In the modern world of financial technologies and cryptocurrencies, trading on Binance Futures is becoming increasingly popular among traders. This is especially true in anticipation of the impending bullish trend and the growth of cryptocurrency rates. Also, in the near future, the start of the altseason is very likely, during which the rates of almost all altcoins grow. It is futures trading that allows you to get the most out of trading, thanks to the use of leverage. In this complete guide, we will look at the basics of futures trading on the Binance exchange, as well as step by step and with illustrations explain how to register on the exchange, make a deposit and close your first deal on the Binance futures platform. This guide may be useful to you if you are going to participate in our new promotion "Get guaranteed 50 USDT for registration on Binance", which will last until the end of the month.

In the modern world of financial technologies and cryptocurrencies, trading on Binance Futures is becoming increasingly popular among traders. This is especially true in anticipation of the impending bullish trend and the growth of cryptocurrency rates. Also, in the near future, the start of the altseason is very likely, during which the rates of almost all altcoins grow. It is futures trading that allows you to get the most out of trading, thanks to the use of leverage. In this complete guide, we will look at the basics of futures trading on the Binance exchange, as well as step by step and with illustrations explain how to register on the exchange, make a deposit and close your first deal on the Binance futures platform. This guide may be useful to you if you are going to participate in our new promotion "Get guaranteed 50 USDT for registration on Binance", which will last until the end of the month.

Before you start trading futures on Binance, it is important to understand how the platform works and all its features. This guide will cover the basics and settings related to trading perpetual futures on Binance. It is important to be aware of the risks associated with futures trading. Only start trading when you are confident in your knowledge and understanding of how this product works. Futures trading requires some technical skills and an understanding of trading basics. The Binance Futures user interface may seem complex, but this guide will help you quickly understand its main features and aspects of its operation.

How to register on Binance futures:

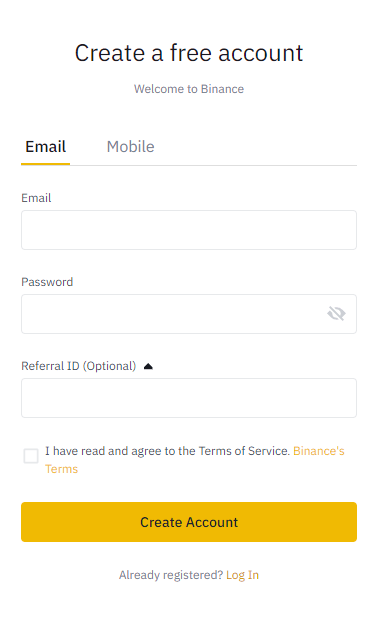

To open an account on Binance Futures, you will need an existing Binance account. If you do not have a Binance account yet, register on the Binance website, enter your email address and create a strong password. Be sure to use the referral ID MLDOBG5I - it will allow you to get the maximum possible discount of 10% on the futures market, as well as 20% cashback when trading on spot.

