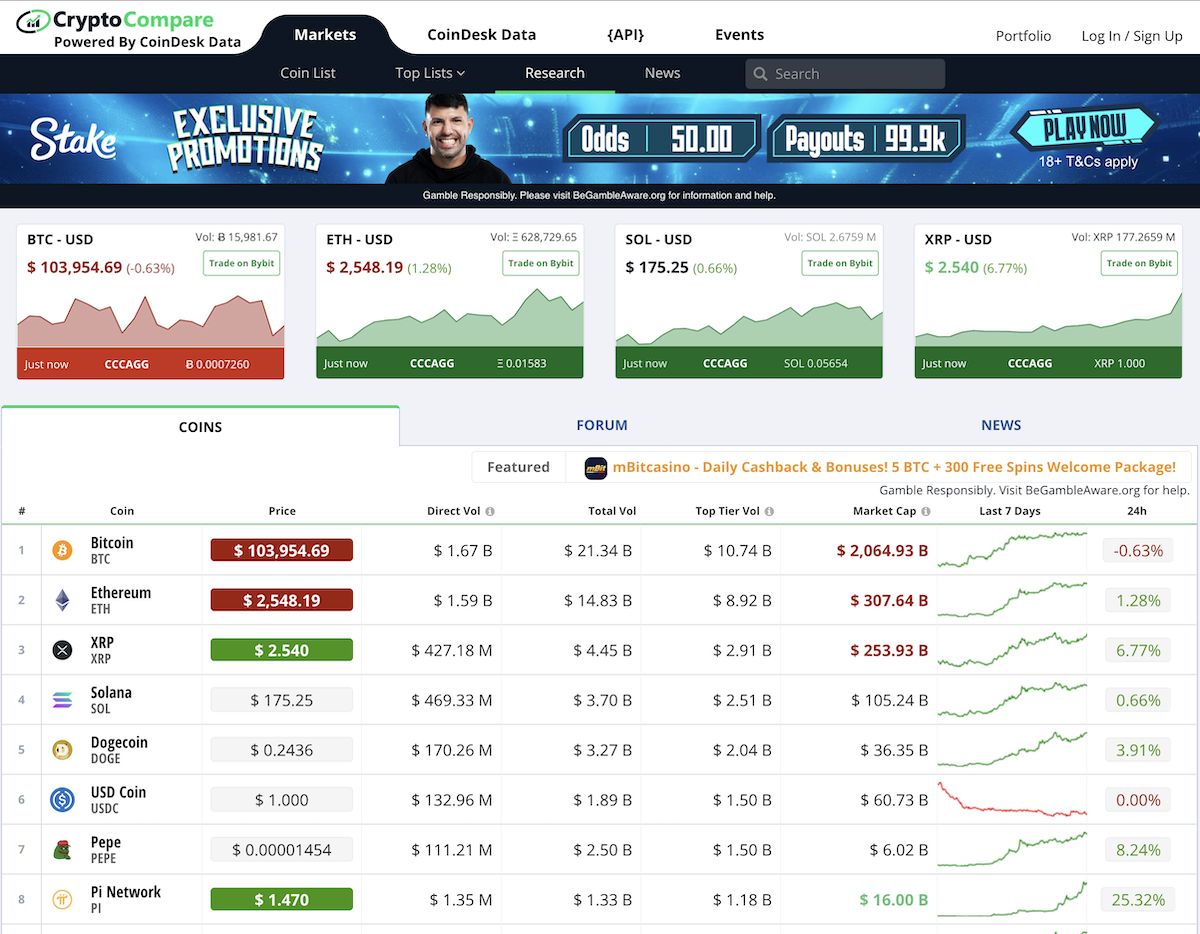

- CryptoCompare: Offers real-time data, portfolio tracking, and multiple chart types. The free version suits beginners, while the premium version adds advanced features.

- CoinMarketCap: Best known for market data, it also provides basic charts and price alerts, useful for quick analysis.

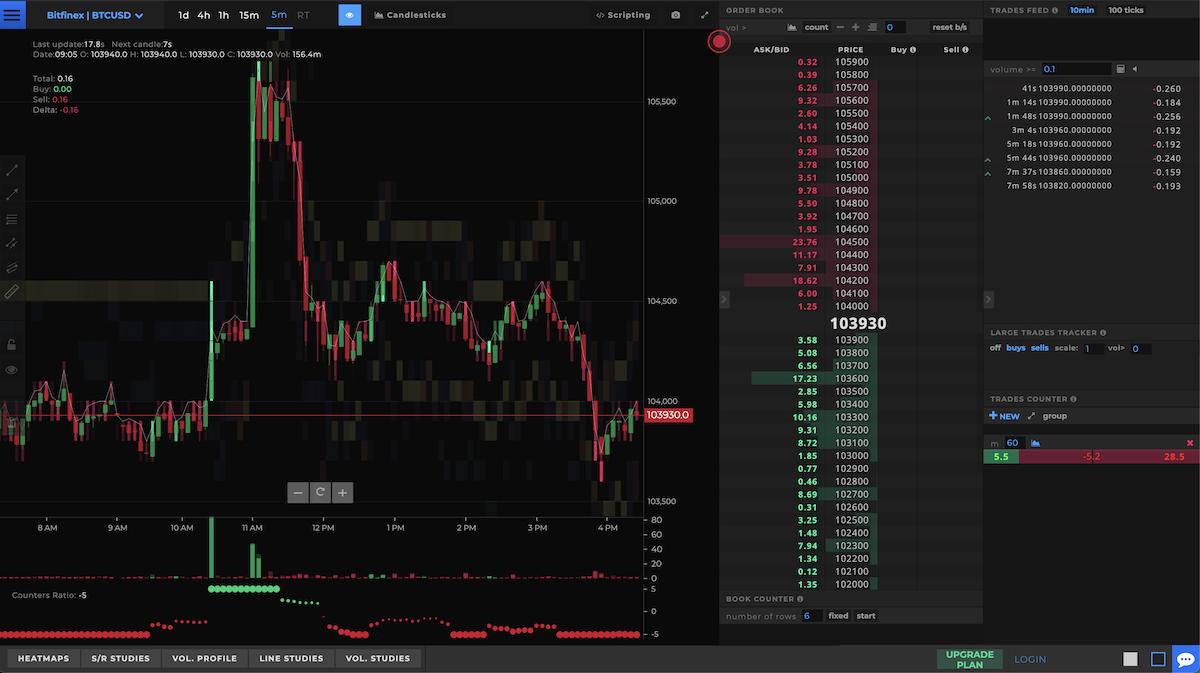

- Tensorcharts: Specializes in order book heatmaps and delta-divergence indicators to identify trend reversals.

