The cryptocurrency exchange Binance offers its users an extensive list of various services related to cryptocurrencies. Today, we will explore how one of these services, called Binance Dual Investments, works and discuss a relatively secure way to use such investments, which we have employed multiple times to generate additional income from our crypto assets. Finally, we will share our favorite way of utilizing this service.

The cryptocurrency exchange Binance offers its users an extensive list of various services related to cryptocurrencies. Today, we will explore how one of these services, called Binance Dual Investments, works and discuss a relatively secure way to use such investments, which we have employed multiple times to generate additional income from our crypto assets. Finally, we will share our favorite way of utilizing this service.

You can find the Dual Investments service on the Binance website in the Earn section, under the submenu High Yield.

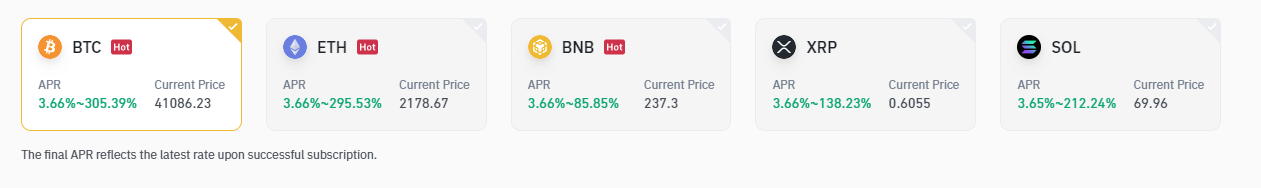

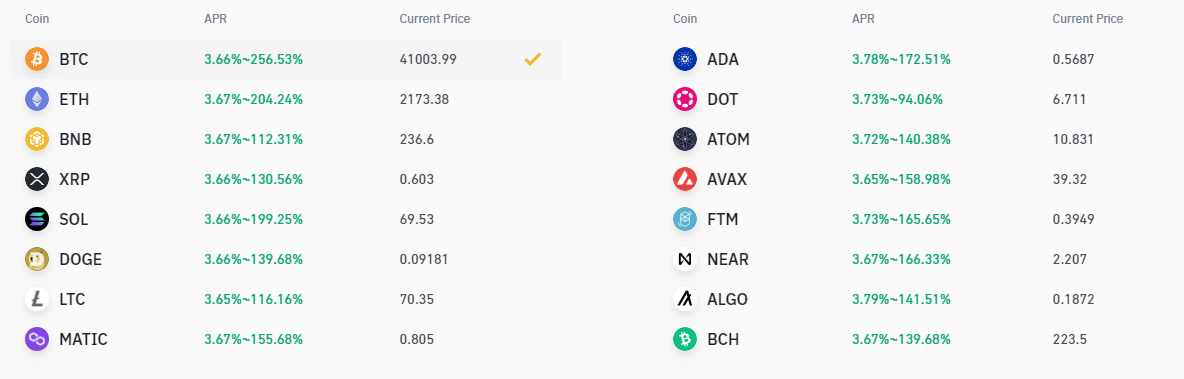

Dual Investments are appropriately placed in the High Yield section because the returns from investing in this instrument can reach 100-200% per annum or even more. However, as an investor, you have the flexibility to choose the investment period, risk level, and potential returns. Due to this flexibility, we can use Dual Investments to extract additional profits based on our goals.

To understand how to relatively safely achieve high returns from your crypto asset investments, let's first delve into how this type of investment works.

How Binance Dual Investments Work:

Binance Dual Investments are a relatively complex financial product that involves staking, futures, and options technologies. However, without delving into economic terms, we won't detail how this service works under the hood or where Binance itself derives profits from our investments in this instrument.

In brief, Dual Investments are short-term investments that allow you to profit from market fluctuations.

We will only examine dual crypto investments from the investor's perspective, exploring the options and functionality available within this service to use cryptocurrency more profitably than if it were simply sitting in the exchange accounts.

At present, Dual Investments are limited to 12 cryptocurrencies: BTC, ETH, BNB, XRP, SOL, DOGE, LTC, MATIC, ADA, DOT, ATOM, AVAX, FTM, NEAR, ALGO, BCH. This functionality is not available for other cryptocurrencies, and the list of cryptocurrencies available for dual investment may change and expand over time.