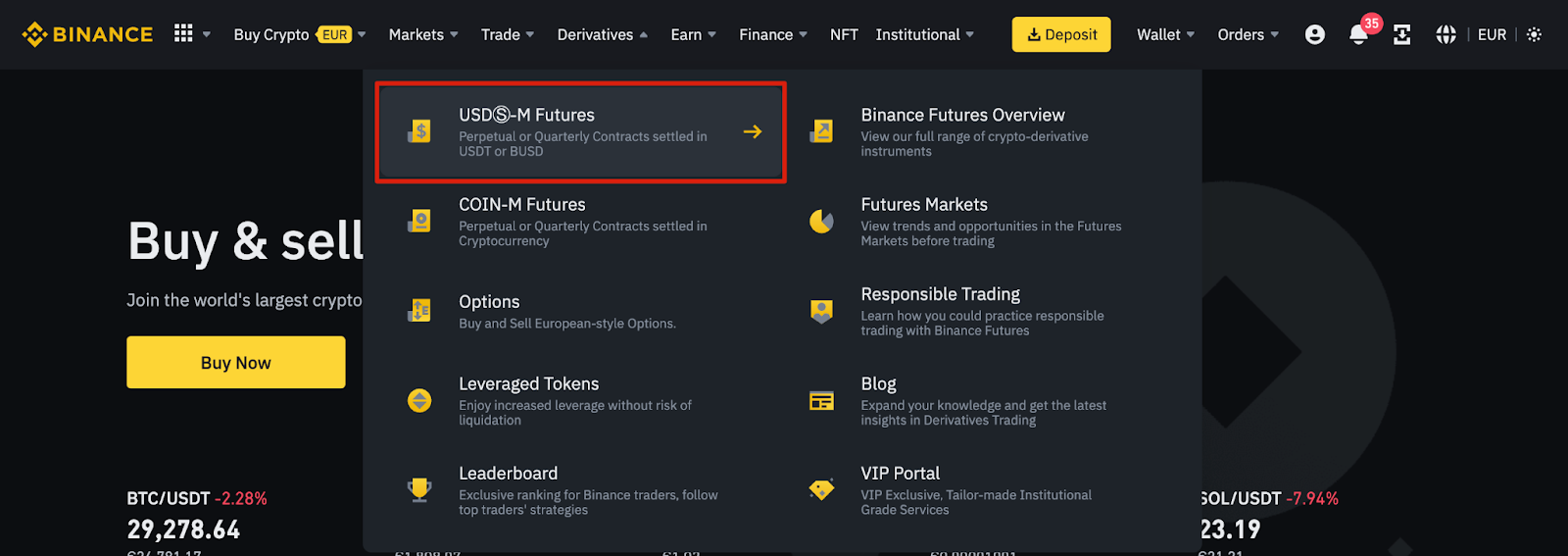

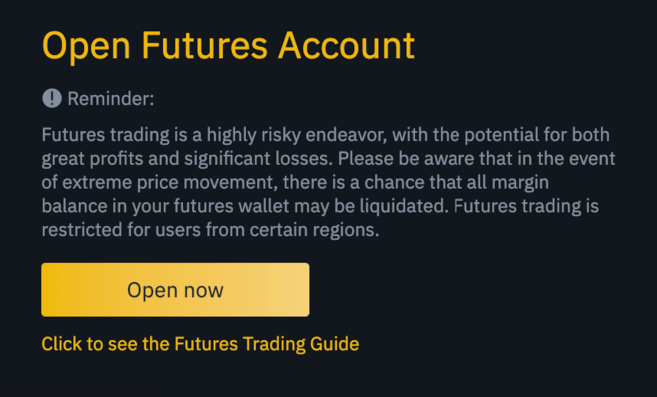

Click “Create Account” and wait for the confirmation email. Log in to your Binance account and go to the “Derivatives” section on the top bar. Select “USD(S)-M Futures” and click “Open Now”.

You can now trade futures on Binance. However, please note that this tool requires training and preparation to operate safely. If you are not yet ready to use real funds, try the Binance Futures testnet.

How to top up Binance futures balance:

To fund your Binance Futures balance, you will need funds in your Binance account. These can be in a fund wallet, fiat, spot, margin, or options wallet. If you do not have funds in your balance, it is recommended to read the instructions.

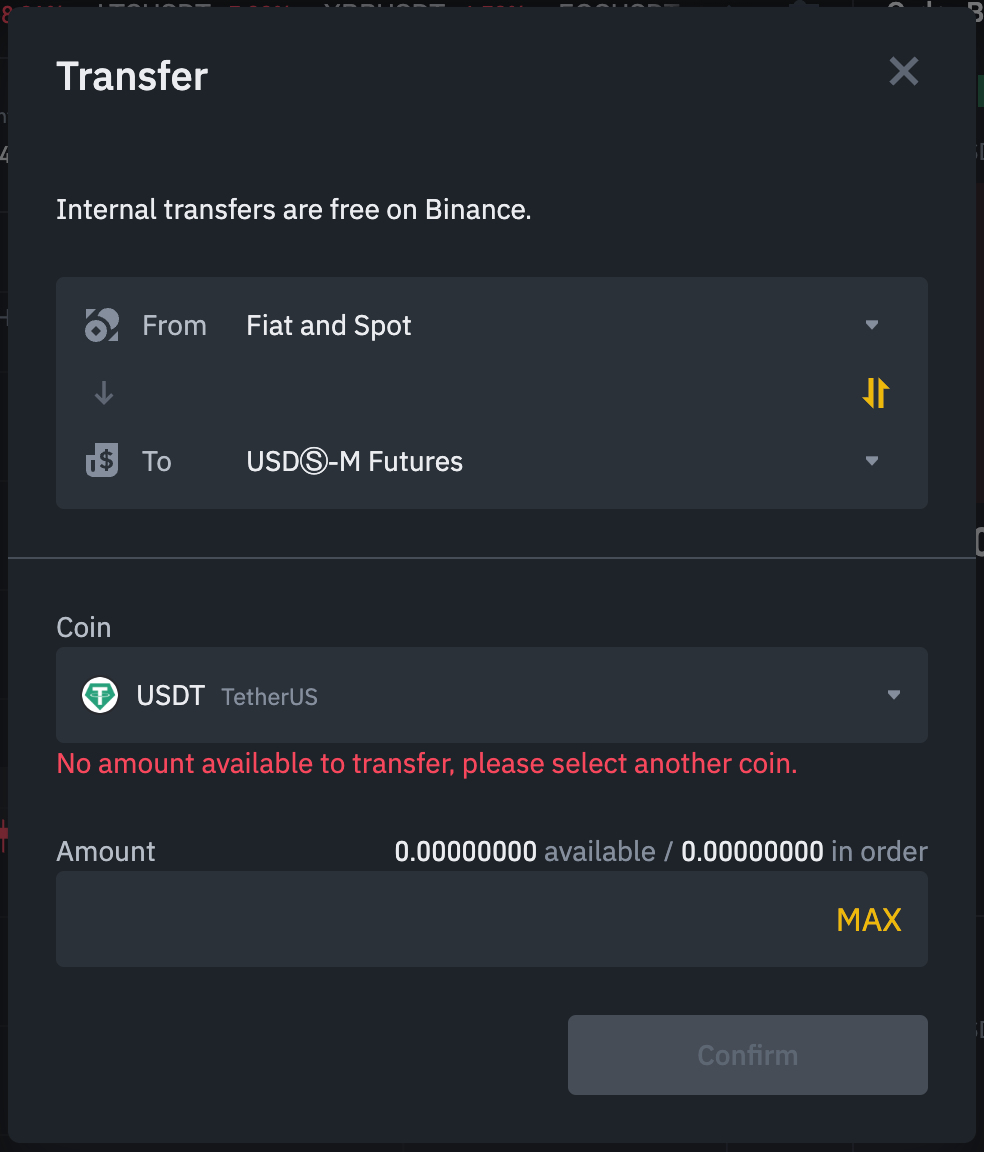

To transfer funds to your futures wallet, click on the transfer icon on the right side of the Binance Futures page.

Specify the transfer amount, select the source wallet and click "Confirm". The funds should then be transferred to your futures wallet. You can also change the transfer direction if necessary.

