The Binance cryptocurrency exchange is not only a spot or futures market for cryptocurrencies, but also many other services. One of the popular services on Binance, which is popular not only among investors, but also among developers of crypto projects, is Launchpad and its variation of Launchpool. At its core, this is an IEO (Initial Exchange Offerings). In other words, a crypto exchange acts as an intermediary between investors and a crypto startup that needs to raise money for the development of their project, i.e. IEO is an analogue of IPO in the already familiar financial markets.

The Binance cryptocurrency exchange is not only a spot or futures market for cryptocurrencies, but also many other services. One of the popular services on Binance, which is popular not only among investors, but also among developers of crypto projects, is Launchpad and its variation of Launchpool. At its core, this is an IEO (Initial Exchange Offerings). In other words, a crypto exchange acts as an intermediary between investors and a crypto startup that needs to raise money for the development of their project, i.e. IEO is an analogue of IPO in the already familiar financial markets.

You can read more about IEO in this article: What is IEO and how is it different from ICO

It turns out Launchpad and Launchpool is the original name of the initial offering of startups on the Binance exchange. Accordingly, similar services on other sites may be called completely differently, but the essence will be the same.

Because Binance is the leader in the IEO market, which is why the most promising startups go through an initial offering on Binance. This moment attracts so many investors, which is beneficial not only for startup owners, investors, but also for the service providing such a service, because. this attracts more customers interested in investing in startups, and also increases the demand for the exchange cryptocurrency Binance coin (BNB).

How launchpad works

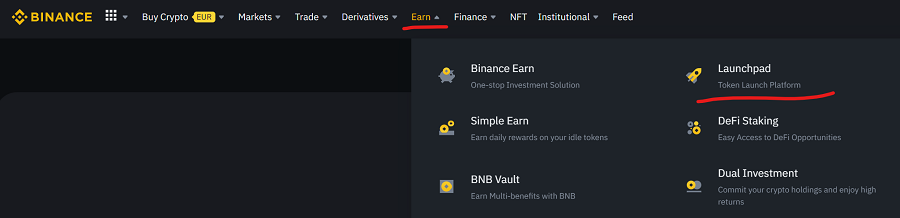

To become an investor in a crypto startup on Binance, you first need to register (600 USD bonus and 20% refback upon registration) and pass KYC (identity verification). After that, you will have access to all the functionality of the exchange, including investing through Launchpad. You can find this service through the main menu at the top of the site in the Earn section.

But before you start investing, you must first buy a native token of this BNB exchange on the spot market. Binance Coin is traded in tandem with many other cryptocurrencies, stablecoins and fiat currencies, including rubles.

You can replenish your account on the Binance exchange both in rubles and immediately with cryptocurrency through the P2P service or use the deposit service of the exchange itself.

We will assume that you already have Binance Coin or BNB on the exchange account and in order to participate in Launchpad, you just have to keep your BNB on the exchange and follow new launches of new launchpads on the Binance exchange.

At some point, you will need to confirm your participation in the Binance Launchpad by clicking on the button on the new project launch page. Usually, only one hour is given for this action, if you did not have time or missed this hour, then you will no longer be able to take part in the distribution of startup tokens, even if you kept your BNB tokens on the exchange all the time.