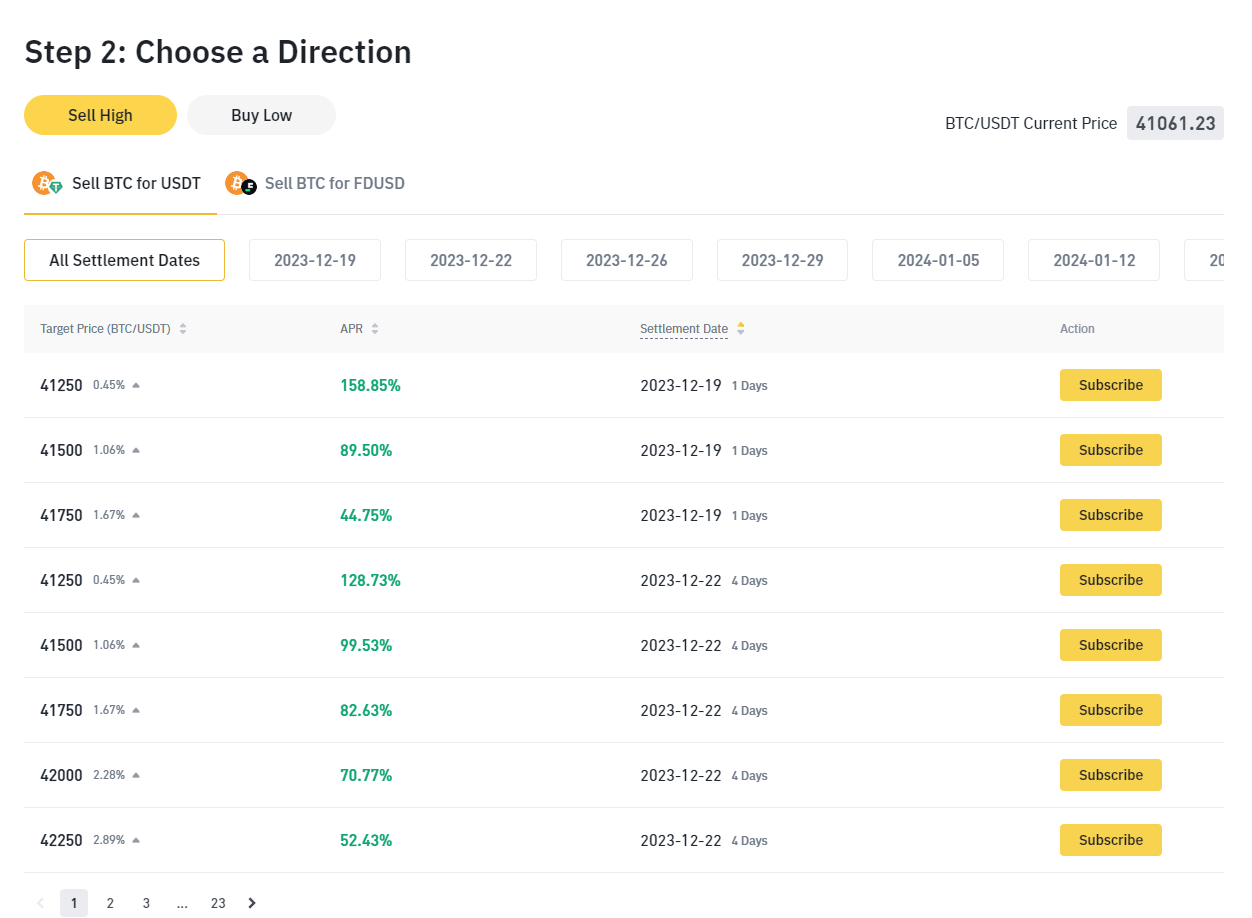

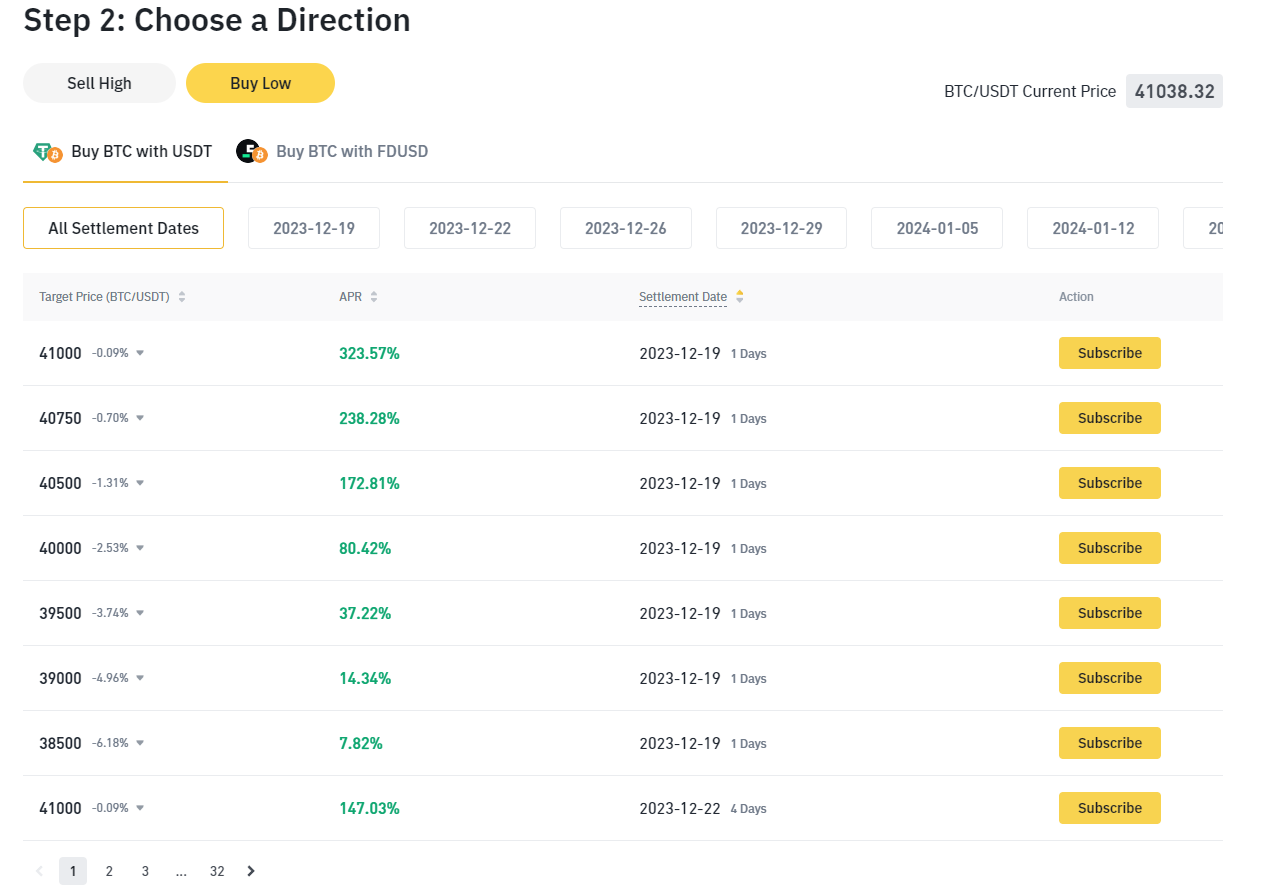

When choosing a cryptocurrency, such as Bitcoin, two options will be available: Sell High and Buy Low.

Sell High Option:

In this scenario, you should have Bitcoins in your account that you can invest in dual investments.

Next, you choose the investment period, ranging from 1 day to several months.

The next parameter is the closing price of your trade, in this case, the selling price. The closer the price is to the current BTC price, the higher the percentage of profitability.

After investing your BTC, there are two possible outcomes:

- The BTC price at the time of investment closing is lower than the set price. In this case, you receive back your BTC and the earned percentage, also in BTC. The profits are paid out.

