After 4 years of Ethereum Proof of Stake (POS) mining, I exited the network and withdrew 32 ETH from my validator. Below, I will explain why I made this decision, but first, let’s summarize the results of my solo ETH staking over this period. I started my Ethereum POS mining journey back in December 2020, when it was still a test network, and the main network was operating on the traditional Proof of Work (POW) mining with GPUs and ASICs. At that time, there were only a few tens of thousands of validators in the Ethereum network, and the annual yield was over 20%, not even including block proposal rewards. Block rewards only became available after the so-called Merge, when Ethereum fully transitioned to POS mining on September 15, 2022.

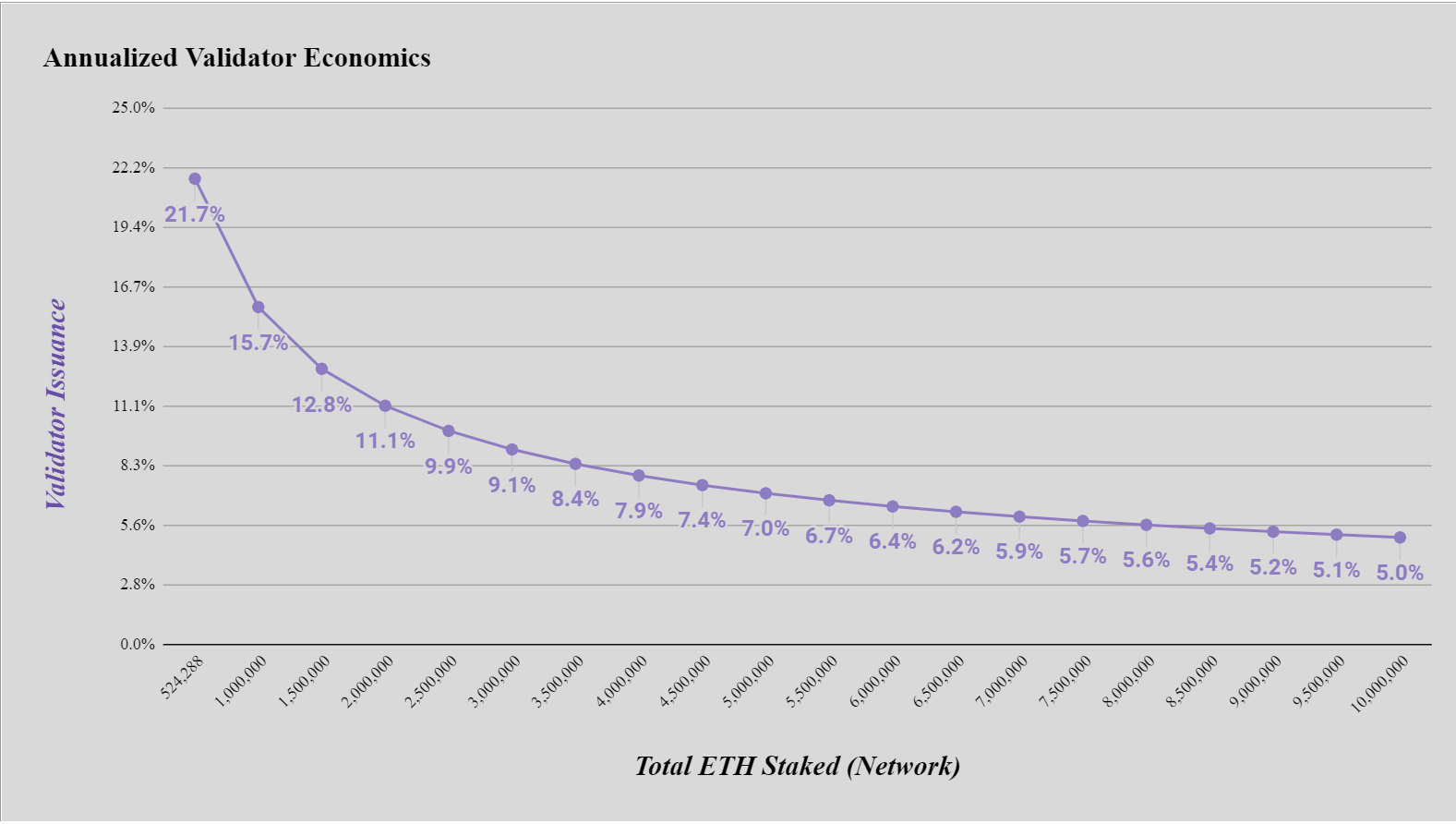

After 4 years of Ethereum Proof of Stake (POS) mining, I exited the network and withdrew 32 ETH from my validator. Below, I will explain why I made this decision, but first, let’s summarize the results of my solo ETH staking over this period. I started my Ethereum POS mining journey back in December 2020, when it was still a test network, and the main network was operating on the traditional Proof of Work (POW) mining with GPUs and ASICs. At that time, there were only a few tens of thousands of validators in the Ethereum network, and the annual yield was over 20%, not even including block proposal rewards. Block rewards only became available after the so-called Merge, when Ethereum fully transitioned to POS mining on September 15, 2022.

