The cryptocurrency market continues to evolve, offering traders and investors increasingly sophisticated tools for capital management and profit generation. One of the most popular instruments is cryptocurrency futures, which allow users to profit from price fluctuations without owning the underlying assets. In this comprehensive guide, we’ll explore what futures are, how they work, strategies for trading, top exchanges to use, and the risks and benefits they entail.

The cryptocurrency market continues to evolve, offering traders and investors increasingly sophisticated tools for capital management and profit generation. One of the most popular instruments is cryptocurrency futures, which allow users to profit from price fluctuations without owning the underlying assets. In this comprehensive guide, we’ll explore what futures are, how they work, strategies for trading, top exchanges to use, and the risks and benefits they entail.

Table of Contents

- What Are Cryptocurrency Futures?

- How Do Futures Contracts Work?

- Step-by-Step Guide: How to Start Trading Futures

- Top Strategies for Trading Futures

- Best Crypto Exchanges for Futures Trading in 2025

- Risks and How to Minimize Them

- Advantages and Disadvantages of Futures

- Practical Tips for Successful Trading

- Conclusion: Are Futures Worth Trading in 2025?

What Are Cryptocurrency Futures?

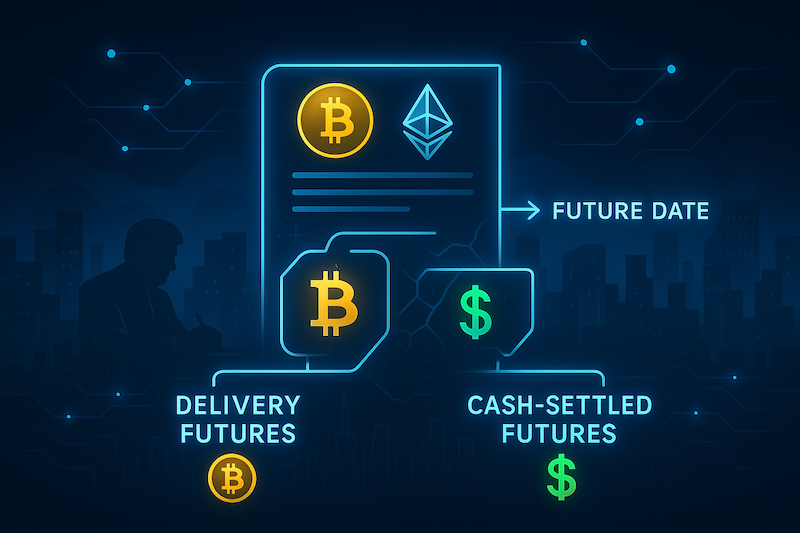

Futures are derivative financial instruments representing a contract between two parties to buy or sell an asset (in this case, a cryptocurrency like $BTC or $ETH) at a predetermined price at a specific future date. Unlike spot trading, where transactions settle immediately, futures lock in the trade now with settlement occurring later.

Types of Futures:

-

Delivery Futures: At the contract’s expiration, the seller must deliver the underlying asset (e.g., 1 BTC) to the buyer, who pays the agreed-upon price. These are popular among institutional investors, such as on the Chicago Mercantile Exchange (CME).

-

Cash-Settled Futures: No physical delivery occurs at expiration. Instead, the parties settle the difference between the contract price and the market price. This is the most common type in the crypto industry.

-

Perpetual Futures: A unique type of futures with no expiration date. Settlements occur periodically (typically every 8 hours) through a funding rate mechanism, where one side pays the other based on market conditions.

What Futures Allow Traders to Do:

- Speculate on cryptocurrency price movements.

- Hedge risks (e.g., protect a portfolio from a $BTC price drop).

- Use leverage to amplify potential profits.

How Do Futures Contracts Work?

To understand cryptocurrency futures, let’s break down their key mechanics.

Core Concepts:

- Underlying Asset: The cryptocurrency tied to the contract, such as $BTC, $ETH, $SOL, or $BNB.

- Futures Price: The futures price generally tracks the spot price of the underlying asset but may diverge due to market conditions: Contango: Futures price is higher than the spot price (market expects growth).