Using the Binance Futures Interface:

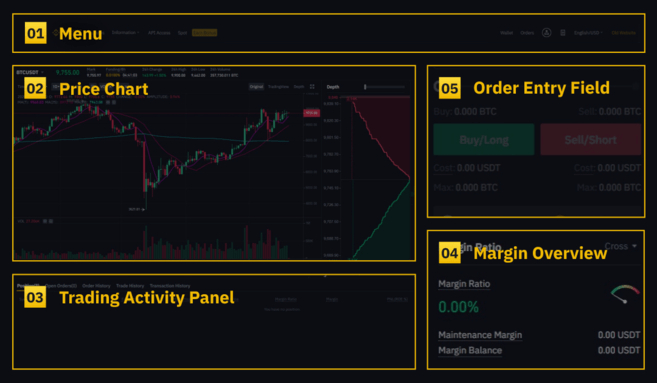

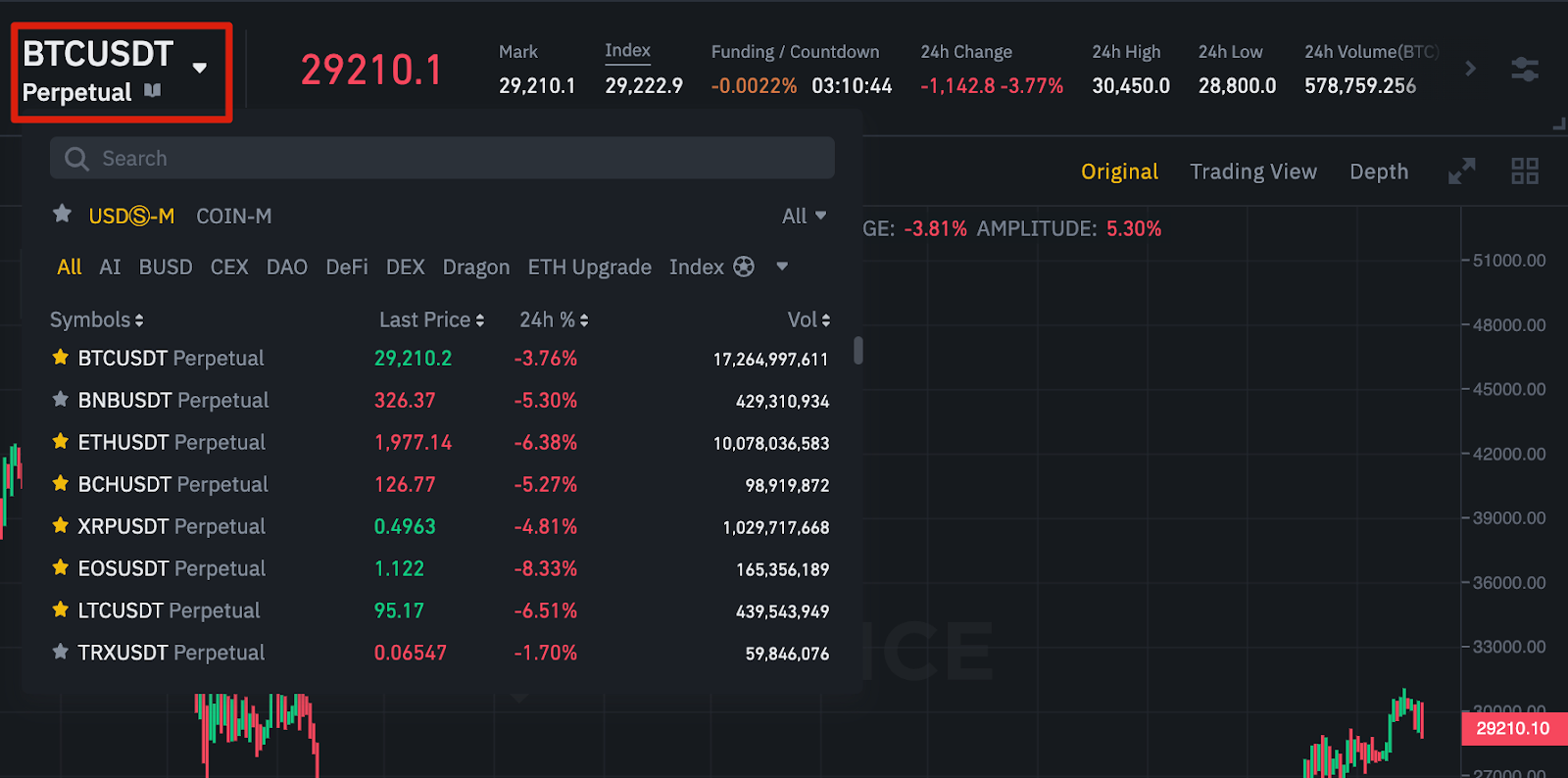

The menu offers access to various sections of Binance, such as COIN-M futures, options, trading strategies, and activity. The Info tab contains information about API access, funding rate, index price, and other market data.

On the right side of the top panel is a section for going to your Binance account and tracking wallet balances and orders across the entire Binance ecosystem.

The "Price chart" section allows you to:

-

select a contract by clicking on the name of the current contract (BTCUSDT by default);

-

view the price of marking, which is important for liquidation;

-

study the expected funding rate and the countdown timer to the next round of funding;

-

analyze the current chart by switching between the basic version and the TradingView chart, and evaluate the current order book depth in real time using the depth button;

-

the ability to monitor order book data in real time is provided by the drop-down menu in the upper right corner of the window (default value is 0.01);

-

you can also study the history of transactions on the platform.

The trading activity panel provides the ability to monitor your activity on the futures platform. Here you can monitor the current status of positions, view open and executed orders, as well as the history of trades and transactions for a certain period.

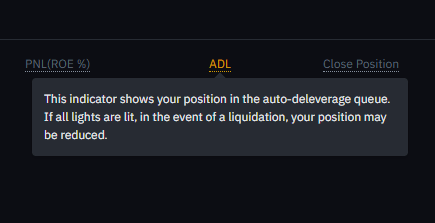

You can also monitor positions that are in the Automatic Leveraging De-Leverage (ADL) queue, which is especially important during periods of high volatility.