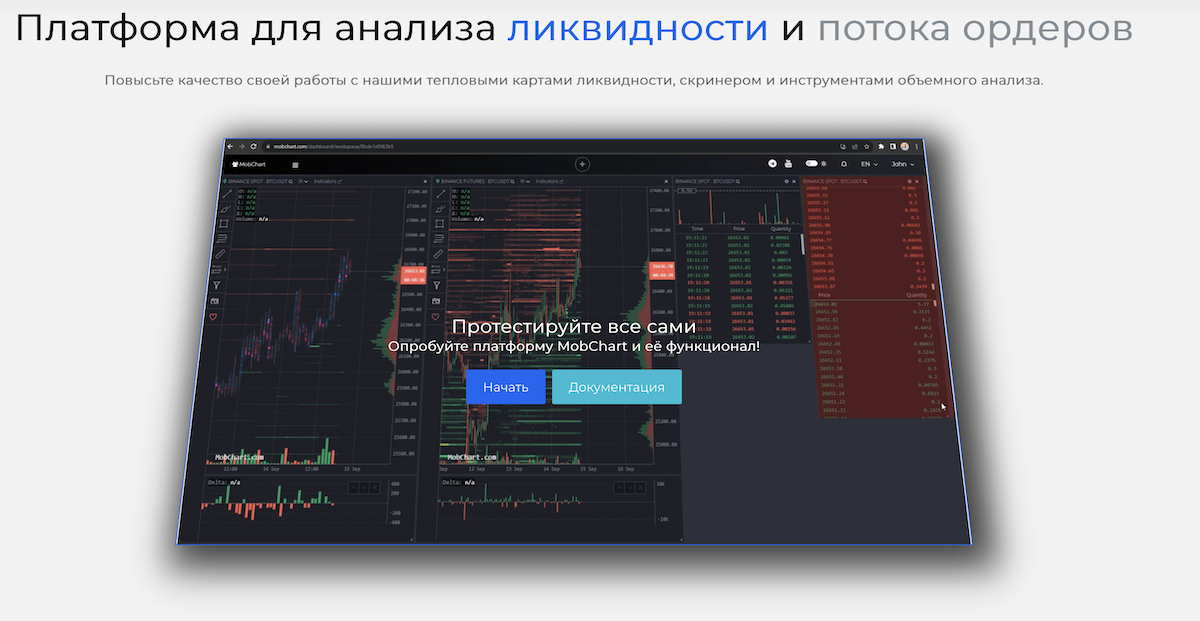

- Mobcharts: Advanced order book heatmaps with numerous indicators, perfect for in-depth analysis.

These tools enable traders to build complex strategies based on technical analysis and adapt to rapidly changing market conditions.

Tools for On-Chain Analytics and Research

On-chain analytics provide insights into transactions, wallet activity, and network health, helping to understand the market's fundamental aspects. In 2025, the following platforms stand out:

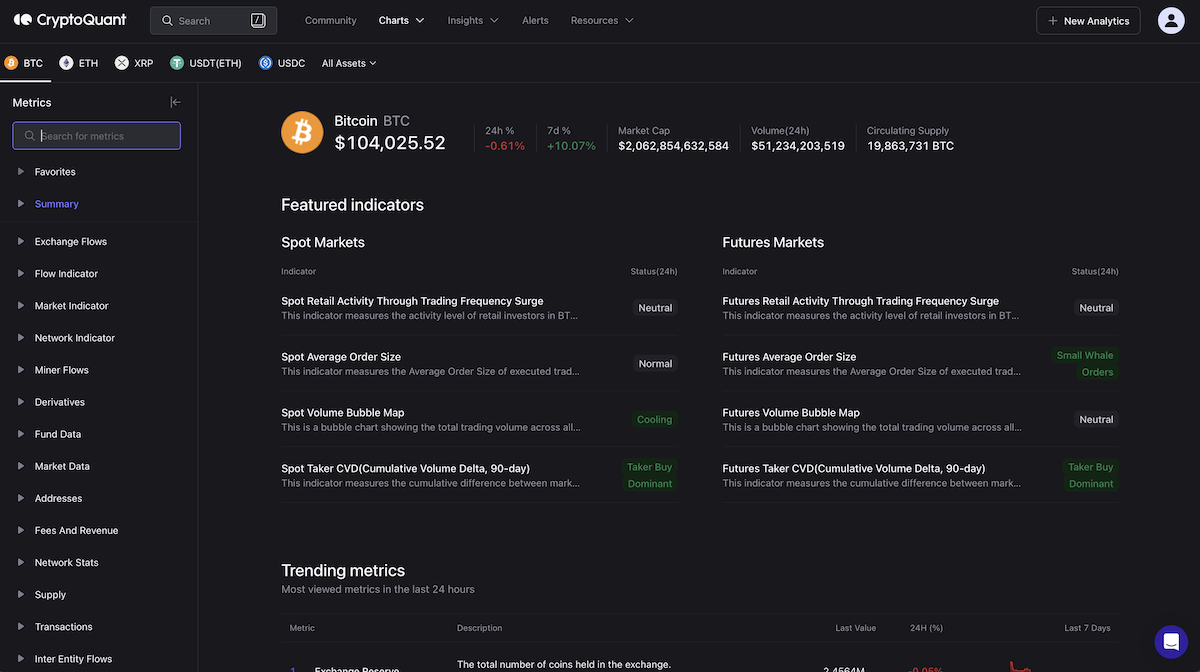

- CryptoQuant: Offers on-chain metrics like exchange flows, whale activity, and market fundamentals. Useful for tracking the behavior of large players.

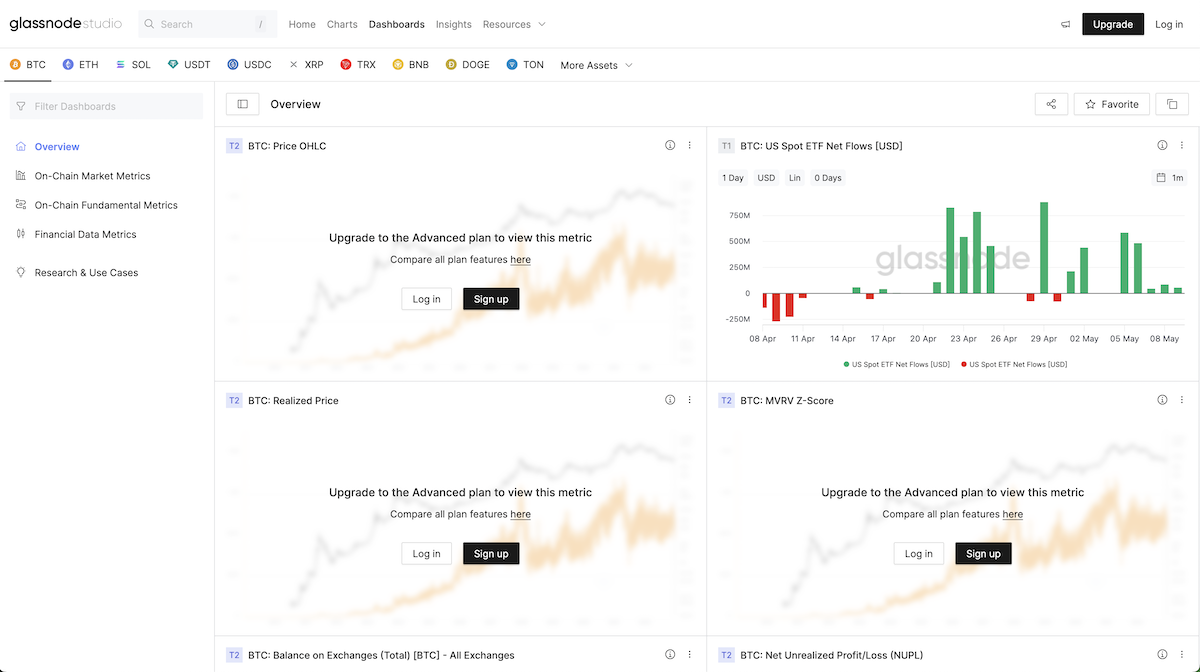

- Glassnode: Provides advanced on-chain analytics, including sentiment indicators (SOPR, NUPL), HODLer data, and address distribution. Example use case: analyzing active address trends.

