MEV-boost is short for Maximal Extractable Value, and "boost" can be translated as an increase. In other words, MEV-boost is an increase in mining revenue. This article will explore how additional software can be used to boost earnings in both POW (Proof of Work) and POS (Proof of Stake) mining and how this is achieved.

How MEV-Boost Works

To understand the mechanism of extracting greater profits from mining, we first need to recall how blockchain technology operates and at which stage it is possible to integrate into the cryptocurrency's source code without disrupting the entire network's operation.

As is known, simply launching a modified client into the shared Bitcoin or Ethereum network is not feasible. This is because blockchain is a peer-to-peer (P2P) network where each client has equal weight in voting for the correct block. In other words, if an individual client proposes its own block where it claims 500BTC as a reward instead of the 6.25BTC originally programmed into the code, it will be rejected by the majority of votes. To make modified code a common rule for everyone, it must be installed on 51% of all the computational power mining Bitcoin or any other cryptocurrency. Such an attack on the network is called a 51% attack, which is very costly for the attacker, and even from an economic perspective, it is more profitable for the owner of 51% of the network's power to play by the common rules rather than jeopardize the entire blockchain. Consequently, starting from the loss of investor trust, such an asset will rapidly devalue, and the expenses incurred for purchasing 51% of the mining power for an attack will simply not pay off. This rule applies to large and established POW cryptocurrencies. However, if a cryptocurrency is new and has not attracted a large number of miners, such an attack may be easily executed. It is a common occurrence when the developers of a new cryptocurrency use already popular mining algorithms (such as SHA-256, Scrypt, Dagger Hashimoto), where there are already major miners or pools capable of overwhelming 51% of the attacked blockchain with their computing power.

Related material: What does a computer do when mining cryptocurrencies in simple words

In other words, it's not easy to simply mine more coins, so MEV-boost offers a more sophisticated way to extract additional profits, although it may not be as lucrative.