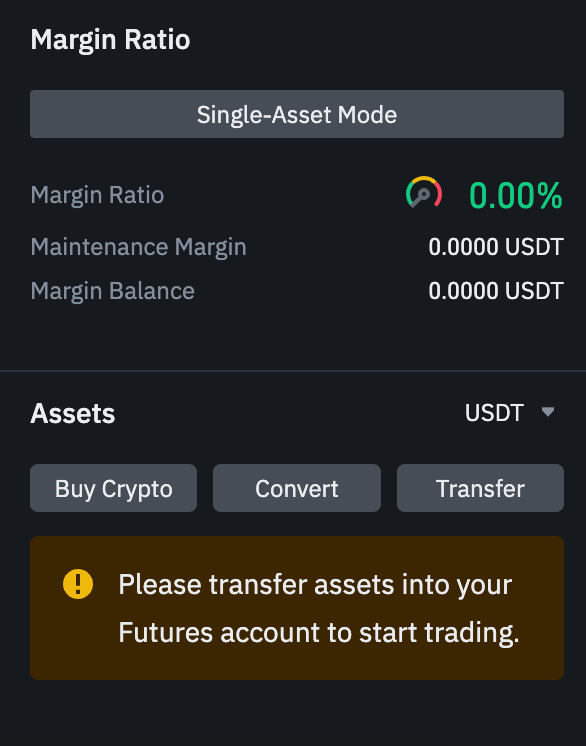

In the Margin Trading Overview section, you will find information about the assets available for transferring funds and buying cryptocurrency. The current contract and positions are also presented here. It is important to monitor the margin level to avoid liquidation.

To transfer funds between the Futures Wallet and other wallets in the Binance ecosystem, use the Transfer function.