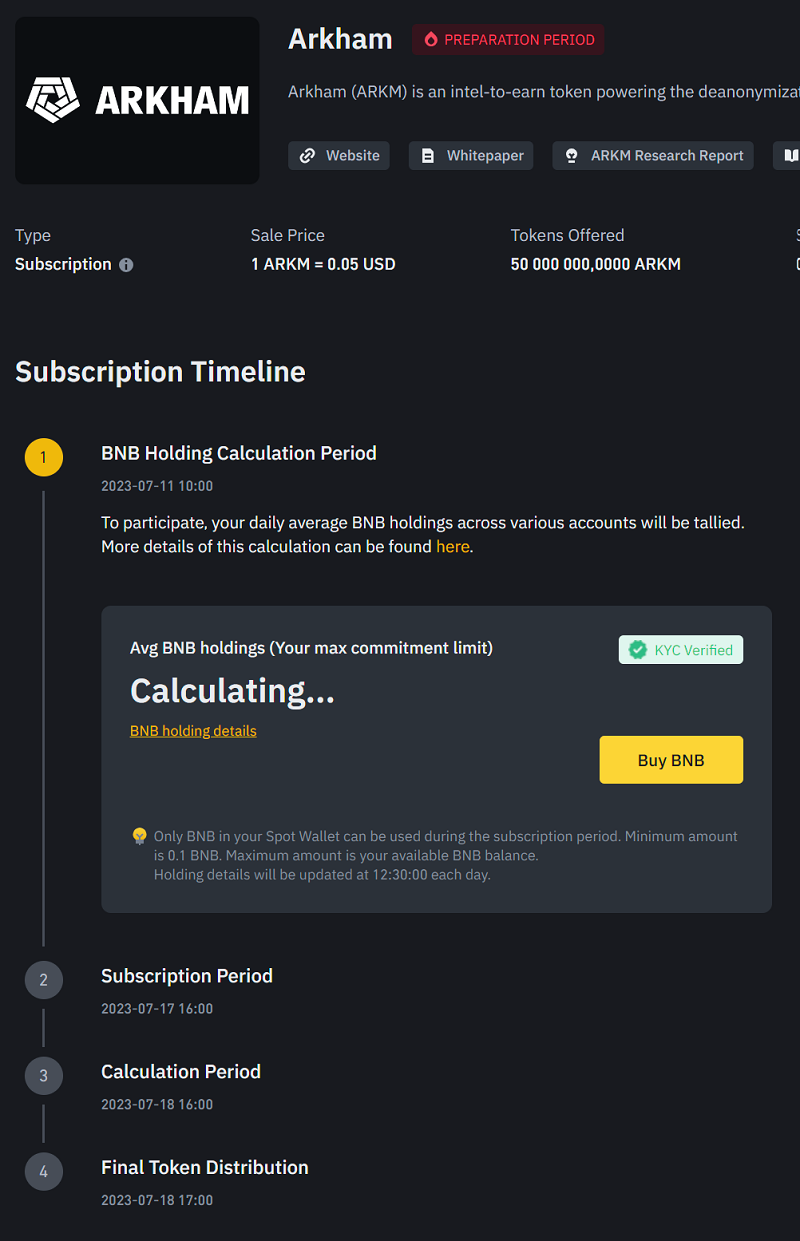

Consider how Launchpad works on Binance using the example of the current IEO ARKHAM

As you can see in the image, from July 11 to July 17, 2023, there is a so-called preparatory period. During this period, you must hold as much BNB as possible in your Binance exchange account. The exchange will automatically calculate the average amount of BNB that was in your account and at the next stage "Start Subscription" invite you to participate in the distribution of new tokens and the more BNB you had in your account, the more you will receive Arkham tokens or any other project that will participate in launchpad.

The most important thing here is not to miss the moment when the "Participate" button will be active.

Cryptocurrency participating in the distribution will be credited to your account within one or two hours after you click the Participate button in Launchpad.

It is worth noting that Binance takes a small BNB commission of less than 1% for participation in Launchpad.

What is the difference between Launchpool and Launchpad

In addition to Launchpad on Binance, there is a second way to distribute tokens called Launchpool. At its core, this is also an IEO, but it has a slightly different way of distributing assets.

Firstly, in order to participate in the Launchpool, you can have not only BNB, but also the TUSD stablecoin.

An investor can immediately invest both BNB and TUSD, and he can choose what amount to choose for investment.

The second difference between Launchpool is the longer duration - usually one month. During which investors will be credited with startup assets while they hold TUSD and BNB in the Launchpool.

The investor can both enter and exit Launchpool at any time.

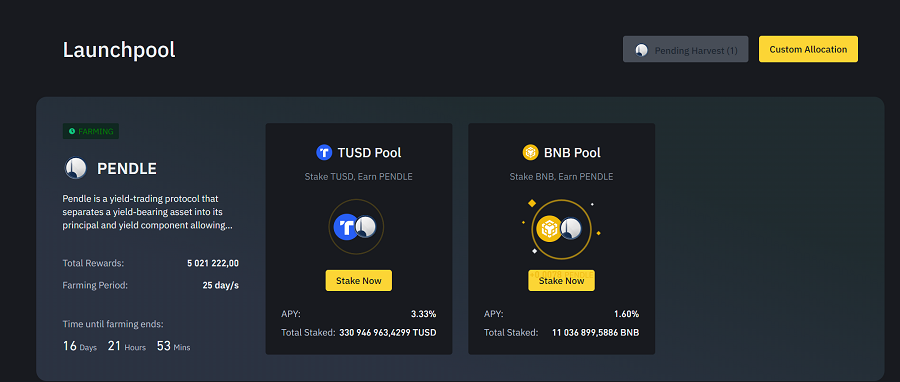

Consider the example of the current Launchpool Pendle.

The validity period (farming) of this Launchpool is 25 days. Of these, there are still 17 days left. Next, we see that TUSD and BNB are involved in farming and the profitability of such farming as a percentage. In the presented example, it is more profitable to invest TUSD, because. the percentage for farming is higher than that of BNB. The percentage is calculated based on the assumption that you will sell the received crypto asset at current prices on the spot market. In the future, this percentage may either rise or fall, depending on the price and popularity of the asset.

In order to receive Pendle tokens in our example, the investor needs to go to the TUSD or BNB investment type of their choice and invest the selected amount in the Launchpool. At this point, while Launchpool is running, you will not be able to sell or otherwise use your invested assets.

You can receive rewards in Launchpool in real time, i.e. you can go to the appropriate section and click the "GET" button, after which the accumulated amount in startup tokens will be credited to your account. You can also just wait until the end of the farming period and then the entire accumulated balance of tokens will be returned to your account along with your initial assets in BNB or TUSD.

Conclusion: Launchpad and Launchpool are the same asset allocation mechanism for crypto startups on the Binance exchange, with slight differences in the timing of asset allocation and the number of investors. But in any case, this is an interesting and most importantly safe way for investors to take part in the initial distribution of tokens of new crypto projects without risking their capital, because. the capital in USDT or BNB remains with the investor, and the crypto enthusiast can already dispose of the startup tokens accrued as a result of the distribution at his own discretion: sell immediately on the market or hold in the long term for the possibility of obtaining greater profits. And even if the new project does not become widespread in the future and its tokens depreciate, the investor in this case loses practically nothing. Unlike ordinary investing in stocks, IPO or ICO, where there is a direct exchange of a more liquid asset: money, stablecoins, Bitcoin, Ethereum for an investment asset that can most likely depreciate.