On September 15, 2022, the cryptocurrency Ethereum fully transitioned from Proof of Work (POW) mining (using ASICs and graphics cards) to Proof of Stake (POS) mining, where validators are required to hold 32 ETH on a server and receive rewards for it. Such a server is called a validator. Depositing one's cryptocurrency into POS mining is called staking. The profitability of Ethereum mining in 2024 is approximately 3% annually, which is relatively low by cryptocurrency standards. Everything changed in June 2023 with the introduction of the EigenLayer protocol (smart contract), which allows Ethereum validators to earn additional income almost risk-free through a mechanism called restaking (reStake). Currently, over 70% of validators use restaking services, indicating the high popularity of this approach. Next, we will attempt to explain in simple terms how the asset restaking mechanism works and why it is needed, using EigenLayer as an example.

To better understand the concept of restaking, it's necessary to start from the beginning, namely with the emergence of Bitcoin and POW mining. For this, we recommend familiarizing yourself with the following materials:What is cryptocurrency mining?, What does a computer do when mining cryptocurrencies in simple words

In short, POW or POS mining is a mechanism to protect the blockchain network from attacks. However, each technology still has a way to bypass its protection. For POW, it's the 51% attack, where the attacker needs to have 51% of the network's power. For POS, one needs more than 51% of all assets, but this breach is still possible at the blockchain level.

An example of restaking in POW mining is dual mining cryptocurrencies like Litecoin and Dogecoin. This means that by mining one coin, you automatically receive the second one.

When a new project with POW and POS mining emerges, due to the low network difficulty in POW mining or a small number of validators, plus the low value of the cryptocurrency itself for POS mining, such projects are highly vulnerable to hacking attacks. Because of this, a project might start but get hacked, which severely impacts its future development prospects.

Restaking precisely addresses this problem for new crypto projects. They can "lease" validators from a larger network, in our case Ethereum, and use them to ensure the security of their protocol.

Such leasing is not free, and it requires payment. Restaking services act as intermediaries between validators and projects (charging a 2% commission), which decide to leverage the reliability of a large blockchain, thus increasing trust among potential investors.

The mechanism of transferring validators is built on smart contracts and has proven to be a reliable tool over time. This allows validators to earn additional profit, and new projects gain a reliable blockchain and recognition among Ethereum holders and validators.

Crypto projects that use restaking are also called L2 solutions (Layer 2). Moreover, the fees in L2 projects are much lower than in the main Ethereum network due to the implementation of ZKSync technology and the recent Ethereum Dencun hard fork, which reduced fees for L2 solutions by 10-100 times.

L2 solutions, although based on the Ethereum blockchain, are effectively separate blockchains. To transfer 100 USDT ERC-20 from the main network to an L2 network, such as Linea, one needs to use bridges (Bridge) like owlto.finance. Similarly, bridges can be used to transfer tokens between different L2 networks.

In addition to the pioneer of this direction, EigenLayer, several followers have emerged using the same working principle: EtherFi, Renzo, Puffer, Kelp, Swell, Mantle.

Consider methods of restaking using the EigenLayer as an example.