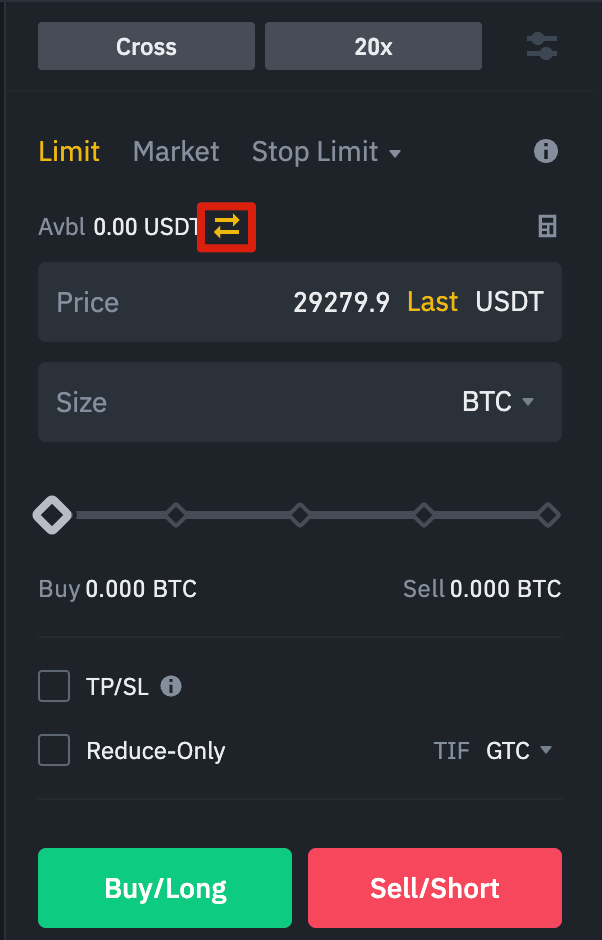

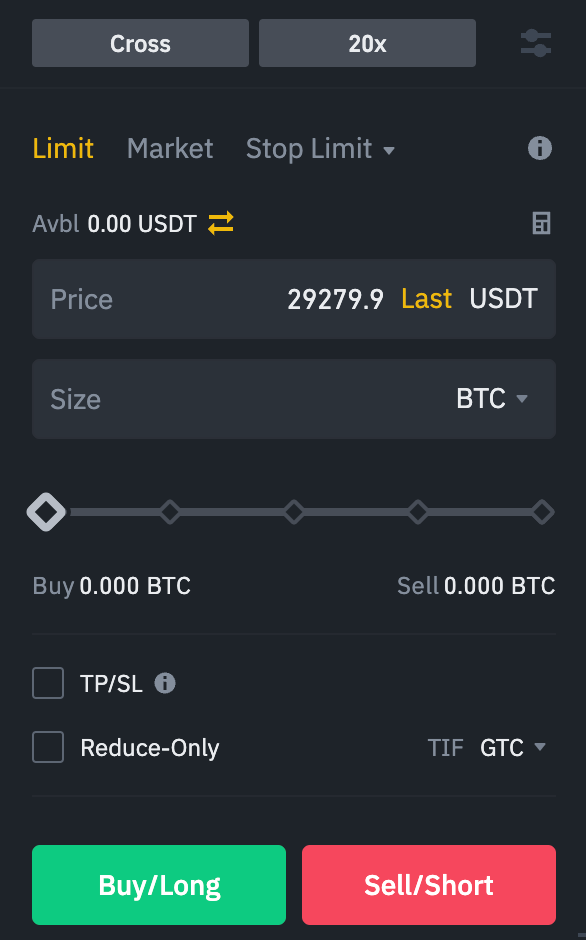

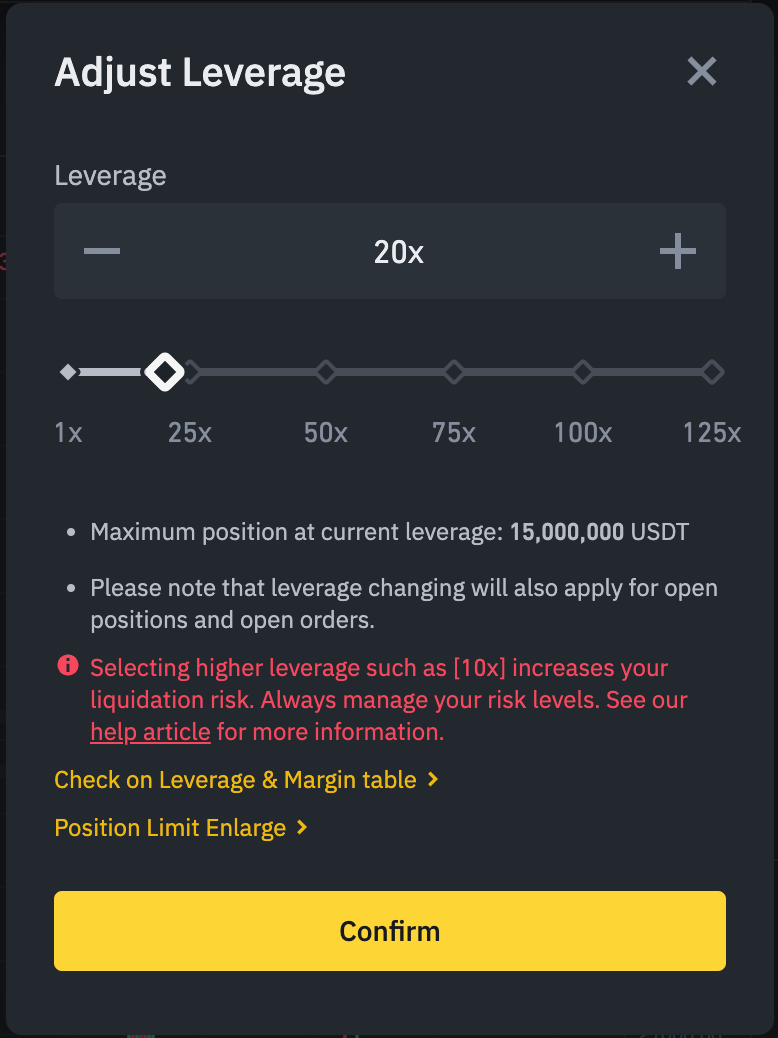

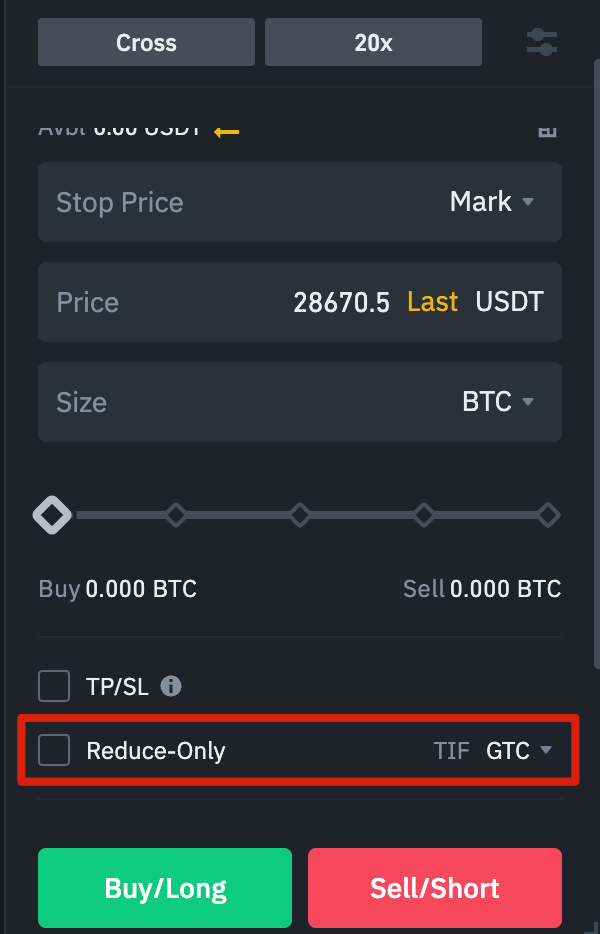

In the Order Entry field, you can set the parameters of buy (long) and sell (short) orders. A detailed description of order types is available in this article. At the top of the section, you can switch between cross margin and isolated margin modes. To set the leverage, click on the current leverage level (default is 20x).

In all modules and sections, you can resize elements by moving the arrow in the lower right corner of the module. This allows you to easily customize the interface for yourself.

How to set up leverage:

Binance Futures allows you to manually adjust your leverage. To select a contract, hover over the current contract (BTCUSDT by default) in the upper left corner of the page.

Then, to change the leverage, go to the order entry field and click on the current leverage level (default is 20x). Use the slider to select the desired amount or enter the required number, then confirm the changes.

Please note that as position size increases, the available leverage decreases and vice versa. Higher leverage increases the risk of liquidation. Traders should carefully consider the amount of leverage used and the risks associated with it.

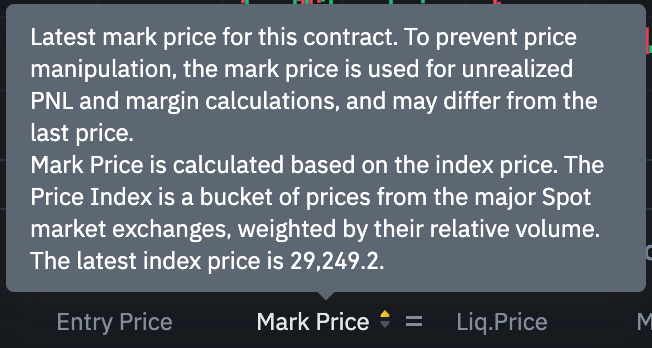

What is the difference between the marking price and the final price??