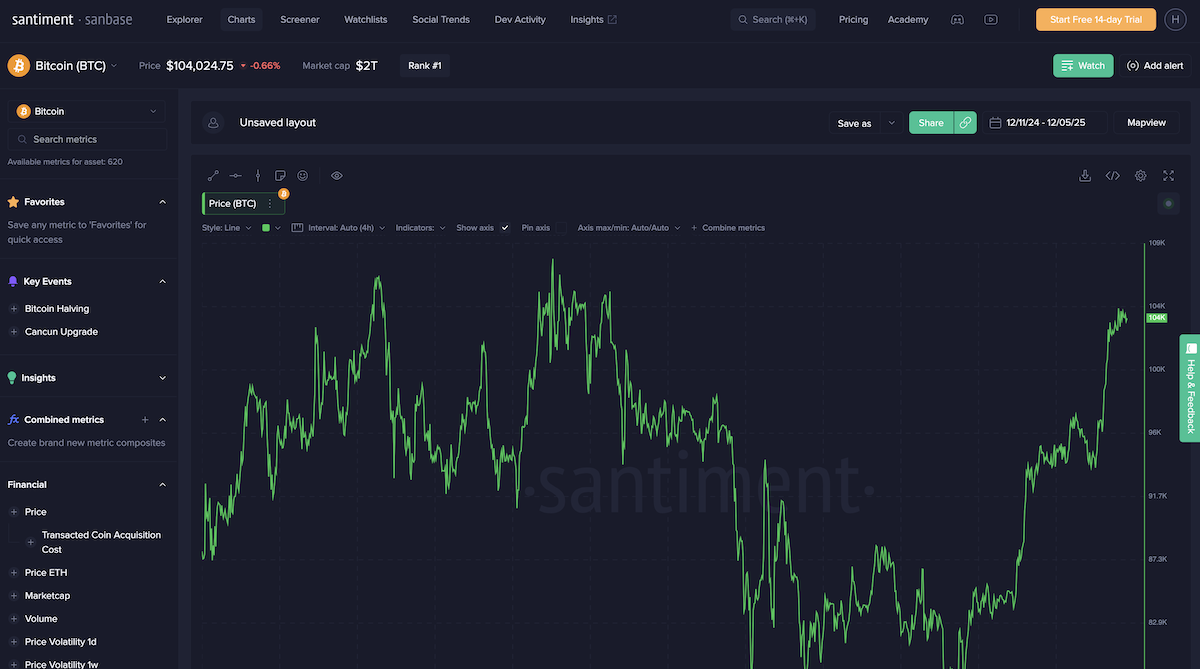

- Santiment: Combines on-chain data with social metrics like social media mentions and FOMO, plus developer activity tracking. Example: assessing sentiment to spot trends.

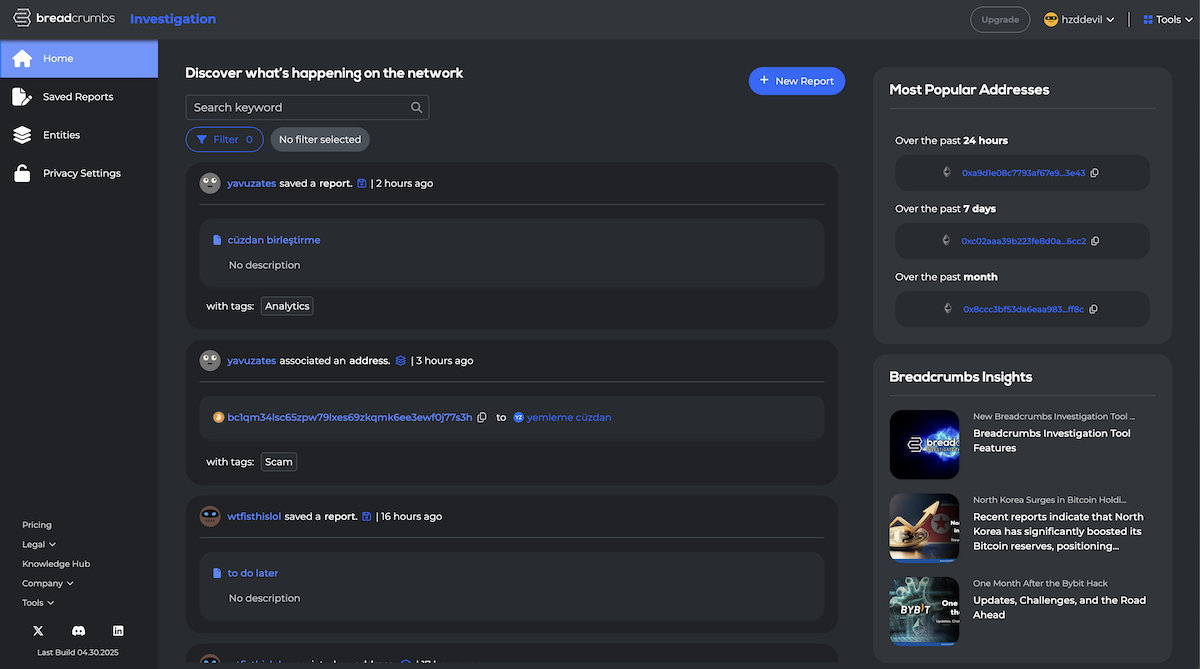

- Breadcrumbs: A tool for wallet analysis, transaction tracking, and identifying activity patterns.