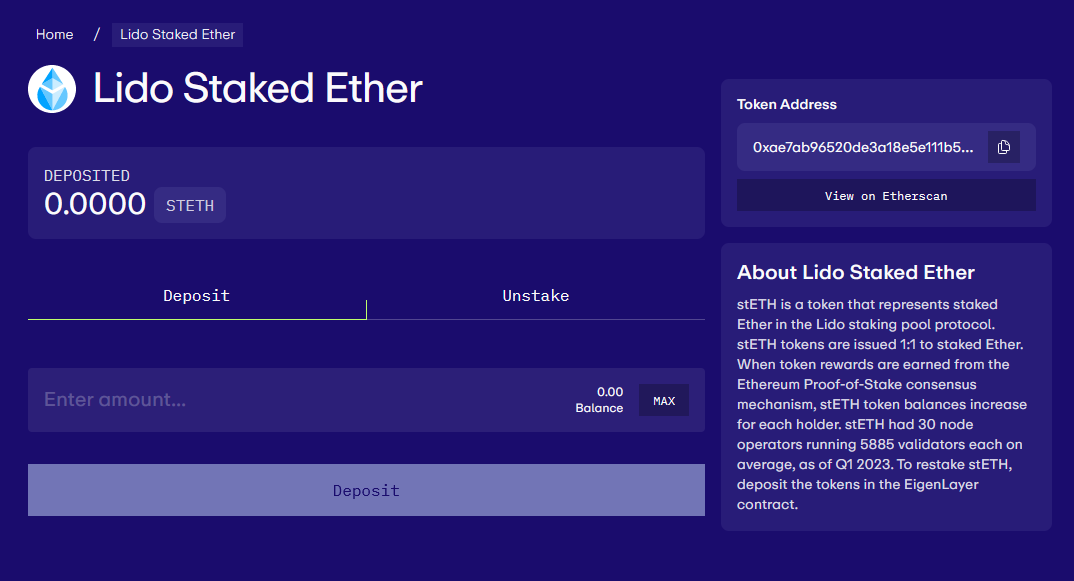

To participate in restaking, it's not necessary to have your own validator with 32 ETH because EigenLayer supports restaking tokens from Liquid Stake services (such as Lido, Rocket Pool, and others). Liquid Stake is essentially a mining pool analogue through which you can participate in POS mining with any amount. Using a smart contract, you delegate your Ethereum and receive tokens in return (stETH for Lido, rETH for Rocket Pool). stETH holders earn interest for POS mining in the same stETH token. When you want to exit staking, you can exchange stETH for ETH on DEX or CEX exchanges or retrieve your ETH back by calling the smart contract on the Lido website.

For holders of full validators with their own server to participate in restaking, there is one condition: your validator must have a specified address for block rewards withdrawal, which is indicated on the EigenLayer website. If you have already specified your own withdrawal address for the validator, unfortunately, you will have to exit the validator and re-enter with the EigenLayer address because you can only specify the withdrawal address for the validator once.

Keep in mind that the validator has two withdrawal addresses: the first is for block rewards (BLS address), which can be set only once, and the second is for income withdrawal from the Consensus layer, which is credited with each epoch and can be changed an unlimited number of times in the validator settings.

It's also worth noting that support for restaking full validators is organized through a native smart contract, creating a so-called EigenPod, so they can participate in restaking without any restrictions. EigenLayer may impose restrictions on depositing tokens for liquid staking on its platform. Due to this, you may not always be able to use the EigenLayer service, and you may have to wait until deposits for liquid staking tokens become available again. These restrictions are periodically introduced to maintain a higher yield percentage for EigenLayer depositors.

So, to start restaking Ether, you need to go to the eigenlayer.xyz website, then go to the Restake tab (the service may not be available in some countries, so you may need to use a VPN).

Next, choose a liquid staking service, such as LIDO, that you used for staking. Connect your web3 crypto wallet (MetaMask or any other) and specify the amount in stETH that you want to invest in restaking.

Click the Deposit button and confirm the transaction in your crypto wallet.

As a result, you will receive LRT tokens (Liquid Restaking Tokens) equivalent to the value of the initial ETH asset.