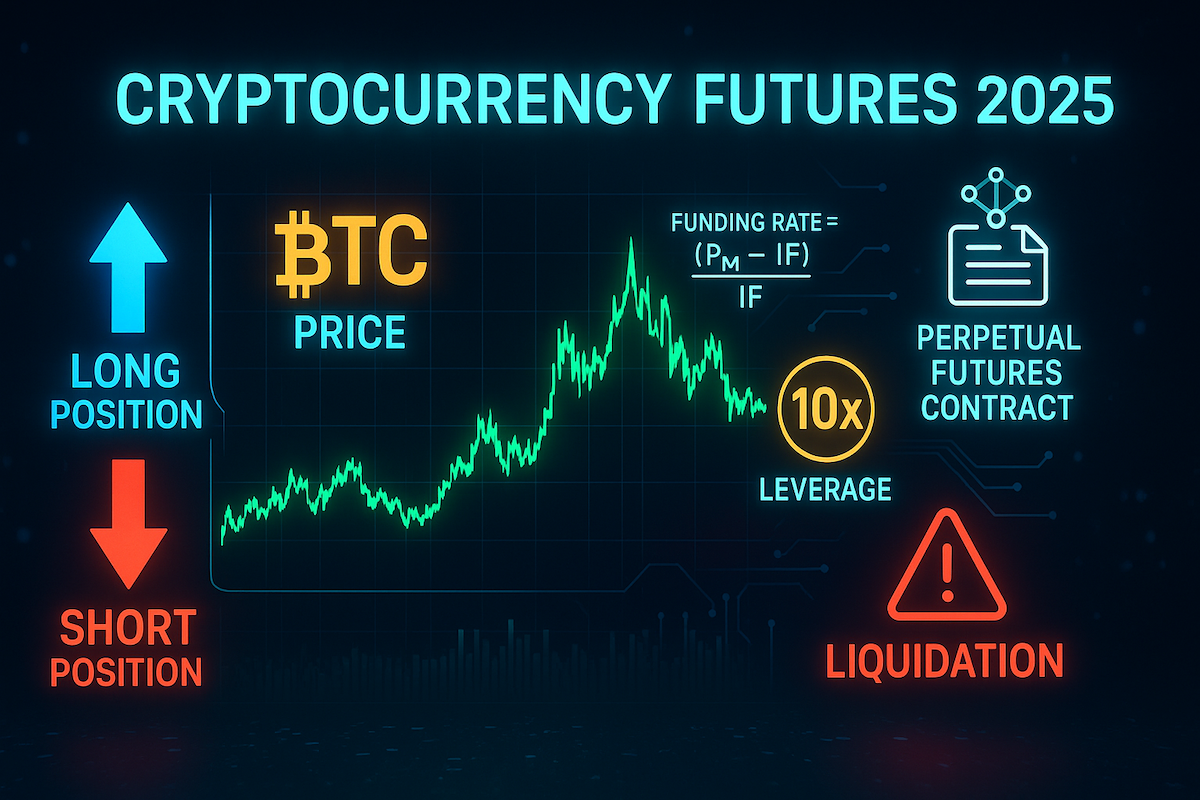

Backwardation: Futures price is lower than the spot price (market expects a decline). - Leverage: Futures allow trading with leverage, such as 10x, 50x, or even 100x. For example, with a $1,000 deposit, you can control a $100,000 position. However, this increases both potential profits and risks.

- Margin: Traders must deposit collateral (margin) to open a futures position: Initial Margin: The minimum amount required to open a position. Maintenance Margin: The minimum balance needed to keep a position open.

- Long and Short: Long: Buying a contract expecting the price to rise. For example, if $BTC rises from $60,000 to $65,000, the trader profits. Short: Selling a contract expecting the price to fall. If $BTC drops from $60,000 to $55,000, the trader profits.

- Liquidation (Margin Call): If the price moves against your position and losses approach the margin amount, the exchange automatically closes the position to prevent a negative balance. For example, with 10x leverage, a 10% price move against your position triggers full liquidation.

- Funding Rate (for Perpetual Futures): Periodic payments between long and short position holders. If the funding rate is positive, long traders pay short traders, and vice versa. This keeps the futures price aligned with the spot price.

Example:

Suppose you open a long position on $BTC with a $1,000 deposit and 10x leverage, controlling a $10,000 position. If $BTC’s price rises by 5%, you earn $500 (50% of your deposit). However, if the price drops by 5%, you lose $500, and a 10% drop wipes out your entire deposit through liquidation.

Step-by-Step Guide: How to Start Trading Futures

Futures trading may seem complex, but with the right approach, beginners can master it. Here’s a step-by-step guide.

Step 1: Choose a Reliable Exchange

Select a platform with a strong reputation, high liquidity, and a user-friendly interface. Popular options include:

- Binance: The largest by trading volume, supporting numerous pairs.

- Bybit: Beginner-friendly with low fees.

- OKX: Offers a wide range of contracts and tools.

Step 2: Register and Complete KYC

Create an account, verify your email, and complete Know Your Customer (KYC) verification, a requirement for most major exchanges.