To prevent unwanted liquidations due to sharp price movements during periods of high volatility, Binance Futures uses last price and mark price parameters.

- The last price is the value of the last trade on the contract, i.e. the last price is determined by the last trade in the trading history. It is used to calculate the realized profit or loss (PnL).

- The mark price is designed to prevent price manipulation. It is calculated based on funding information and a basket of prices from several spot exchanges. The liquidation price and unrealized profit or loss (PnL) are determined based on the mark price.

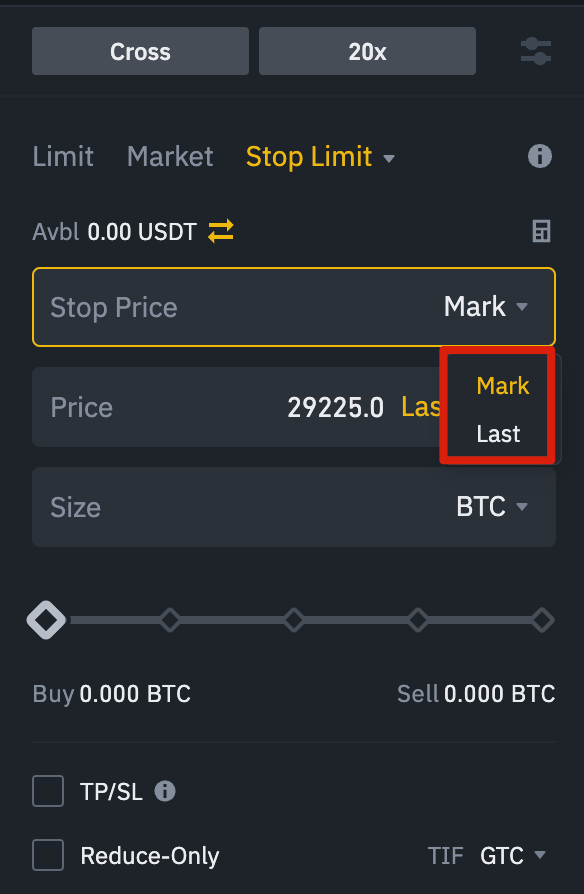

Please note that the mark price and the last price may differ. When setting a stop price, you can select the last price or mark price as the trigger threshold in the corresponding drop-down menu in the order entry field.

What types of orders exist and how to use them:

When placing an order, you can choose one of several types:

-

Limit order: Placed in the order book with a specific limit price. The order will only be executed if the market price reaches or exceeds the limit price. Limit orders are used to buy at a lower price or sell at a higher price relative to the market.

-

Market order: an order to buy or sell at the best market price. It is executed based on previously placed limit orders. When you place a market order, you pay a taker fee.

-

Stop Limit Order: Consists of two parts - the stop price and the limit price. The stop price is responsible for placing a limit order when the asset reaches a certain value, and the limit price is a predetermined value of the limit order. When the stop price is reached, the limit order appears in the order book. The limit price and stop price can be the same, but this is not necessary. For a sell order, it is better to set the stop price slightly above the limit price, and for a buy order - slightly below. This will increase the chances of the limit order being executed after the stop price is reached.

-

Market Stop Order: Works similar to a Limit Stop Order, but the order becomes a market order when the stop price is reached.

- A limit take profit is similar to a limit stop order. It also has a trigger price that triggers the order and a limit price at which the order is added to the order book. The main difference between a limit stop order and a limit take profit is that the latter is only used to close open positions. A limit take profit can be useful for risk management and locking in profits at specific price levels. It can also be used in combination with other order types, such as limit stop orders, to provide greater control over positions. Note that OCO orders are not included in this category. For example, if a limit stop order is triggered while you have an active limit take profit, the limit take profit will remain active until you manually cancel it. You can set a limit take profit in the Stop Limit tab of the order entry field.

- Market Take Profit works similar to Limit Take Profit, but the order becomes a market order when the stop price is reached. You can set a market take profit in the Stop Market tab of the order entry field.

- A trailing stop order helps you lock in profits while limiting potential losses on your open positions. For a long position, the trailing stop price rises with the price. When the price falls, the trailing stop price stops again. If the price moves a certain percentage (called the deviation percentage) in the other direction, a sell order is placed. The same thing happens with a short position, but in reverse. The trailing stop price falls with the market, but stops if the market starts to rise. If the price moves a certain percentage in the other direction, a buy order is placed. The trigger price is the desired price level at which the trailing stop order is triggered. If you do not specify a trigger price, the current last price or mark price will be used by default. The trigger price can be entered at the bottom of the order entry field. The deviation percentage is a percentage value that determines how closely the trailing stop price will follow the price movements. So, with a deviation percentage of 1%, the trailing stop price will follow the price at a distance of 1% if the price moves in the right direction. If the price moves in the opposite direction by more than 1%, a buy or sell order is placed (depending on the direction of the trade).

How to use Binance futures calculator:

At the top of the order creation window is a calculator that allows you to determine the optimal parameters for opening a long or short position. You can adjust the leverage value by moving the slider on each tab, which will take it into account in the calculations.

The calculator includes three sections:

-

PNL - to determine the initial margin, profit and loss (PnL), and return on equity (ROE) based on assumed position opening and closing prices and position size.

-

Target Price - to calculate the price at which a position must be closed to achieve the desired percentage return.

-

Liquidation Price - to calculate the liquidation price taking into account the current balance of your wallet, the expected opening price of the position and the size of the position.