- The BTC price at the time of investment closing is equal to or higher than the set price. In this case, you receive stablecoins (USDT or FDUSD) in the amount you would have received if you had sold your BTC at the set price. The profits are paid out.

Buy Low Option:

In this scenario, your account should have USDT or FDUSD stablecoins.

Similar to selling high, depending on your risk level, you choose the investment period and the purchase price. The principle is the same as when buying: the closer the price is to the current one, the higher the percentage, and the greater the market volatility for a specific cryptocurrency, the higher the percentage.

After starting the investment, there are two possible outcomes:

- The BTC price at the time of investment closing is equal to or lower than the set price. BTC purchased at the set price is credited to your account, and profits are paid out.

- The BTC price at the time of investment closing is higher than the set price. Stablecoins with profits are returned to your account, also in USDT. Profits are paid out.

In other words, when the asset price surpasses the set threshold, the exchange executes a sale or purchase transaction based on your choice. If the price does not exceed the set threshold, you get back your initial asset along with the profits.

As we can see, the mechanics of investments, disregarding the complexities of staking and futures, are straightforward for the average user to understand.

Now, let's move on to a more interesting question: How can all of this be effectively utilized?

Using Binance Dual Investments

The profitability of dual investments on Binance depends on the cryptocurrency and the volatility of its market price. Profitability is tied to investment risk, which increases along with potential returns. Here, we'll explain when you can use high-risk dual investments to your advantage.

Let's first explore low-risk scenarios for using dual investments:

- Buying Bitcoin or other cryptocurrencies:

According to the investor's wisdom, you should buy an asset when its price has fallen, but you're still waiting for the optimal moment. Dual investments can be helpful during this wait. While waiting for the desired price drop to buy, you can invest your USDT in dual investments (buying cheap). This way, your assets won't just sit idle; they will generate significant income. If the price drops to or below the specified level, you lose nothing, as you intended to buy at that price anyway.

This is comparable to placing a limit order on the spot market, but with dual investments, you can earn income even if the order is not executed.

- Selling Bitcoin:

Similar to the buying scenario, if you are waiting for a higher price to sell your cryptocurrency, dual investments (selling at a high price) can provide additional income while you wait. It allows you to earn returns from your crypto assets during the waiting period instead of just monitoring price charts.

Next, we will reveal a little secret that you need to bet on an increase precisely at the moment when the price of an asset on the spot market also increases, because It is at this moment that you can set the closing of a transaction on double investments at a higher price and at a higher percentage, for example, in the next few days. Because Most likely, after the price rises, there will be a correction in the market, which will allow you to easily earn a few percent of your deposit in just 1-2 days. A similar technique can also be used with bearish play, i.e. when you want to buy cryptocurrency.

If the price still goes higher than what was stipulated in your investment contract, then this will not upset you much, because You were already going to sell at this price on the spot market.

For beginners, we do not recommend using this tool when the price on the crypto market changes in a wide range, because... You can indicate in an investment contract a price that is favorable today, for example, for the purchase of BTC, but prices may go even lower in the short term. How it was when Bitcoin fell from a price of 60,000 USD to 16,000 USD. In this case, you can become a long-term investor with purchased Bitcoin at a high price, and psychologically it will be very difficult for you to re-enter a new transaction at completely different prices.

More risky strategies using dual-currency investments.

- Active spot market trading:

For active traders, using dual-currency investments can also be useful, especially if you do not risk using futures contracts for hedging due to higher volatility, margin trading and margin calls.

There can be many different strategies used as a risk hedge or vice versa to strengthen your positions in one direction of the market, but with a large gap in price with low chances of breaking through this level, for which you can receive a percentage if the price still does not break through the set one level.

Dual-currency investments can be used against the market trend you expect for your prime rate in the spot market. In this case, you will earn an additional percentage of double investments if you guess with the trend, and if the price reverses, then your investment can work as a purchasing rate.

- Active futures market trading:

In your case, Dual Currency Investments can replace part or all of the spot market to hedge your risks. The main difference will be that if the bet does not work, you will receive a percentage of the investment, i.e. increase profitability if you guessed the market direction or reduce losses if you didn’t guess the market direction, but the price did not reach the desired level. Those. It makes more sense to set the price in an investment contract for a deeper market movement, and in all other cases use a more familiar instrument in the form of the spot market.