Step 3: Fund Your Account

Deposit cryptocurrency (e.g., $BTC, $ETH) or stablecoins ($USDT, $USDC). Some exchanges allow transfers from a spot wallet to a futures wallet.

Step 4: Explore the Futures Interface

Navigate to the futures section on the exchange. Select a contract (e.g., perpetual BTCUSDT) and review:

- Available leverage.

- Margin and liquidation price levels.

- Fees and funding rates.

Step 5: Set Up Your Position

- Choose position type: Long or Short.

- Set leverage (3x–5x recommended for beginners).

- Determine the trade amount.

- Set a stop-loss (to limit losses) and take-profit (to lock in gains).

Step 6: Open and Manage Your Position

After opening a position, monitor it in real-time. Use alerts or Telegram bots to track price movements. Adjust the stop-loss or close the position manually as needed.

Step 7: Analyze Your Results

After closing a position, review what worked and what didn’t. Keep a trading journal to refine your strategy.

Tip for Beginners: Start with a demo account offered by exchanges like, Binance and Bybit, to practice trading without risk.

Top Strategies for Trading Futures

Futures offer numerous trading opportunities. Here are some popular strategies for beginners and experienced traders.

- Long and Short. Long: Buy if you expect the price to rise. For example, if $ETH is $1,500 and you predict a rise to $1,700, open a long position with 5x leverage. Short: Sell if you expect the price to fall. If $BTC drops from $60,000 to $55,000, a short position generates profit. Tip: Use technical analysis (support/resistance levels, RSI, MACD) to identify entry and exit points.

- Hedging Strategy: Minimizes risk by offsetting potential losses.Example: You hold 1 $BTC on a spot wallet at $60,000 but fear a price drop. Open a short position on 1 BTC with 1x leverage. If $BTC falls to $55,000, the $5,000 loss on your spot wallet is offset by a $5,000 profit from the short position. If $BTC rises to $65,000, the $5,000 loss on the short position is offset by a $5,000 gain on your spot holding.

When to Use: Ideal for long-term investors (hodlers), miners, or companies protecting assets from volatility, especially during market corrections like those driven by the ongoing U.S.-China trade war. - Arbitrage Strategy: Profits from price differences across platforms or instruments. Inter-Exchange Arbitrage: Buy a $BTC futures contract on Binance at $60,000 and sell it on OKX at $60,200, locking in the difference. Spot-Futures Arbitrage: If $ETH’s spot price on Binance is $1,500 and the futures price is $1,520, buy $ETH on the spot market and short the futures contract. When prices converge, you profit.

Tip: Account for fees and transaction speeds. Use high-liquidity, low-fee exchanges like Binance и Bybit. - Spread Trading (Pair Trading) Strategy: Simultaneously open long and short positions on correlated assets. Example: $BTC is consolidating at $60,000, while $ETH rises from $1,500 to $1,600. Open a long position on $ETH and a short position on $BTC. If $ETH continues to rise and $BTC falls or stays flat, you profit from both positions. When to Use: Effective in unstable markets where altcoins show divergent performance. Use indicators like RSI and MACD to analyze correlations.

- Scalping Strategy: Short-term trading with multiple small-profit trades (1–3%) in a short period. Example: Open a long position on $BTC with 20x leverage when it breaks resistance at $60,500. Close the position at a 1% gain ($61,100) to lock in profit. Tip: Scalping requires focus and quick decision-making. Use low-fee exchanges like Bybit and set automated orders (take-profit, stop-loss).

Best Crypto Exchanges for Futures Trading in 2025

Выбор правильной платформы — ключевой фактор для успешной торговли. Вот список топовых бирж, которые предлагают фьючерсную торговлю в 2025 году.

1. Binance

- Features: The largest exchange by trading volume, supporting hundreds of futures pairs (BTCUSDT, ETHUSDT, SOLUSDT, etc.).

- Leverage: Up to 125x.

- Fees: 0.02% for makers, 0.04% for takers.

- Advantages: High liquidity, demo account for beginners, FastAPI integration for streamlined setup.

2. Bybit

- Features: Specializes in perpetual futures, supporting BTC, ETH, XRP, SOL, and more.

- Leverage: Up to 100x.

- Fees: 0.01% for makers, 0.06% for takers.

- Advantages: User-friendly interface, copy trading, low fees.

3. OKX

- Features: Wide range of contracts, including spot and futures for BTC, ETH, BNB, and others.

- Leverage: Up to 100x.

- Fees: 0.02% for makers, 0.05% for takers.