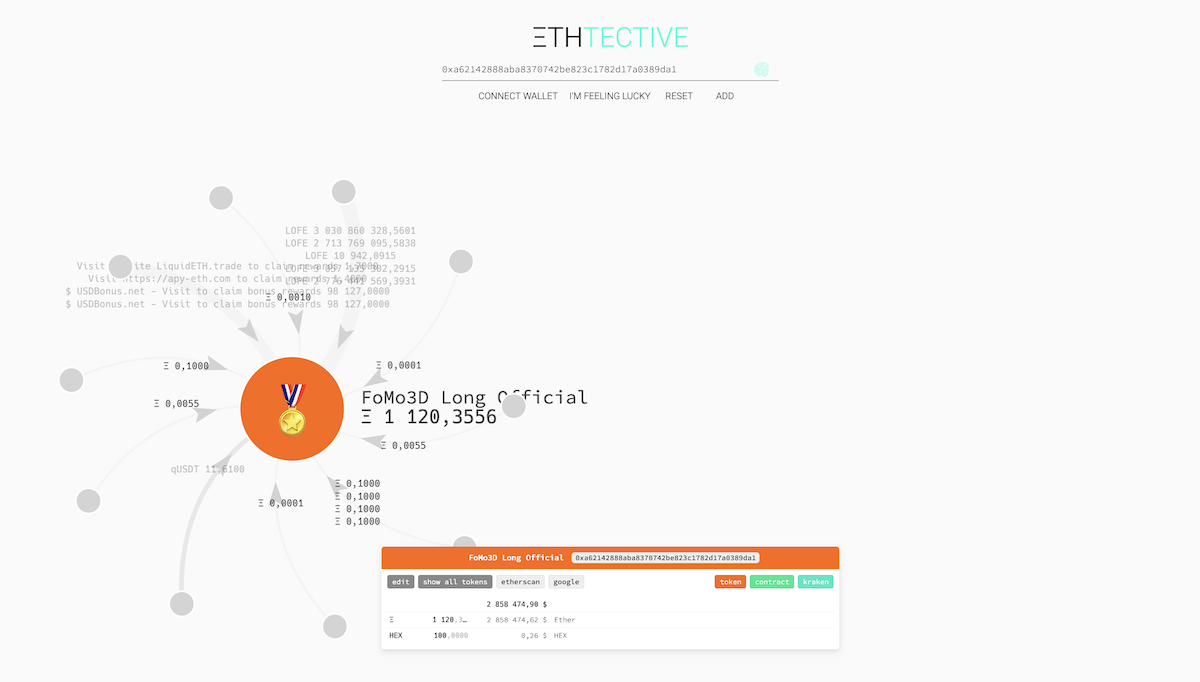

- Ethtective: Focuses on Ethereum on-chain data, providing insights into smart contract interactions.

These tools help traders understand what’s happening "under the hood" of blockchain networks and identify potential opportunities or risks.

Market Sentiment Indicators

Understanding market psychology can provide a trading edge. The following tools help gauge trader sentiment:

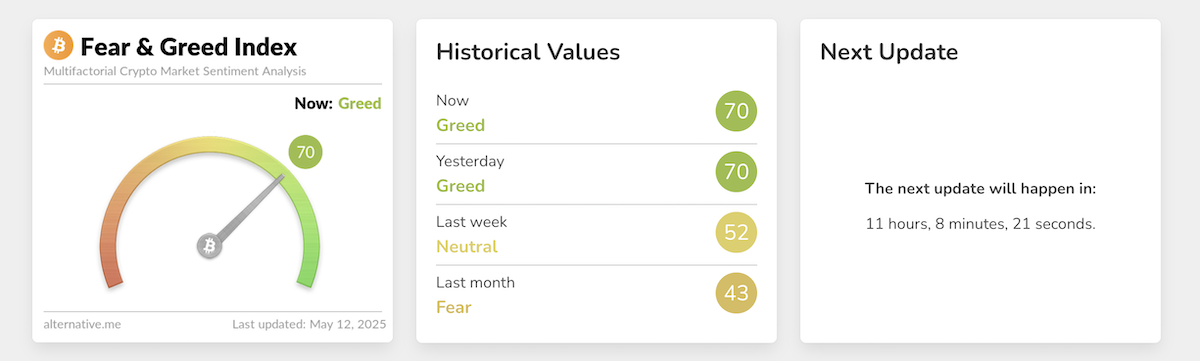

- Alternative.me: The Fear and Greed Index measures market sentiment based on volatility, trading volume, and social media activity. A high index indicates greed, while a low one signals fear.

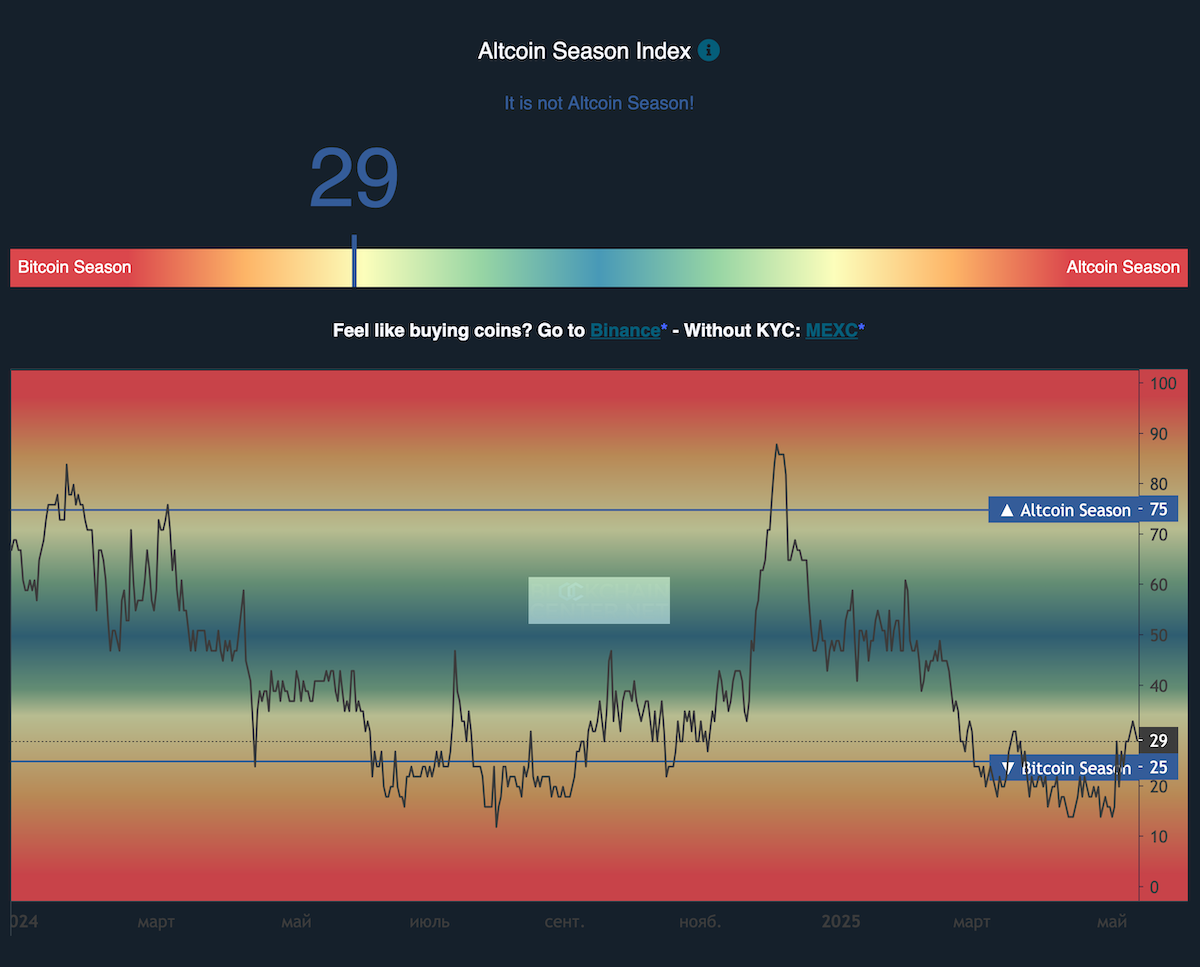

- BlockchainCenter: The Altseason Index shows when altcoins start outperforming Bitcoin, helping to time altcoin investments.