Of course, these are not all possible options for using Dual Investmen for professional market participants; you will probably be able to use this tool in a more sophisticated way, but we have described the most obvious options for those who are just starting their path to becoming a professional trader.

Calculating Dual Investment Returns:

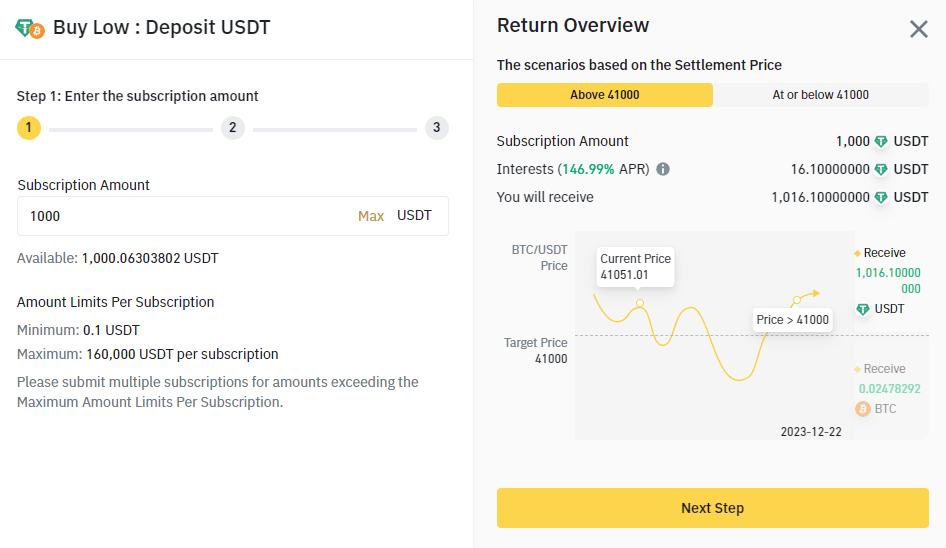

When choosing a direction for your investment and clicking "Subscribe" on Binance, the platform automatically calculates the potential earnings if the investment conditions are not met. The expected figures in this calculation are significantly lower than the APR percentage.

The APR (Annual Percentage Rate) is an annual yield, not a yield for the specified period. For example, if the investment period is only one day, your yield will be 365 times less than the APR. For 30-day investments, divide the APR by 12.

In summary, APR is not the actual return for a specific investment period but an indicator for comparing with more familiar financial instruments over a full year, such as bank deposits or bond purchases.

In the example given, an investment of 1000 USDT within 4 days gives us 16.1USDT or 147% per annum.

Provided that the BTC price does not fall below 4100 USDT. If the price is below 4100, then Binance will buy us 1016.1USD worth of Bitcoin at a price of 4100 USDT.

Conclusion: Dual-currency investments from Binance are an excellent tool that are not at all difficult to understand for both beginners and professional investors and traders. Although using Dual Investment is not as flexible an instrument as can be done on the futures or spot market due to time and price restrictions, it has one very important advantage - additional payments that can reach up to tens of percent over several days of investment. This can greatly diversify your trading strategies.

This service will also be useful for beginners, because. You can not only hold assets in an exchange account, but also actively make money from it. Moreover, the rate of return will be much higher than just putting it in the same Simple earn from Binance, where the annual return on investing BTC is only 0.05%.

P.S. Our favorite strategy at a local minimum, when the cryptocurrency has sharply fallen in price, is to open an investment contract for Buy Cheap with a high percentage (small difference from the current price) and for a longer period (1-2 weeks) if the price drop was strong or by several days if the spill at the price was not large. In 80 percent of cases this strategy worked because... we remained with our own cryptocurrency and, in addition to this, received a few percent of the invested amount. One such successful transaction in a few days can bring the same return as a whole year of investment in a bank deposit.

This is not a trading recommendation, but only our experience using a unique investment product from Binance - Dual Currency Investments.