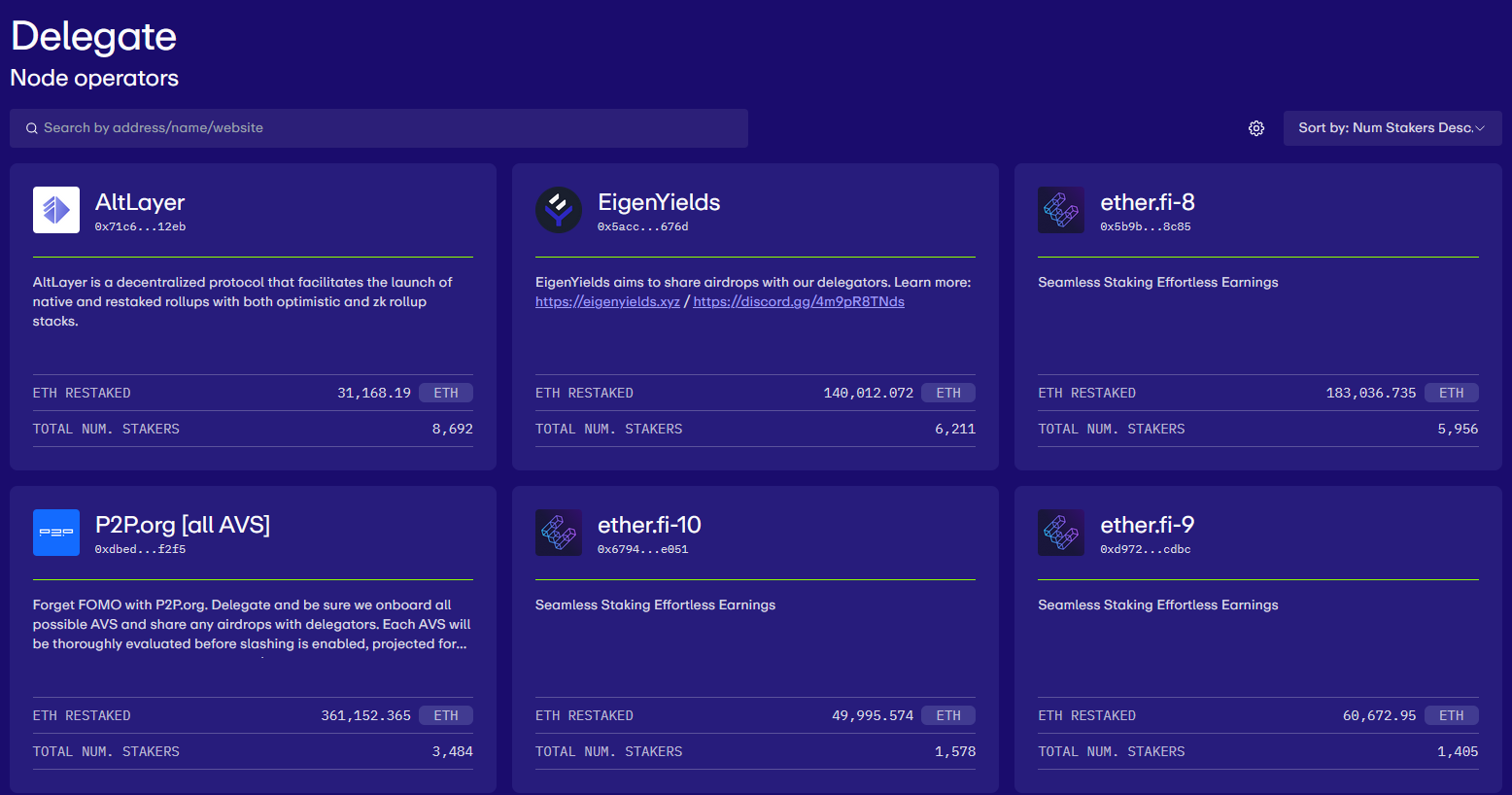

Next, you need to delegate your LRT tokens to one of the operators, of which there are many.

In the list of operators, there are also EtherFi, Renzo, and other restaking services based on EigenLayer algorithms. It's better to use them directly through their websites because in this case, you will receive points from both EigenLayer and EtherFi or Renzo.

How to use EtherFi will be discussed in more detail in another article.

Therefore, choose only those services that work exclusively on EigenLayer, such as EigenYields, ALTlayer, and others.

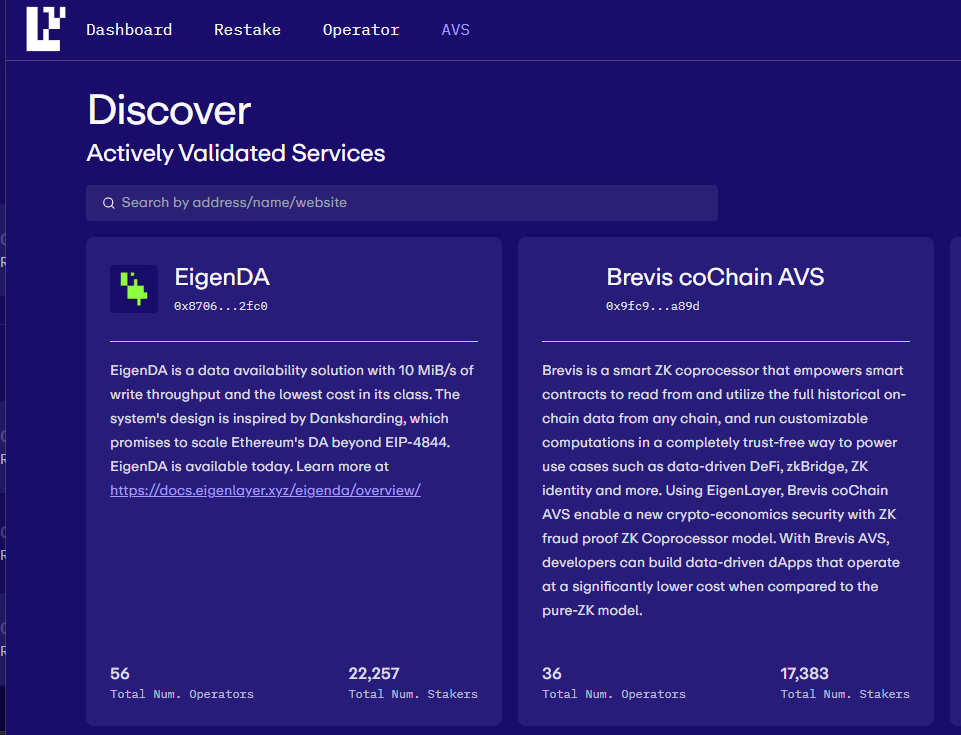

On the website menu, you may also notice a page with AVS (Actively Validated Services), which are separate projects that use multiple operators simultaneously for their operation. The same operator can be used in several AVSs at once.

You cannot delegate your LRT directly to AVS, but you can use AVS as a filter for operators if you want to support a specific AVS, for example, EigenDA, which proposes to organize a data storage with low hosting costs and access speed of 10MB/s.