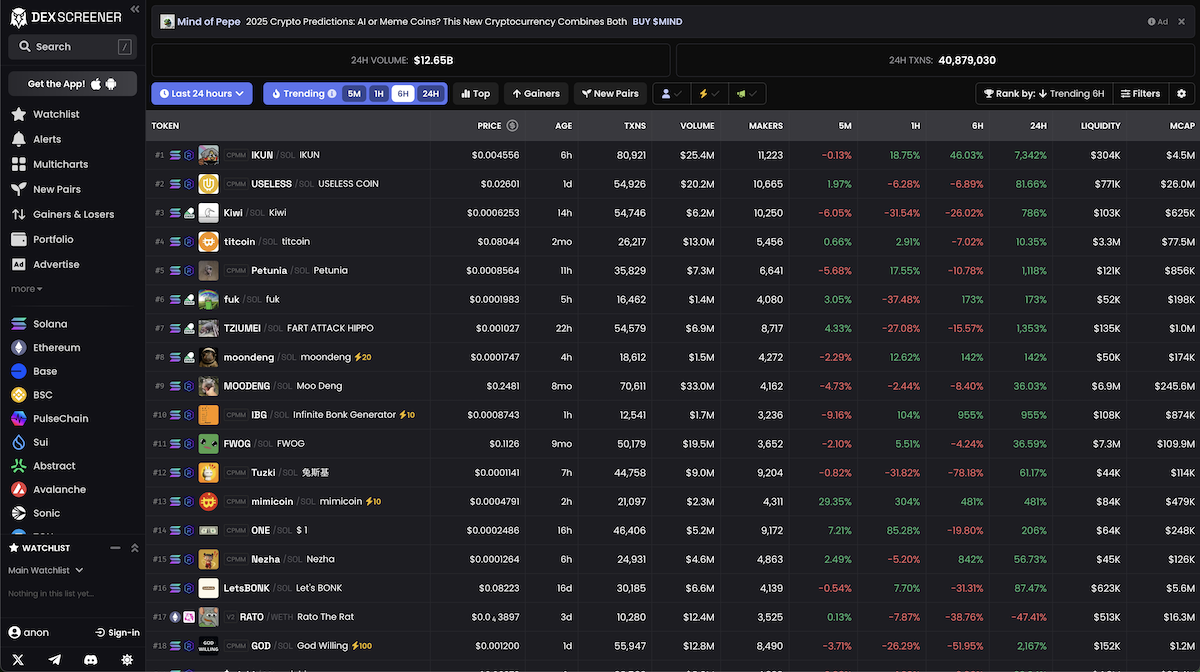

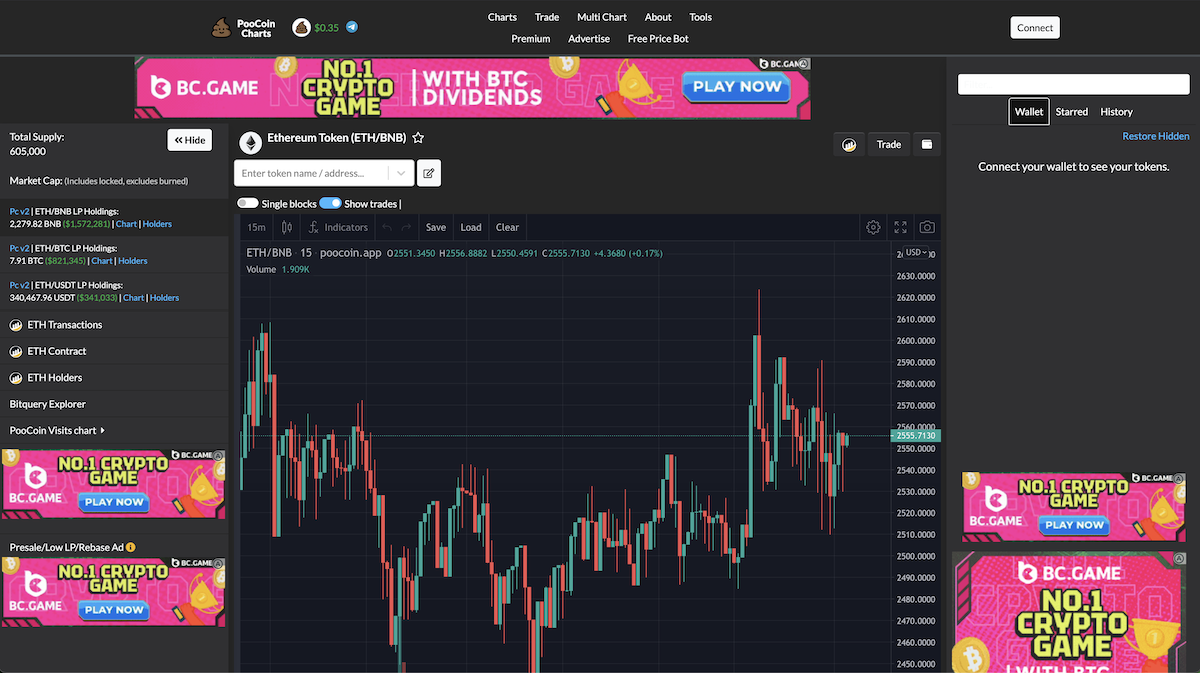

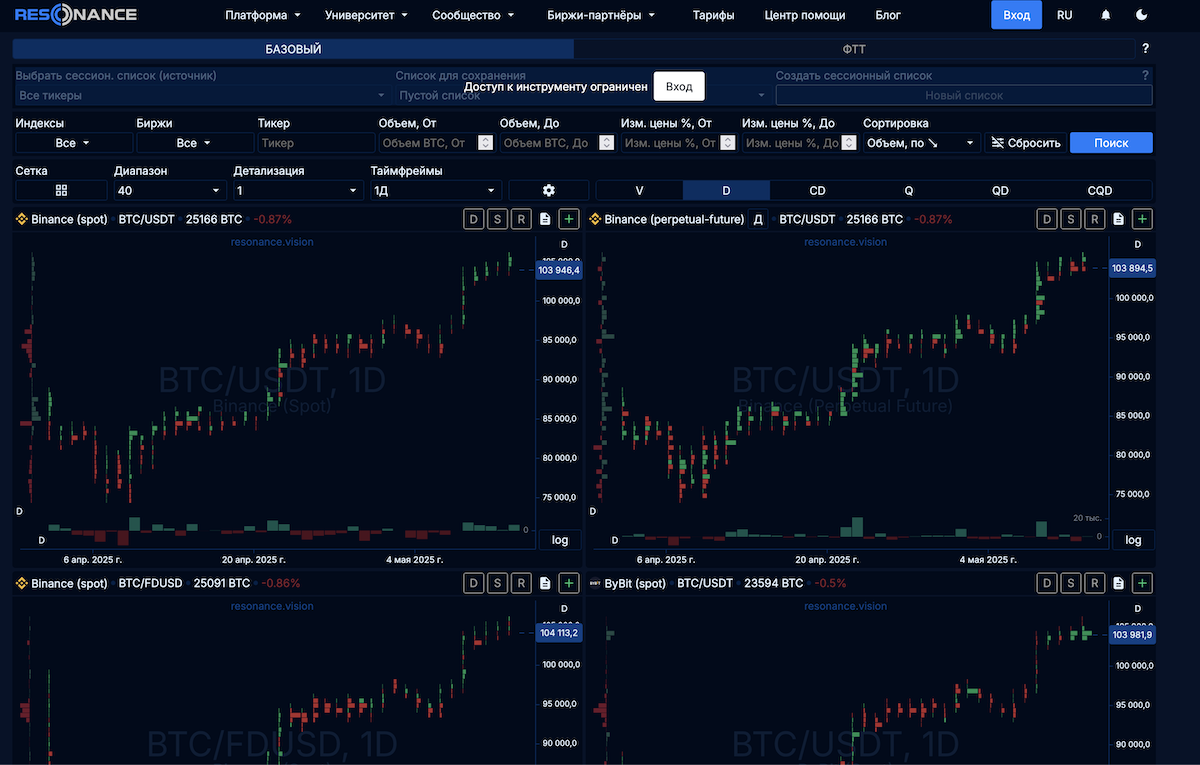

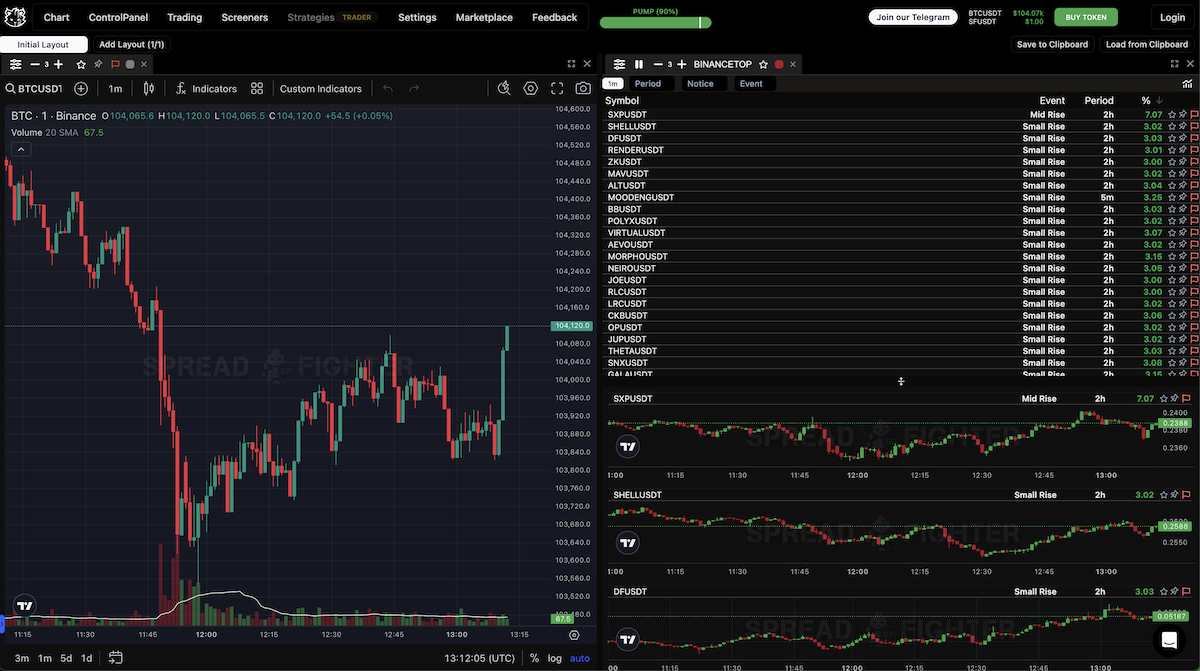

DEX and Liquidity Analytics

With the growing popularity of decentralized exchanges (DEXs), traders need tools to analyze liquidity and token activity:

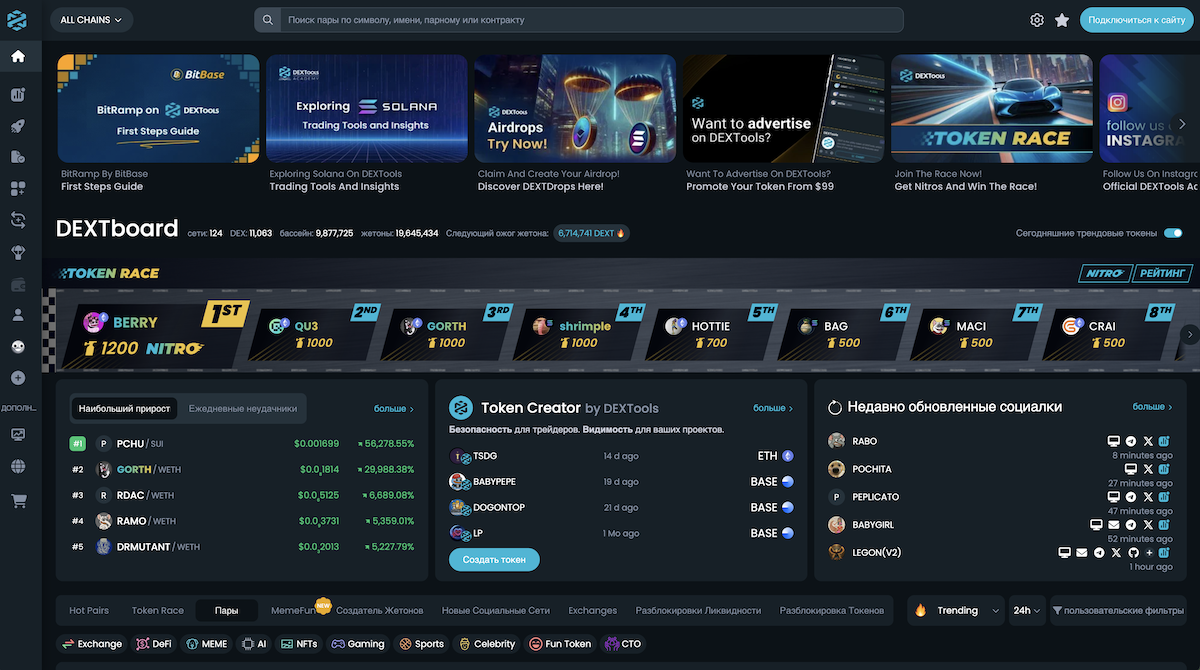

- Dextools: Provides charts, transaction history, and token analytics on DEXs like Uniswap.

- Dexscreener: Real-time data and alerts for DEX tokens, useful for screening new projects.

- Poocoin: Focuses on Binance Smart Chain, offering token tracking and charts.

- Resonance: Uses cluster analysis to detect market anomalies that could lead to 100%-1000% price movements.