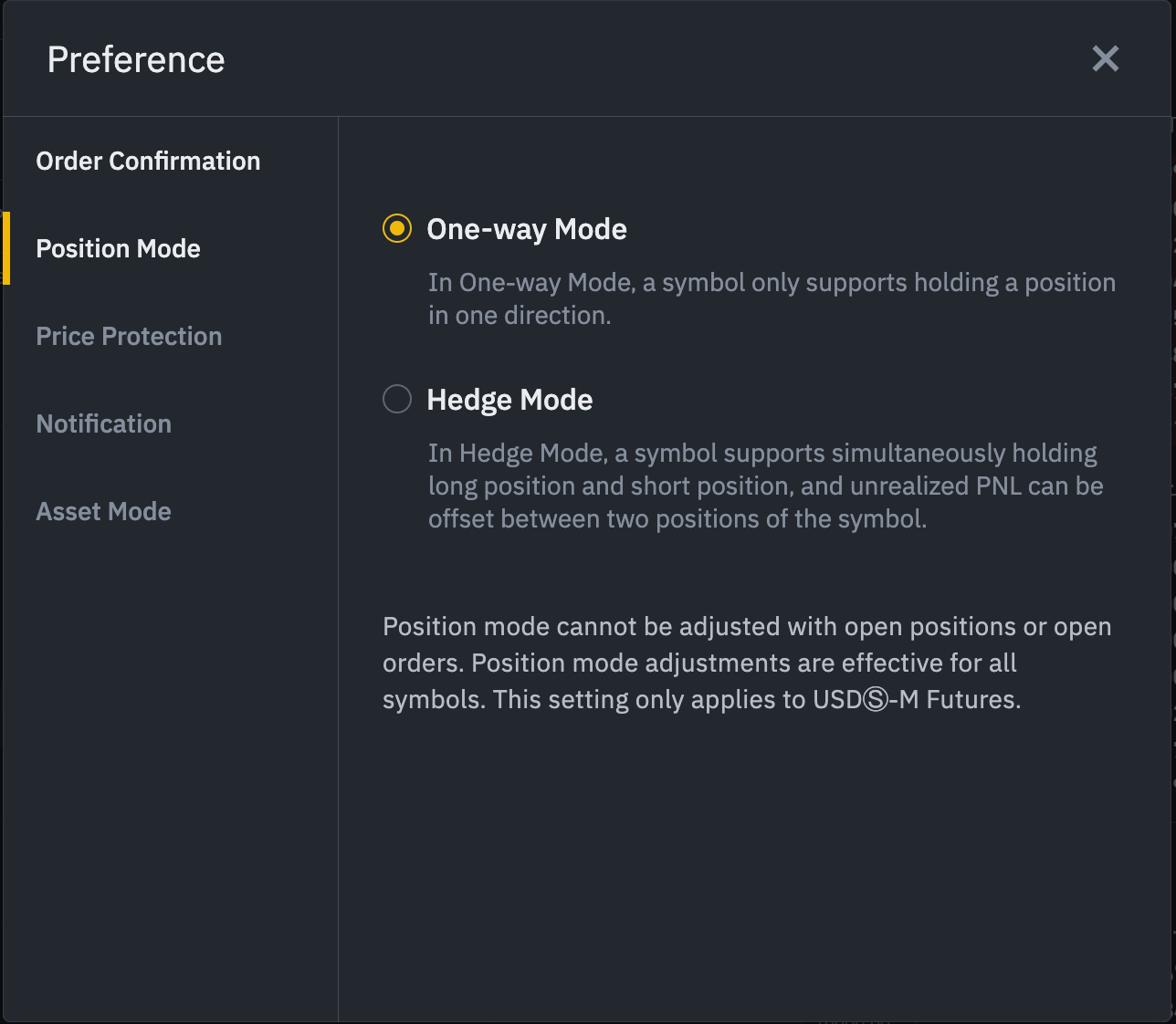

What is hedging mode and how to use it:

Hedging allows you to open long and short positions on the same asset at the same time. This feature is useful for traders who are optimistic about the long term but pessimistic about the short term. Hedging prevents short-term short positions from affecting long-term long positions.