- Advantages: High liquidity, API support, transparent reporting.

4. MEXC

- Features: Extensive range of trading pairs, including perpetual futures.

- Leverage: Up to 200x.

- Fees: 0% for makers, 0.02% for takers.

- Advantages: Wide selection of pairs, including smaller altcoins, API support, high leverage for experienced traders.

Tip: Beginners should start with Binance or Bybit for their intuitive interfaces and demo accounts. Experienced traders may prefer MEXC and OKX for advanced features.

Risks and How to Minimize Them

Futures trading carries significant risks, especially in the volatile crypto market. Here are the main risks and ways to mitigate them.

High Volatility:

Risk: Cryptocurrencies like $BTC and $ETH can swing 5–10% daily, increasing liquidation chances.

Mitigation:

- Use low leverage (3x–5x).

- Set stop-loss orders at 2–3% from the entry point.

- Stay updated on news (e.g., regulatory changes or macroeconomic events).

Risk of Liquidation:

Risk: With high leverage, even a small price move against your position can wipe out your deposit.

Mitigation:

- Use isolated margin to limit risk to the allocated trade amount.

- Avoid putting your entire deposit into one position—diversify.

Counterparty Risk:

Risk: Centralized exchanges may face hacks or bankruptcy (e.g., FTX in 2022).

Mitigation:

- Choose reputable exchange (Binance, Bybit).

- Store most funds in cold wallets, keeping only trading funds on the exchange.

Regulatory Risks:

Risk: Some countries restrict futures trading. For example, tightened DeFi and derivatives regulations in the U.S. could limit access.

Mitigation:

- Use a VPN if the exchange is unavailable in your region.

- Monitor regulatory news in your country.

Technical Glitches:

Risk: During high volatility (e.g., after Federal Reserve rate announcements), exchanges may experience delays or outages.

Mitigation:

- Trade on reliable platforms.

- Set automated orders to reduce manual intervention.

Advantages and Disadvantages of Futures

Advantages:

- Profit from Falling Markets: Futures allow short positions to earn on price declines, unlike spot trading.

- Leverage: Amplifies profits even with small deposits.

- Hedging: Protects portfolios from volatility.

- High Liquidity: Major exchanges (e.g., Bybit) offer seamless position opening and closing with minimal slippage.

- Flexible Strategies: Supports arbitrage, pair trading, scalping, and more.

Disadvantages:

- High Risk of Losses: Volatility and leverage can lead to rapid liquidation.

- Complexity: Beginners must learn margin, funding rates, expiration, and other concepts.

- Fees: Regular funding rate payments and trading fees can erode profits.

- Regulatory Uncertainty: Crypto derivatives laws are still evolving.

- Exchange Reliability: Risk of hacks or platform insolvency.

Practical Tips for Successful Trading

- Start Small: Use a $50–$100 deposit with 3x–5x leverage to minimize risks.

- Learn Technical Analysis: Master indicators like RSI, MACD, and Bollinger Bands to identify entry/exit points.

- Manage Risks: Always set stop-loss orders and risk no more than 1–2% of your deposit per trade.

- Diversify: Avoid putting everything into one position—trade multiple pairs (BTCUSDT, ETHUSDT).Stay Informed: Volatility is often driven by events like Federal Reserve decisions or regulatory changes.

- Use Demo Accounts: Practice risk-free on Binance or Bybit.

- Keep a Trading Journal: Record all trades to analyze mistakes and improve strategies.

Conclusion: Are Futures Worth Trading in 2025?

Cryptocurrency futures are a powerful tool that can yield high profits but require discipline and knowledge.

They are ideal for:

- Traders aiming to profit from both rising and falling markets.

- Investors looking to hedge risks.

- Those willing to use technical analysis and strategies like arbitrage or scalping.

However, high volatility and liquidation risks make futures unsuitable for everyone. Beginners should start with small amounts, low leverage, and demo accounts to avoid losses. Experienced traders can leverage futures for advanced strategies like arbitrage, pair trading, and hedging.

In 2025, the crypto market remains under pressure from global economic instability, including the U.S.-China trade war. This makes futures particularly relevant for hedging but increases risks for speculative trades. For example, the recent $ETH crash below its realized value ($1,500 vs. $1,950) signals a capitulation phase, but historically, such moments have been opportunities for long-term buys.

Bottom Line:

Cryptocurrency futures are not a get-rich-quick scheme but a complex instrument requiring preparation and discipline. If you’re ready to learn, manage risks, and apply proven strategies, futures can be a valuable addition to your trading arsenal. Start with platforms like Binance or Bybit, and build your expertise gradually!