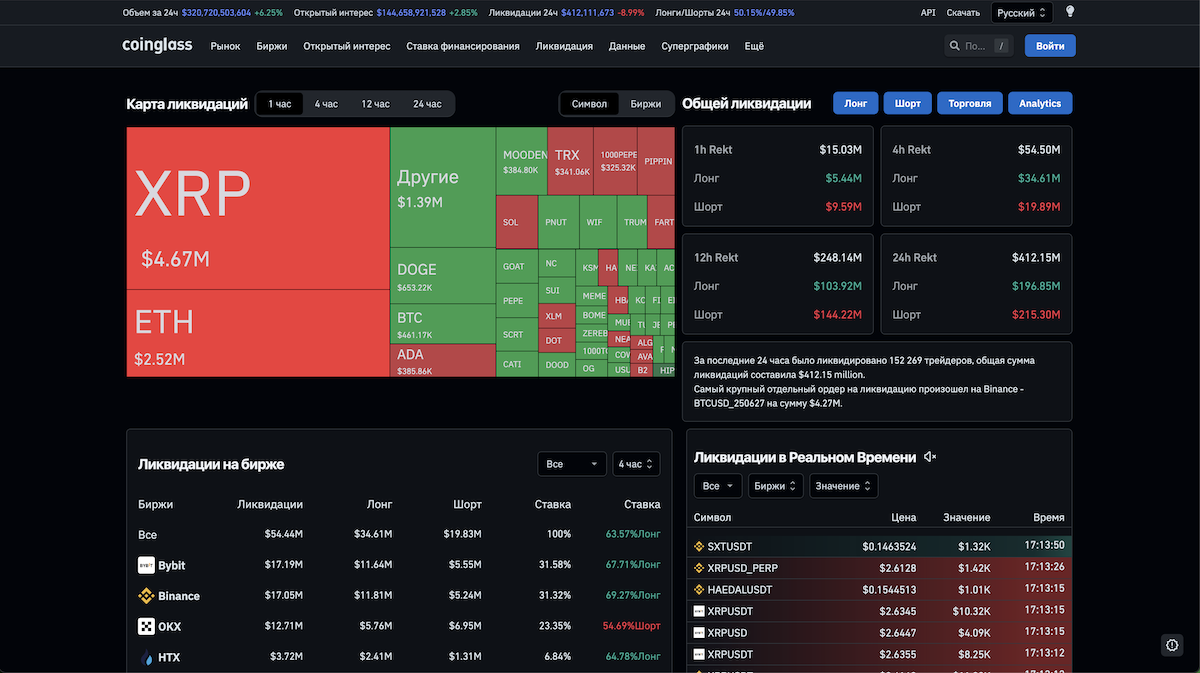

- Spreadfighter: Detailed liquidation heatmaps for all coins, aiding in risk management.

- Coinglass: Visualizes liquidation data directly on charts, simplifying analysis.

These tools are particularly valuable for traders working with new tokens or highly volatile markets.

