Tokenomics is the fundamental economic model that defines how a token functions within a cryptocurrency project’s ecosystem. It encompasses the rules for token creation, distribution, and usage, as well as mechanisms affecting its value and stability. Understanding tokenomics helps investors assess a project’s potential and make informed decisions. In this article, we’ll explore what tokenomics entails, how to analyze it, and why it’s so critical, using a real-world project as an example.

Tokenomics is the fundamental economic model that defines how a token functions within a cryptocurrency project’s ecosystem. It encompasses the rules for token creation, distribution, and usage, as well as mechanisms affecting its value and stability. Understanding tokenomics helps investors assess a project’s potential and make informed decisions. In this article, we’ll explore what tokenomics entails, how to analyze it, and why it’s so critical, using a real-world project as an example.

What is Tokenomics?

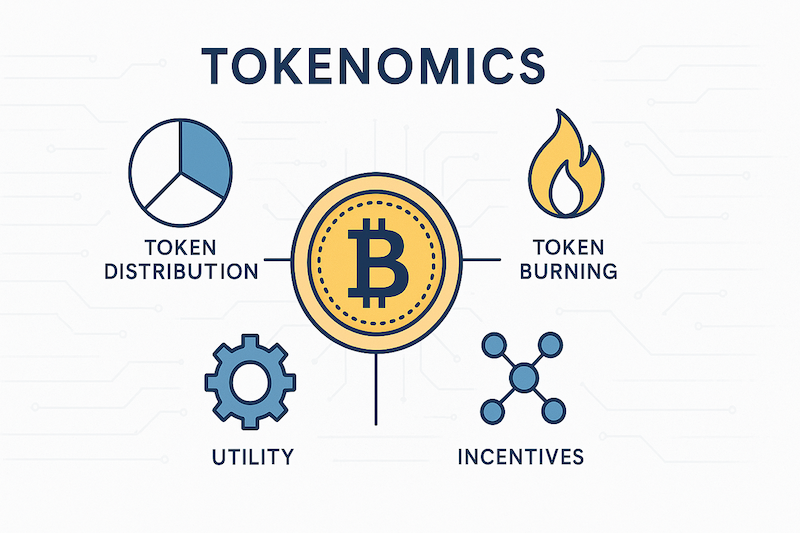

Tokenomics (from "token economics") is the set of economic and technical principles that govern how a token is created, distributed, and operates within a blockchain project. It addresses key questions: How many tokens exist? Who owns them? How are they used? And how does their supply impact their price?

Key Components of Tokenomics

- Total and Circulating Supply: Total supply is the maximum number of tokens that can ever be created, while circulating supply is the number currently available in the market. The difference between these can significantly affect price: if a large portion of tokens is yet to be released, their market entry could create downward price pressure.

- Token Distribution: Tokenomics outlines how tokens are allocated among participants—development team, early investors, community, foundations, and other stakeholders. Transparent distribution and the presence of lockup periods (where tokens are restricted for the team or investors) increase trust in the project.

- Emission and Burning: Emission refers to the process of issuing new tokens, which can be fixed (like Bitcoin) or dynamic (like Ethereum before its Proof-of-Stake transition). Token burning, conversely, reduces supply, potentially supporting price by decreasing available tokens.

- Utility: A token must have a clear function in its ecosystem, such as paying for transactions, accessing services, or participating in governance. Higher utility drives greater demand for the token.

- Incentives for Participants: Tokenomics includes mechanisms to motivate users, such as staking, network participation rewards, or bonuses for token holders.

Why is Tokenomics Important?

Analyzing tokenomics enables investors and users to gauge a project’s sustainability and potential. Here’s why it matters:

- Price Growth Potential: Supply and demand directly influence a token’s value. Limited supply with growing demand can drive price increases.

- Project Sustainability: Well-designed tokenomics ensures long-term project viability by preventing manipulation and balancing stakeholder interests.

- Decentralization: Token distribution reveals how decentralized a project is. If most tokens are held by the team or major investors, it may indicate centralization.

- Community Motivation: Tokenomics should encourage active user participation, strengthening the ecosystem.

How to Analyze Tokenomics: A Step-by-Step Guide

To evaluate a project’s tokenomics, follow these steps:

- Review the Whitepaper: The whitepaper is the primary document outlining the project’s goals, tokenomics, and technical details. Pay attention to sections on token distribution, emission, and usage.

- Compare Total and Circulating Supply: If the total supply greatly exceeds the circulating supply, future token releases could pressure prices downward. For example, a project with 1 billion tokens, only 100 million of which are circulating, may face price drops when the remaining tokens enter the market.

- Assess Distribution and Lockups: Check what portion of tokens belongs to the team and investors and whether lockup periods exist. Long-term lockups (1–2 years) signal the team’s commitment to the project’s success.

- Evaluate Utility: Ensure the token has a meaningful role in the ecosystem. A token used solely for transaction fees may have limited demand compared to one enabling unique features.

- Look for Burning Mechanisms: Token burning (removing tokens from circulation) reduces supply and can support price. For instance, Binance Coin (BNB) periodically burns tokens, contributing to its value growth.

Example: Ethereum’s Tokenomics

Let’s examine Ethereum’s tokenomics as an example of a successful model:

- Total Supply: Ethereum has no fixed token cap, but after transitioning to Proof-of-Stake in 2022, new ETH issuance significantly decreased.

- Distribution: Initially, tokens were distributed through an ICO in 2014, with 60 million ETH sold to investors, 12 million allocated to developers, and the rest used for network development.

- Utility: ETH is used for transaction fees (gas), staking, and interacting with decentralized applications (dApps), creating consistent demand.

- Burning: Since the EIP-1559 upgrade in 2021, a portion of transaction fees is burned, reducing the circulating supply.

- Incentives: Staking ETH encourages users to hold tokens, securing the network while earning rewards.

Thanks to its well-thought-out tokenomics, Ethereum remains one of the most resilient and in-demand cryptocurrencies, despite lacking a fixed supply.

Conclusion

Tokenomics is more than just numbers and rules—it’s a key indicator of a crypto project’s health and prospects. By analyzing total supply, distribution, utility, and burning mechanisms, investors can assess a project’s ability to grow and maintain token value. However, even perfect tokenomics doesn’t guarantee success without real demand for the token. Always combine tokenomics analysis with an evaluation of the team, technology, and market conditions.