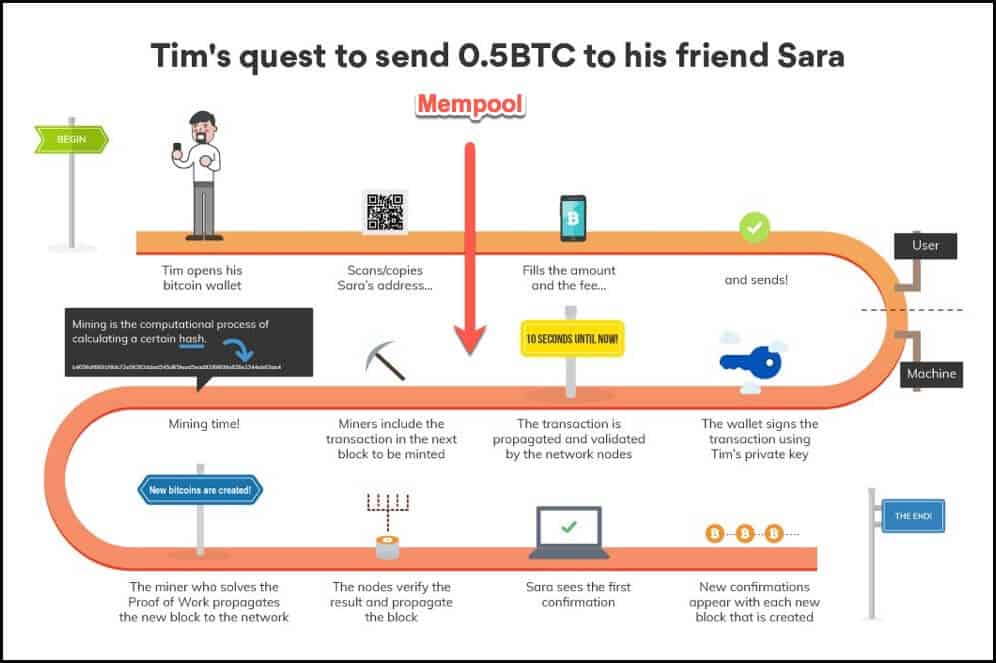

To work with MEV-boost, a so-called MEMPool is required, which exists for all cryptocurrencies using POW and POS mining. The MEMPOOL is like a cache where transactions that have not yet been approved by miners or validators and are not recorded in a block are stored. If you send cryptocurrency to another address with a low fee, your transaction will remain in the MEMPool for a long time until network congestion decreases and the fees decrease. Miners choose transactions for inclusion in a block randomly but with priority given to the size of the fee. In other words, the higher the fee, the more likely a transaction is to be included in the blockchain. It's important to note that a transaction is considered complete only after being recorded in the blockchain, as a transaction stuck in the MEMPool can still be modified or completely canceled.

You've probably already guessed that MEV-Boost is all about selecting transactions to be recorded in a block, based on the maximum fee attached to those transactions, which will be paid to the miner who finds the block and records these transactions in the blockchain.

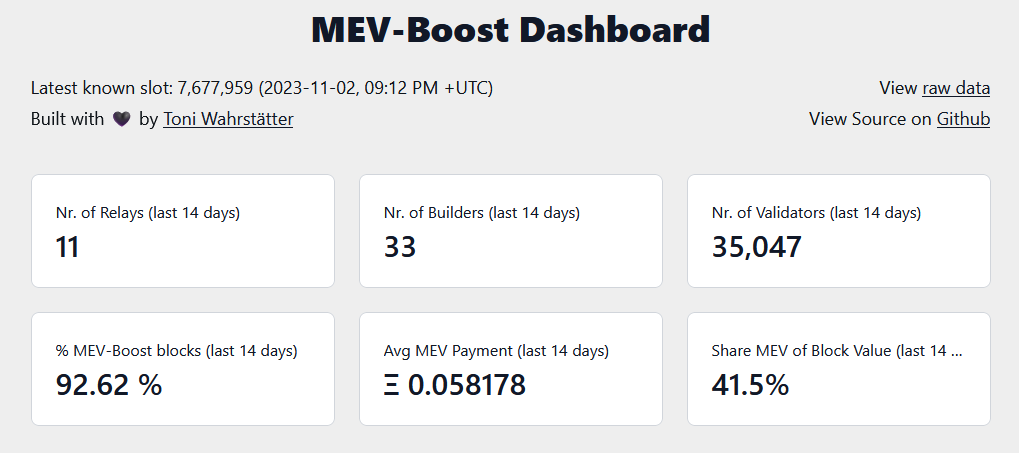

MEV-boost also randomly adds high-fee transactions to a block, just like the standard client (otherwise, it would be flagged as a modified code). However, if a standard client does this once, MEV-boost offers multiple block options and chooses the one where transaction fees are maximized. This means that clients using MEV-boost gain an advantage over standard clients by earning additional income through the selection of high-fee transactions. Standard clients typically end up with transactions featuring minimal fees.

MEV boost and AML

In addition to increasing profits, MEV Boost is used to comply with Anti-Money Laundering (AML) requirements. This means that proposed blocks are filtered not only by the size of the fee but also by addresses on a blacklist (stolen cryptocurrencies, sanctions, etc.). If a proposed block contains even a single address on the blacklist, it is simply excluded, and other transactions from the MEMPool are considered for inclusion in the block.

The AML issue is currently a pressing concern in the Ethereum blockchain, as about 90% of all validators use MEV-boost, and 70-80% of them adhere to AML policies. This primarily concerns centralized services such as LIDO, Coinbase, Binance.

For Ethereum validators, MEV-boost can be downloaded via this link.

For classic POW mining, this problem also exists because mining pools also use MEV-boost, and some of them also adhere to AML policies, especially pools registered in the USA and Europe.

Conclusion: MEV boost is a lightweight exploit for the current architecture of cryptocurrencies built on blockchain technology, which does not affect the overall functionality of the network but takes advantage of the architecture's features to increase the profitability of miners using MEV-boost while reducing the earnings of miners who have not adopted it.