Fee Comparison

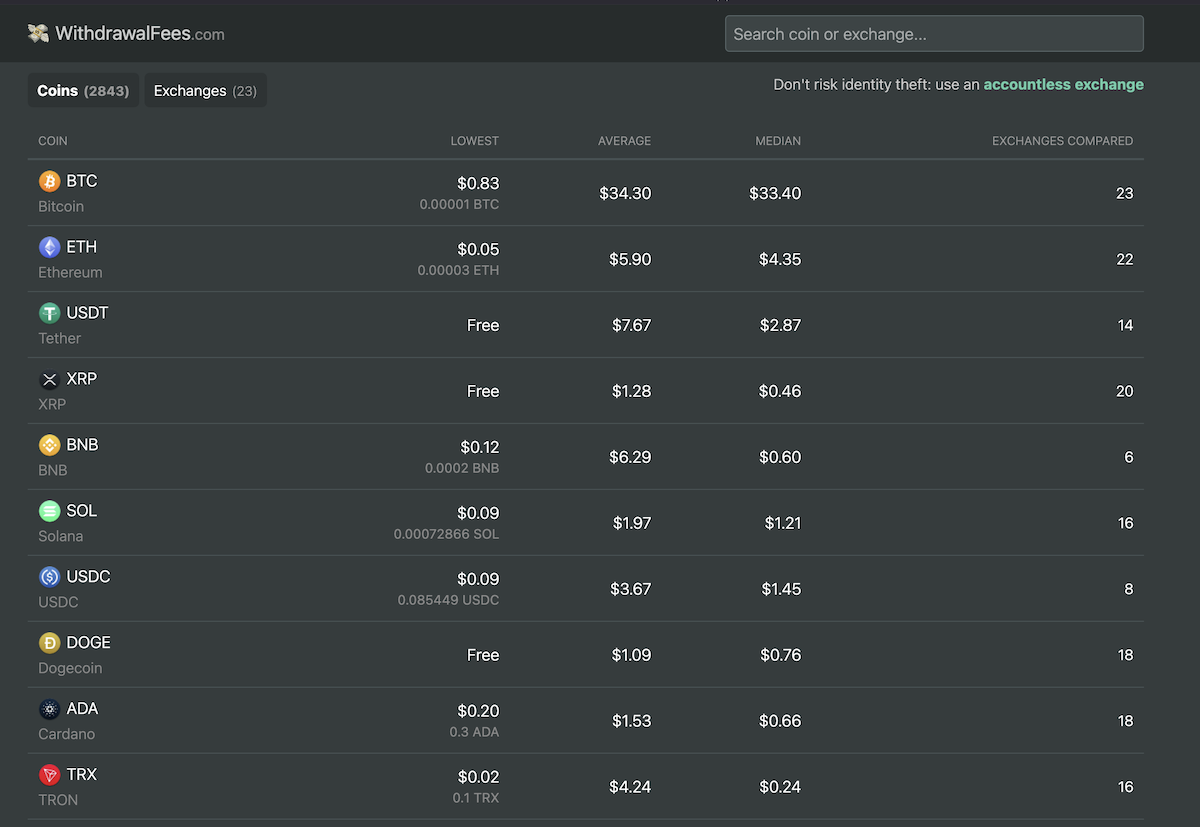

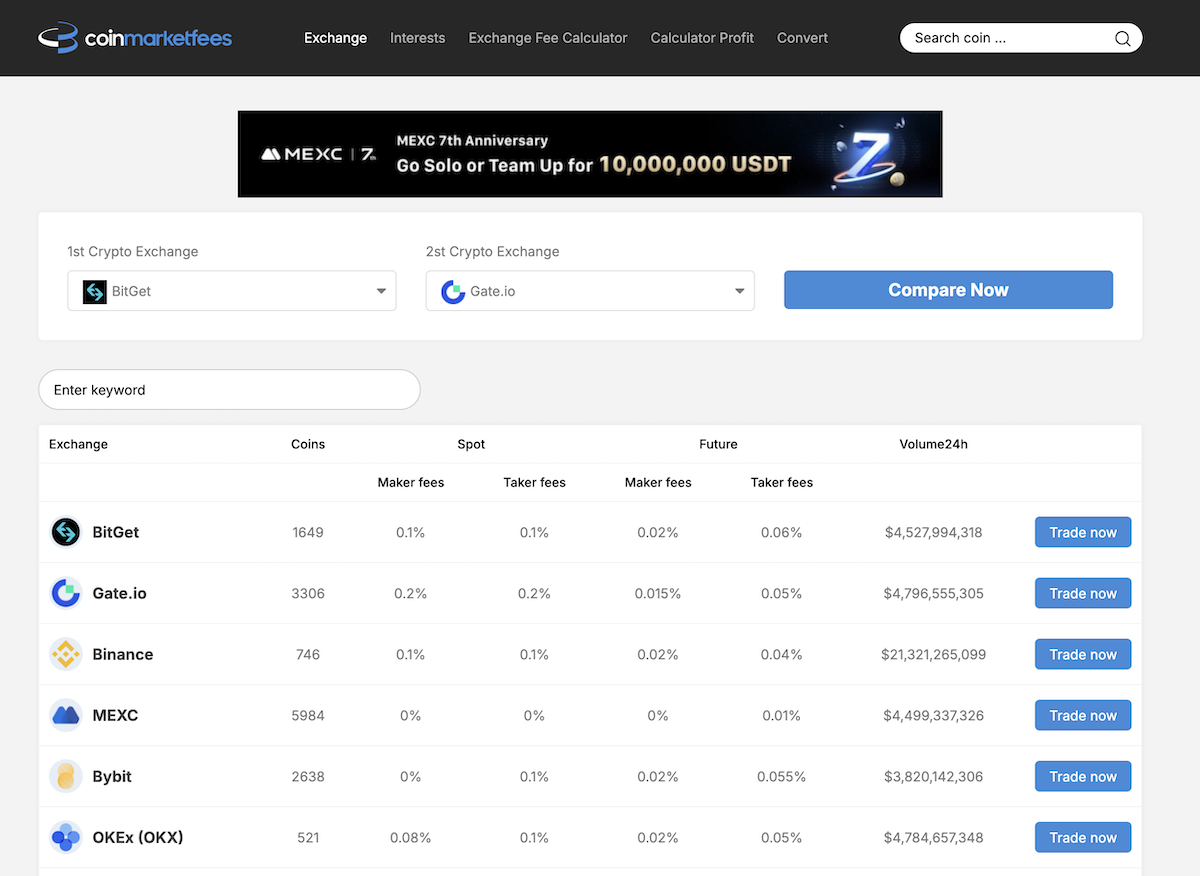

Minimizing trading fees is a key aspect of profitability. The following services help choose cost-effective platforms:

- Withdrawalfees: Compares withdrawal fees across exchanges, helping to select platforms with the lowest costs.

- CoinMarketFees: Compares trading fees on exchanges, beneficial for active traders.

Other Useful Tools

These tools complement analysis by providing additional data and features:

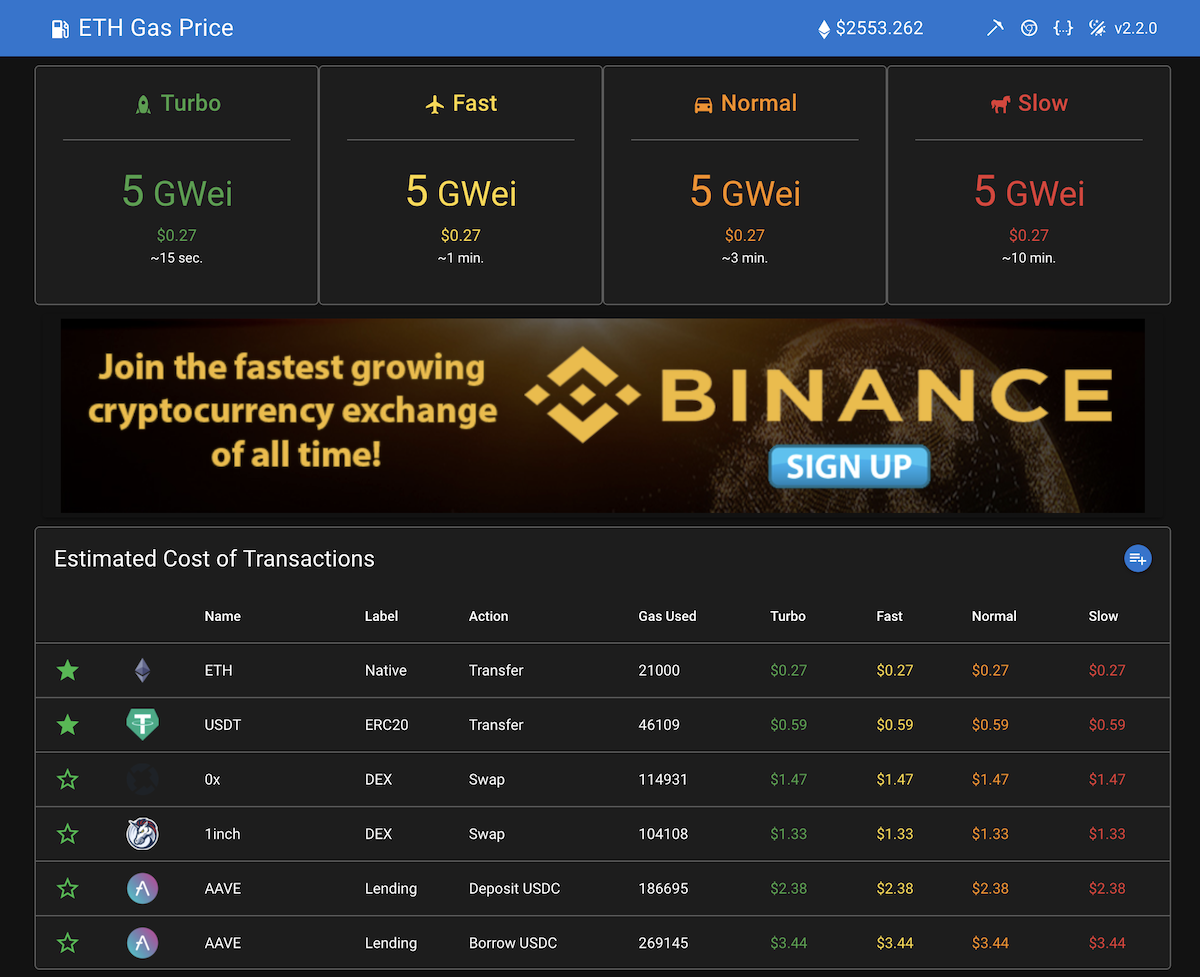

- Ethgasprice: Tracks Ethereum gas fees, crucial for planning transactions during high network activity.

- Coinbubbles: Visualizes cryptocurrency price movements as animated bubbles.

- Defillama: Offers DeFi analytics, including Total Value Locked (TVL) and protocol performance.

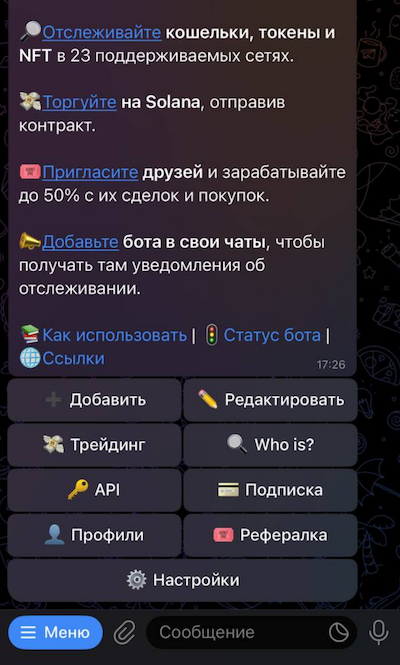

- EtherDrops (Telegram): A Telegram bot that notifies users about wallet transactions and price changes for selected tokens.

In 2025, cryptocurrency trading demands a diverse set of tools for analysis, portfolio management, and decision-making. From trading platforms like Bybit and OKX to analytical tools like TradingView and Glassnode, these resources equip traders with everything needed for success. By combining these tools and adapting to market conditions, traders can enhance their competitiveness and achieve their financial goals. For more information, visit platforms like CoinMarketCap or TradingView and start leveraging their features today.