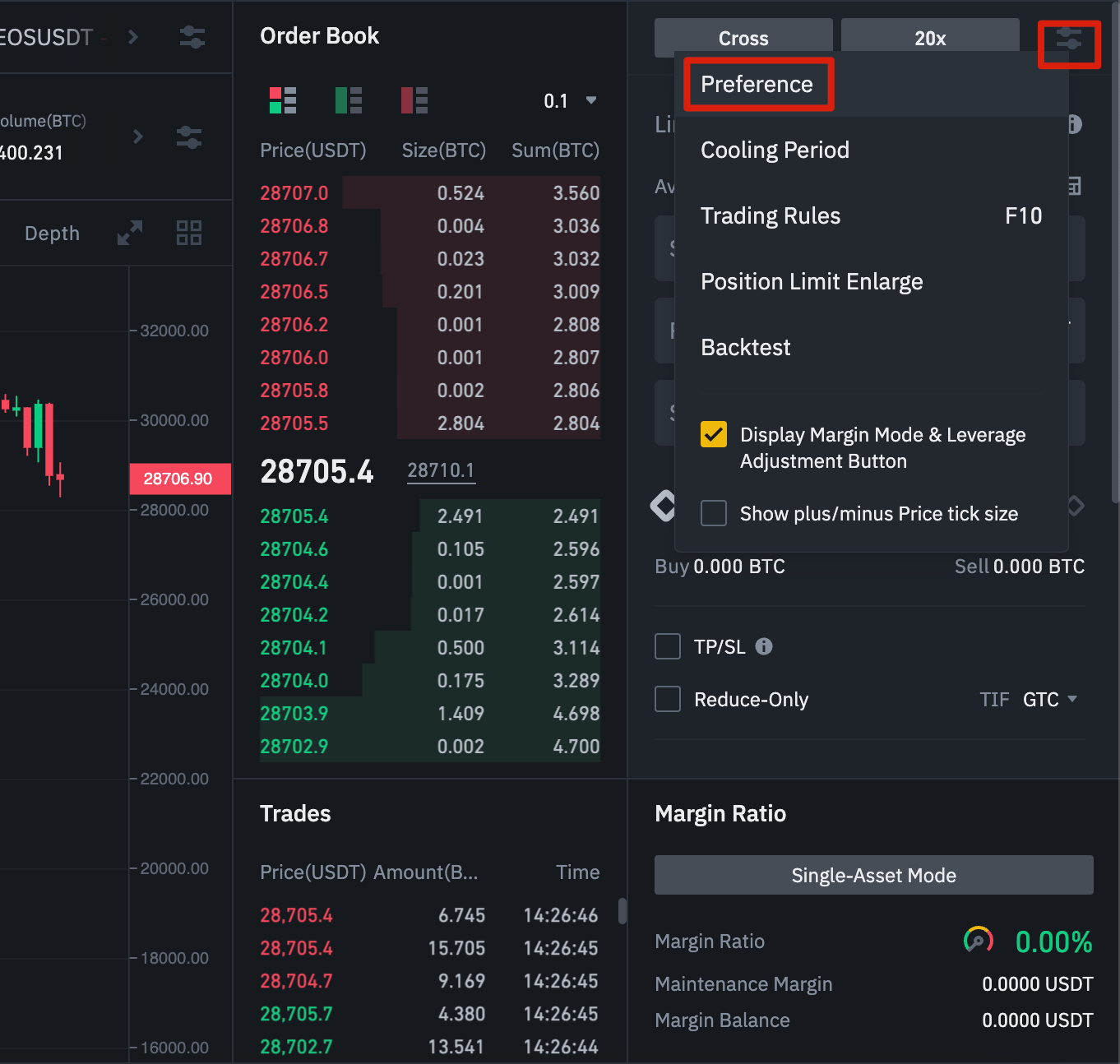

By default, the position is opened in one-way mode, which does not allow opening long and short positions on the same asset at the same time. If you try to do this, the positions will be automatically cancelled. To activate hedging, follow these steps:

In the upper right corner of the screen, select "Settings".

Go to the Position Mode tab and select Hedging.

Before changing the mode, make sure you have no open orders or positions.

What is the financing rate and how to check it:

The financing rate ensures that the price of the perpetual futures contract matches the underlying asset (spot). Essentially, traders make mutual payments depending on their positions. The amount of the payment is determined by the difference between the price of the perpetual futures contract and the spot price.

If funding is positive, long positions pay short positions, and if funding is negative, short positions pay long positions.

This means that depending on your positions and the funding rate, you either pay or receive a payout. Binance Futures pays out every 8 hours. At the top of the page, next to the mark price, you can see the estimated funding rate for the next period and the time.

To view the financing rate history for each contract, hover over the Information tab and select Financing Rate History.

Placement Only Mode, TIF and Position Reduction

If you are placing limit orders, you can set the "place only" and "order life in force" (TIF) parameters. These settings determine how limit orders work and are available at the bottom of the order entry form.

The "place only" option specifies that the order will be added to the order queue and will not be matched with other orders immediately. This is useful for those who want to pay a fee as a maker.

The TIF parameter allows you to set the period of time your order will be active before being executed or expiring. You can choose from three options:

- GTC (valid until cancelled).

- IOC (Immediately or Canceled).

- FOK (fulfilled in full or cancelled).

If you are using one-way mode, you can check the "reduce only" box to limit the resizing of your position and prevent it from growing.

What are the conditions for liquidation of positions:

Liquidation occurs when the margin balance falls below the required maintenance margin level. The margin balance includes unrealized PnL (profit and loss), so profit and loss directly affect the change in margin. If the cross margin mode is used, then the total balance is calculated for all positions. If the isolated margin mode is used, then the balance is distributed among the positions.

Maintenance margin is the minimum amount required to keep open positions active. The amount required depends on the size of the position, with larger positions requiring a higher maintenance margin.

The current margin ratio can be checked in the lower right corner. When the ratio reaches 100%, all positions are liquidated.

During liquidation, all open orders are forcibly cancelled. It is recommended to monitor the status of your positions to avoid automatic liquidation, which incurs additional fees. If your position is close to liquidation, it may be worth closing it manually to avoid additional charges.

Automatic removal of borrowed funds:

If the trader's account balance becomes negative, the insurance fund is used to compensate for the losses. However, during periods of increased market volatility, a situation may arise where the insurance fund is not enough to cover the losses, and then the number of open positions is reduced. This means that open positions may be affected by the reduction.

The reduction of positions occurs according to the order set by the queue. This queue starts with orders that have the highest leverage and potential profit. To find out the position number in this queue, select "ADL" in the "Positions" tab at the top of the page.

Conclusions:

A traditional futures contract is a derivative instrument that obligates traders to buy or sell an asset at a certain price in the future. Unlike regular futures, perpetual futures contracts do not have a set expiration date. However, these instruments can be difficult for newcomers to understand, so it is important to learn how they work before making financial decisions. You can use the Binance Futures testnet to test the platform without the risk of losing real money. However, if you have some experience in futures trading, this instrument will allow you to earn much more compared to the classic spot market, and the correct use of leverage does not increase the risks too much.

You can use our promo code MLDOBG5I when registering on Binance, this will allow you to get the maximum possible discount on fees of 10% on futures trading (and 20% on spot), which will allow you to maximize your profits.

Also, join our "Get guaranteed 50 USDT for registration on Binance" promotion that will run until the end of November, where the first participants are guaranteed to receive a 50 USDT reward that can be easily withdrawn or used to trade on Binance.