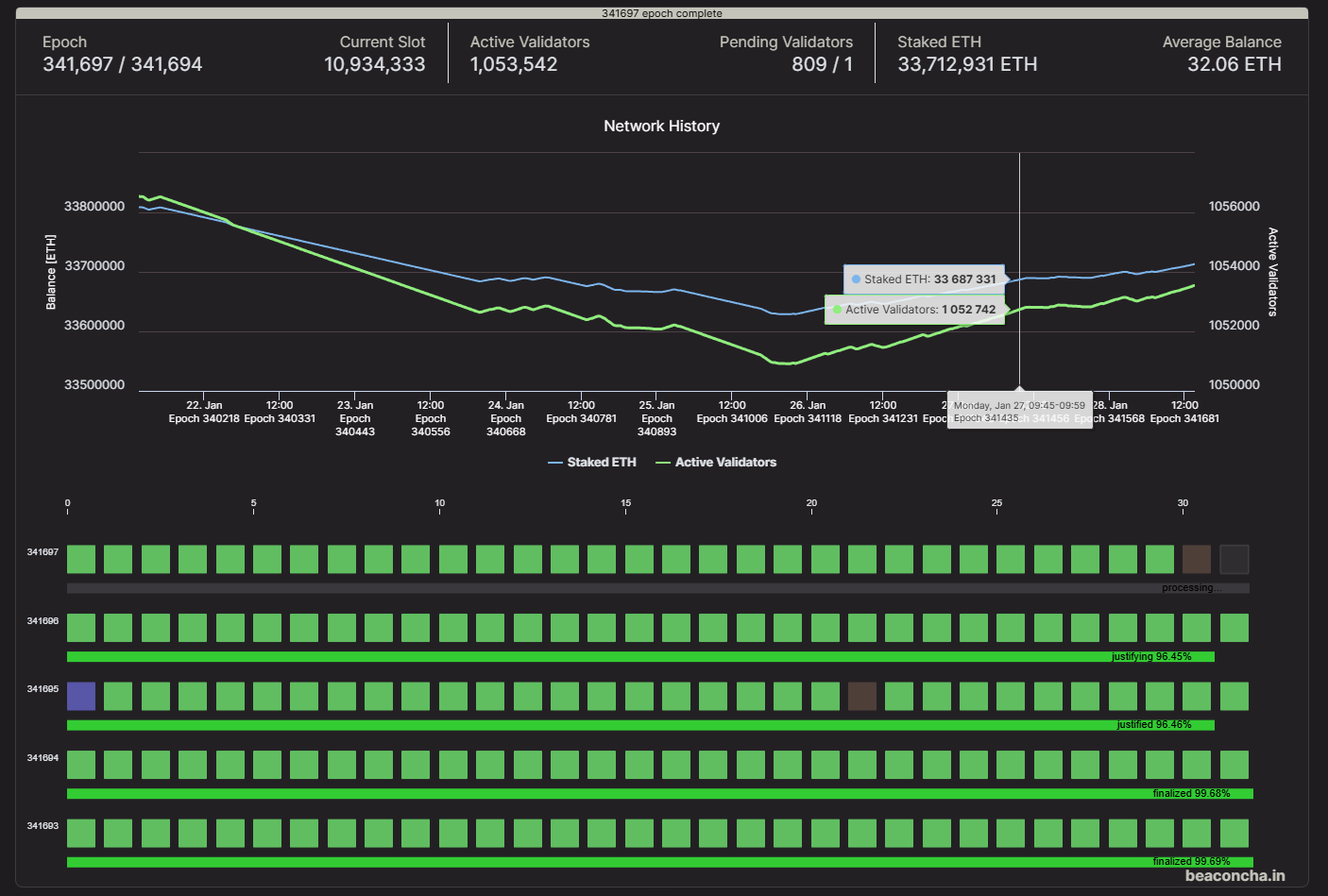

Hoping for a consistent 20% annual yield was nothing more than a pipe dream. Everyone understood this, but no one expected POS mining to become so popular, primarily due to the emergence of liquid staking services like Lido, Rocket Pool, and others. As a result, by early 2025, the number of validators far exceeded 1 million servers.

Even the developers in 2020 did not anticipate that 32 million ETH would be staked.

After the first year of ETH POS mining, I summarized my results, and the annual yield was slightly over 8%. Investments in Ethereum 2.0 for the year yielded a profit of 8% per annum

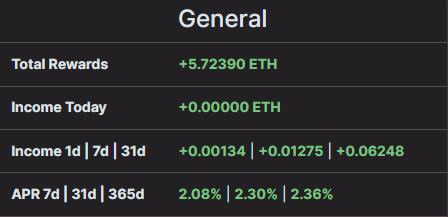

In 2024, the annual yield from ETH POS mining was 2.36%, or 0.75 ETH. The decline in mining profitability was primarily due to the increasing number of validators.

