There are already several dozens of stablecoins or cryptocurrencies tied to the value of real assets (gold, dollars, euros). The most popular stablecoin is USDT, pegged to the US dollar. This stablecoin is managed by the company Tether, which has faced numerous questions regarding the legislative regulation of their activities and asset transparency. FDUSD is another stablecoin introduced by the specialized fund First Digital, which ensures a 1:1 peg to the dollar through a balance of various assets.

There are already several dozens of stablecoins or cryptocurrencies tied to the value of real assets (gold, dollars, euros). The most popular stablecoin is USDT, pegged to the US dollar. This stablecoin is managed by the company Tether, which has faced numerous questions regarding the legislative regulation of their activities and asset transparency. FDUSD is another stablecoin introduced by the specialized fund First Digital, which ensures a 1:1 peg to the dollar through a balance of various assets.

The main difference between FDUSD and Tether lies in the high-quality reserves distributed across various financial institutions in Asian countries. First Digital Trust is registered in Hong Kong, where financial regulators (Hong Kong Monetary Authority - HKMA) are preparing a legislative proposal to allow the use of stablecoins for companies registered in Hong Kong. This means that until this happens, FDUSD is not available for public trading within this territory. Nevertheless, this did not prevent the addition of First Digital's stablecoin for trading on the largest exchange, Binance.

Binance, in turn, is gradually moving away from using USDT (reducing the number of traded pairs, not using it in their launchpad) due to reputational losses suffered in the recent past because of BUSD (Binance's subsidiary stablecoin) and USDC (Coinbase's stablecoin).

A year ago, BUSD and USDC were considered the main competitors of USDT in terms of the volume of issued stablecoins. However, after legal proceedings initiated by the US SEC, these stablecoins lost investor trust and effectively distanced themselves.

FDUSD is being introduced with a clearer legislative foundation from the start, which significantly reduces regulatory risks. In fact, FDUSD could become a full-fledged replacement for USDT and BUSD on the Binance exchange and other smaller crypto markets.

FDUSD was launched as an ERC-20 token on the Ethereum and Binance Smart Chain blockchains.

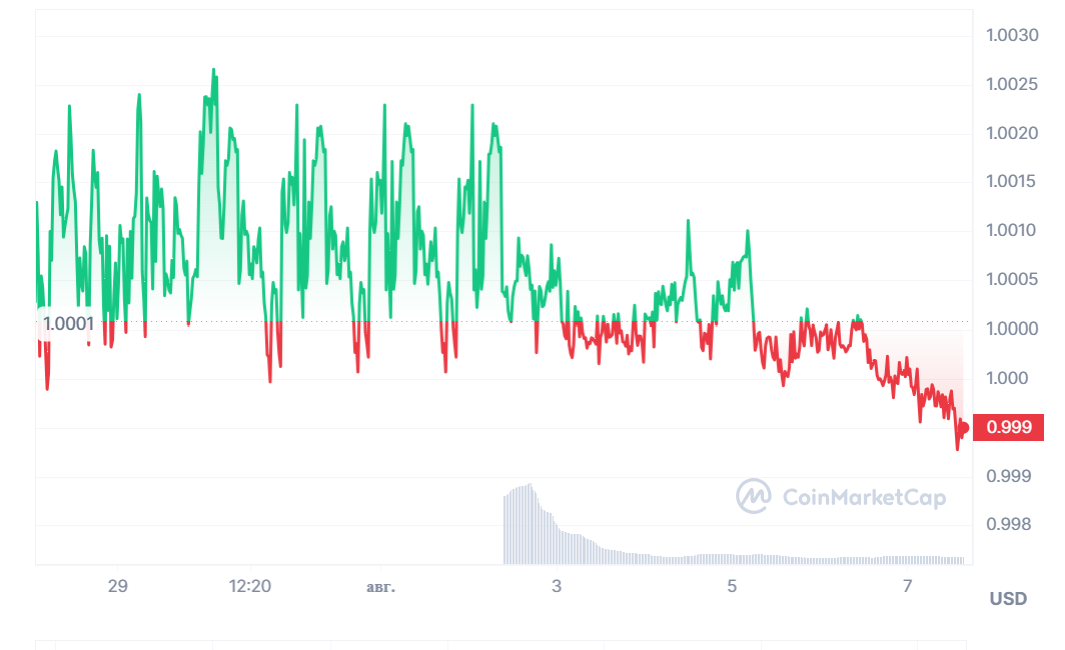

FDUSD appeared on June 1, 2023, and has been traded at a rate of 0.99 per 1 USD for just over a month. With the growing popularity of this stablecoin and the enactment of a law allowing its legal use in Hong Kong, things could change for the better. However, the risks of FDUSD price decline are not negligible either.

Conclusion: FDUSD, with the support of Binance and the Hong Kong authorities, can be a good alternative to the popular USDT stablecoin, which, like BUSD and USDC, may fall another victim of the SEC in the USA battle with cryptocurrencies.