Market Capitalization is a universal indicator that works not only in the stock market but also in the world of cryptocurrencies and blockchain technologies. It shows the current value of a specific digital currency or the entire network as a whole. No less valuable is the global indicator — the total capitalization of the entire crypto market. This metric helps assess the overall value of all blockchain projects and crypto assets, providing insight into the scale of the industry.

Market Capitalization is a universal indicator that works not only in the stock market but also in the world of cryptocurrencies and blockchain technologies. It shows the current value of a specific digital currency or the entire network as a whole. No less valuable is the global indicator — the total capitalization of the entire crypto market. This metric helps assess the overall value of all blockchain projects and crypto assets, providing insight into the scale of the industry.

Determining the market capitalization of a crypto project is quite simple. While many investors focus on comparing individual coins, it's also useful to look at the bigger picture of the market. The total value of crypto assets significantly exceeds the capitalization of just Bitcoin or Ethereum, despite their leadership in individual metrics.

All major aggregator platforms, such as CoinMarketCap or CoinGecko, provide data on total capitalization, making monitoring easier. But what exactly does this indicator mean and how does it help understand market dynamics? Let's dive deeper.

Definition of Market Capitalization in Crypto

Market capitalization, or market cap, represents the current valuation of a cryptocurrency network. It is calculated by multiplying the number of coins in circulation by their current price.

Imagine two fictional networks: AlphaToken and BetaToken. AlphaToken has only 500 tokens in circulation, each priced at $200. BetaToken operates on a Proof-of-Work basis, with 50,000 tokens in circulation out of a possible 80,000, at $3 per token. Which network is more valuable?

Formula: Capitalization = Circulating Supply × Price

- For AlphaToken: 500 × 200 = $100,000

- For BetaToken: 50,000 × 3 = $150,000

Although BetaToken costs dozens of times less, its network as a whole is valued higher. That's why market cap better reflects the real value of a project than just the price of one coin.

What Does the Total Capitalization of the Crypto Market Represent?

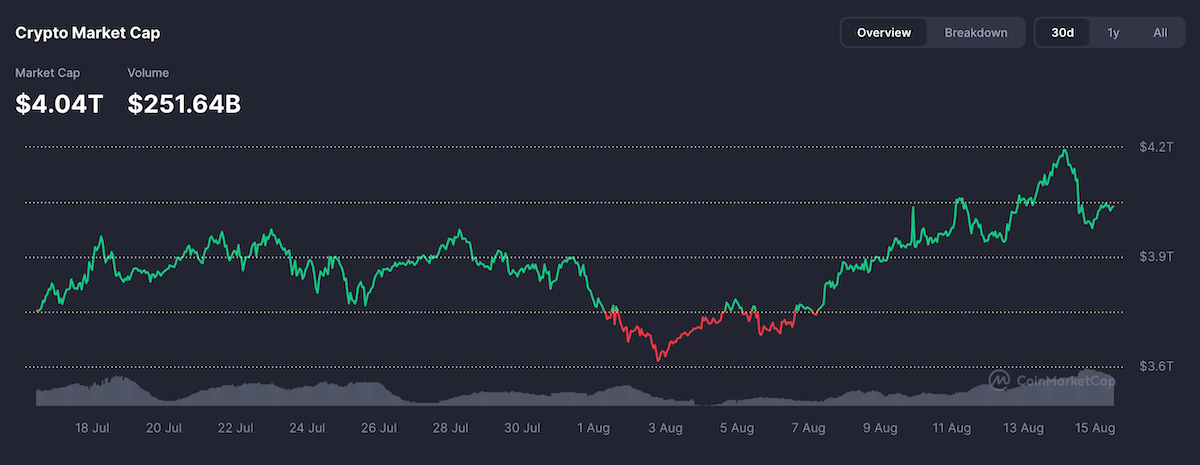

Total capitalization is the overall value of all crypto assets: from Bitcoin and altcoins to stablecoins and tokens. This indicator is important because it illustrates the size of the entire cryptocurrency ecosystem.

The crypto market is known for its high volatility, so capitalization often fluctuates. In the early years (before 2017), it did not exceed $20 billion. After peaking in 2018 at $800 billion, it stabilized in the range of several hundred billion.

Applications of Total Cryptocurrency Capitalization

This indicator is often used to compare the crypto industry with other economic sectors, such as the precious metals market or stocks. Why make such parallels? They help forecast the potential growth of the crypto market in the coming years. However, accurately valuing crypto assets is a complex task, and such comparisons are not always reliable.

Different markets attract different investors: crypto may not necessarily interest stock or forex traders. Cryptocurrencies are a unique asset class with their own rules, and they should be approached accordingly.

Why Can Total Capitalization Be Misleading?

Decisions based solely on this indicator are risky for several reasons.

- First, accurate calculation requires reliable information on the number of coins in circulation. If the data is distorted, the entire valuation loses meaning.

- Second, project capitalizations can be artificially inflated, creating an illusion of reliability. Ignoring this can lead to erroneous investments.

- Finally, market cap is just a snapshot in time. Today it might be in the trillions, and tomorrow it could drop by an order of magnitude due to market fluctuations.

Diluted Capitalization in the Crypto World

There are different evaluation methods. One of them is fully diluted capitalization, which accounts for future supply. This term is borrowed from stocks, where it reflects a company's value after exercising all options.

In crypto, it's important to consider not only the current but also the maximum supply. For example, Bitcoin has a limit of 21 million coins, with about 19 million currently in circulation. At a price of $120,000, the current capitalization is approximately $2.28 trillion, and the diluted one is $2.52 trillion (21 million × $120,000).

This approach applies to all assets: multiply the maximum supply by the current price. It helps identify undervaluation or overvaluation, though due to price volatility, it's not an exact forecast.

Features of Deflationary Tokens

Most cryptocurrencies are inflationary — their supply grows over time, which increases diluted capitalization even at a stable price. But there are deflationary tokens where the supply decreases, for example, through a burning mechanism. This reduces the maximum volume and can increase value.

Example: FlameToken with a maximum of 15 million at $2 each. The team burns 3 million, reducing the limit to 12 million. If the price doesn't change, the diluted capitalization drops from $30 million to $24 million.

However, between the announcement and the burn, the price may change. For deflationary assets, the diluted metric is more of a hypothesis about the future than a fact.

Conclusions

Market capitalization is a key metric for tracking the dynamics of the crypto industry. It shows current trends and helps compare projects. It's useful to distinguish between the standard and diluted versions to understand long-term potential.

Nevertheless, it's not the only indicator. Before investing, study trading volume, liquidity, the project team, and other factors. Market capitalization is just one element of the bigger picture in the world of cryptocurrencies.

If you're interested in similar informational materials, be sure to subscribe to our Telegram channel.