Over the entire period of running my Ethereum validator, from December 2020 to January 2025, I earned a total of 5.7 ETH.

Compared to other validators, this result is below average. In the early stages, I had to frequently reconfigure or even move my validator to different devices due to the ever-increasing performance and SSD storage requirements. Initially, my validator ran on a virtual hosting server for 4 USD per month. However, the hosting provider had to continuously upgrade the server, and eventually, the cost reached 90 USD per month—less than a year into POS mining.

Ultimately, I installed Linux and a 2TB NVMe SSD on my Ryzen 1700X workstation to avoid further upgrades and reduce validator costs, as 90 USD per month was roughly the validator’s monthly earnings. In other words, it became economically unfeasible to continue using dedicated hosting servers, especially considering the constant growth in SSD storage requirements. Here, I must vent my frustration at AMD, as the Ryzen 1700X was extremely unstable on Linux, frequently freezing and rebooting. It turned out that the processor could not operate in power-saving mode under Linux, so I had to disable this feature. Additionally, I had to replace the RAM because the processor was unstable with low-latency memory. I had expensive 16GB CL14 memory, which I replaced with standard 32GB CL16 memory, as 16GB was barely sufficient, and the system constantly relied on disk swap files. Eventually, I replaced the 1700X with a 5700G, and all stability issues were resolved instantly. While I was dealing with these problems, the validator lost some income when the server was offline, meaning I not only failed to earn but also lost previously earned ETH.

I’ll keep a photo of the computer with the ETH validator as a memento.

There were also periods when I had to update the validator software almost every week due to bugs or Ethereum network upgrades. One such software issue cost me two weeks of downtime while I was on vacation and unable to update the server software. Nowadays, validator software updates are less frequent, but it’s still something to keep in mind.

Overall, I estimate that the losses from these downtimes amounted to at least 0.3 ETH, or 5% of the total income.

Additionally, throughout the entire POS mining period, my validator never made it into the sync committee (How POS mining works on the Ethereum 2 network. Synchronization committee and light clients after the Altair hardfork ), where validation rewards are approximately 20 times higher. The estimated time for a validator to join the sync committee is once every 2,300 days, or roughly once every 6 years.

There were also issues with block proposals, which provide additional income. The estimated time to propose a block is currently 146 days, meaning each validator should, on average, propose 2 blocks per year. However, I was unlucky here as well—the last block my validator proposed was in January 2024. So, I can’t call my validator particularly fortunate.

Moreover, the large number of validators in the ETH network significantly increases the demands on internet connectivity, particularly the number of active connections. On average, an Ethereum validator maintains between 1,000 and 2,000 connections, which severely impacts home internet usage. I personally hit my ISP’s limit on the number of connections, and during peak times, my home internet would stop working because the provider dropped packets exceeding the limit. Regular web browsing became a nightmare, with constant page reloads to ensure my requests were sent and received.

Another downside is the inevitable upgrade of the validator’s SSD from 2TB to 4TB, which I estimate will be necessary this year, as POS mining for ETH will require 1.4TB by early 2025. If the block size increase is approved in the March Pectra upgrade, a 4TB SSD will be needed by summer 2025.

The final and decisive factor for exiting Ethereum mining is the need for a second desktop computer. The tasks my work laptop is facing are now beyond its capabilities. Instead of purchasing new equipment, I decided to eliminate all these problems at once with minimal costs by transferring tasks from the laptop to the current server running the Ethereum validator. This way, all the issues associated with maintaining the ETH validator server will resolve themselves.

Admittedly, I felt a bit sad about exiting solo ETH staking. Over the past 4 years, I had grown accustomed to checking the validator’s statistics, holding onto the faint hope that it would propose a block with a high reward today. Moreover, the POS mining process had become much less time-consuming than it was at the beginning.

The lost income of 0.75 ETH could be compensated by transitioning to restaking ETH on platforms like Ether.fi or Eigen Layer, but with increased risks of protocol lockups or hacks, potentially losing the entire amount at once. This decision is still pending; the freed-up 32 ETH might be distributed across various DeFi investment tools.

In conclusion, I can say that POS mining of Ethereum is a decent passive income method, especially if you’re comfortable with Linux and have 32 ETH to spare. Currently, it’s the most reliable way to earn additional income from your crypto assets, with minimal operational costs beyond the initial server purchase of $500–700. Another important takeaway from ETH POS mining is the advantage of running multiple validators, as one server can support dozens of them.

For new and regular readers, I’ve been mining Ethereum since its inception in 2015, when it was only possible to mine solo using a GPU or even a CPU with the Ethereum Frontier wallet and command line. Moreover, I was one of the 8,000 participants in Ethereum’s ICO in 2014, making me an early adopter of Ethereum. However, for the reasons mentioned above, I’ve transitioned from an active member of the Ethereum community to simply holding Ethereum cryptocurrency.