The year 2025 has marked an explosive boom for decentralized derivatives exchanges (perp-DEXs). This DeFi segment isn’t just growing—it’s dominating, setting the tone for the entire crypto market. In September alone, the total trading volume on these platforms surpassed $1 trillion, a figure comparable to the annual turnover of the top 10 platforms in the previous year, which reached $1.5 trillion. But behind these staggering numbers lies not only technological progress but also time-tested marketing strategies: from generous airdrops to artificially inflated metrics. In this article, we’ll explore the evolution of perp-DEXs, from their roots in centralized exchanges to modern hybrid models. We’ll examine key innovations, new market players, and potential risks to help traders and investors navigate the trend reshaping the crypto trading landscape.

The year 2025 has marked an explosive boom for decentralized derivatives exchanges (perp-DEXs). This DeFi segment isn’t just growing—it’s dominating, setting the tone for the entire crypto market. In September alone, the total trading volume on these platforms surpassed $1 trillion, a figure comparable to the annual turnover of the top 10 platforms in the previous year, which reached $1.5 trillion. But behind these staggering numbers lies not only technological progress but also time-tested marketing strategies: from generous airdrops to artificially inflated metrics. In this article, we’ll explore the evolution of perp-DEXs, from their roots in centralized exchanges to modern hybrid models. We’ll examine key innovations, new market players, and potential risks to help traders and investors navigate the trend reshaping the crypto trading landscape.

Origins: Centralized Exchanges as the Foundation for the DeFi Revolution

Decentralized derivatives didn’t emerge from nowhere—their foundation was laid by centralized platforms (CEXs) that introduced key mechanics for crypto futures trading.

The pioneer was BitMEX, launched in 2014 with Arthur Hayes at the helm. Initially targeting professionals, the exchange offered margin trading with 3x and 5x leverage, calculated in BTC. In 2016, BitMEX introduced perpetual swaps, including the iconic XBTUSD contract with up to 100x leverage. Hayes drew inspiration from traditional finance, incorporating concepts like interest rate swaps and cash-and-carry arbitrage. The central innovation was the funding rate—a mechanism that aligns futures prices with the spot market.

Funding Rate in Trading: Periodic payments exchanged between holders of long and short positions in a contract. The funding mechanism requires traders holding the dominant position to pay a percentage to the opposing side every eight hours. When the funding rate is positive, long position holders pay shorts; when negative, the reverse applies.

However, by 2025, BitMEX lost its leadership due to competition and legal troubles, including lawsuits and investigations against its management. According to CoinGecko, as of October 2025, BitMEX ranks 34th in open interest, with a daily trading volume of about $1 billion.

In 2019, Binance Futures, led by Changpeng Zhao (CZ), took the lead. The platform quickly raised leverage for BTCUSDT to 125x, surpassing BitMEX. By October 8, 2025, its daily volume approached $120 billion, cementing Binance’s dominance in the centralized segment.

These CEXs introduced metrics like daily liquidations, which became a standard for assessing crypto derivatives market volatility.

DeFi Summer 2020: The Birth of Perp-DEX Amid Regulatory Storms

The year 2020 was a turning point for decentralized finance. Total value locked (TVL) in DeFi grew from $1 billion in May to $10 billion in September, driven by user influx to DEXs and the rise of lending protocols like Aave and Curve. The culmination was the launch of Yearn Finance and Uniswap’s UNI airdrop.

Against this backdrop, a criminal case against BitMEX in October 2020 for AML/KYC violations highlighted the risks of centralization. DeFi, with its “gray zone” regulatory status, became more attractive, offering legal loopholes and non-custodial asset storage.

That same year, the first perp-DEXs debuted, blending CEX convenience with decentralization. The main challenge was integrating trading into blockchains without servers. Early projects launched on Ethereum, but its low throughput and high fees spurred migration to Layer 2 (L2) solutions and custom chains.

Two pioneers—dYdX and Perpetual Protocol—defined two development paths:

- Order Book: dYdX adapted the CEX model with off-chain services for liquidations. Hyperliquid, built on its own L1, follows a similar approach.

- Virtual AMM (vAMM): Perpetual Protocol mimicked AMMs without real reserves, generating liquidity through smart contracts. This approach was adopted by GMX and others.

Perpetual Protocol v2 on Optimism slashed fees, bringing usability closer to CEXs. In 2024, dYdX launched a Cosmos SDK-based network with an off-chain order book and on-chain settlements, leading to hybrid models combining off-chain orders with on-chain settlement for speed and security.

New Generation: CEX Speed in a Decentralized Shell

Modern perp-DEXs aim for the ideal: CEX-like speed and usability without KYC and with self-custodial assets. They leverage advanced consensus mechanisms like HotStuff (used in Plasma, Monad, Aptos, Sui), which offer high throughput but lag behind Ethereum in security.

The flagship is Hyperliquid, built on Cosmos SDK. The platform hosts its order book fully on-chain, providing depth for large traders. Its interface resembles Binance or Bybit, with a “deposit” system for operational wallets without fees. It supports USDC from Arbitrum, native BTC, and ETH. In its first year, Hyperliquid faced controversies, including accusations of validator centralization and DAO issues.

In June 2025, Synthetix returned to Ethereum’s mainnet, abandoning L2 due to liquidity fragmentation. The team opted for an order book over AMM for a better user experience, with off-chain matching and on-chain storage.

Similarly, in August, Ronin migrated back to Ethereum after bridge hacks, including the largest in history.

Old-School Marketing: Airdrops, Points, and Hype

Hyperliquid’s success owes much to its airdrop, with average rewards in the thousands of dollars, keeping HYPE tokens in users’ hands and restoring faith in airdrops.

This sparked a trend. Aster, backed by CZ, surpassed leaders in trading volume through points and airdrops. Launched in September, the platform trades U.S. stocks and offers a record-breaking 1001x leverage for BTCUSD, raising concerns about risks for newcomers. Aster’s market cap soared to billions, with plans for an L1 blockchain focused on anonymity and AI trading.

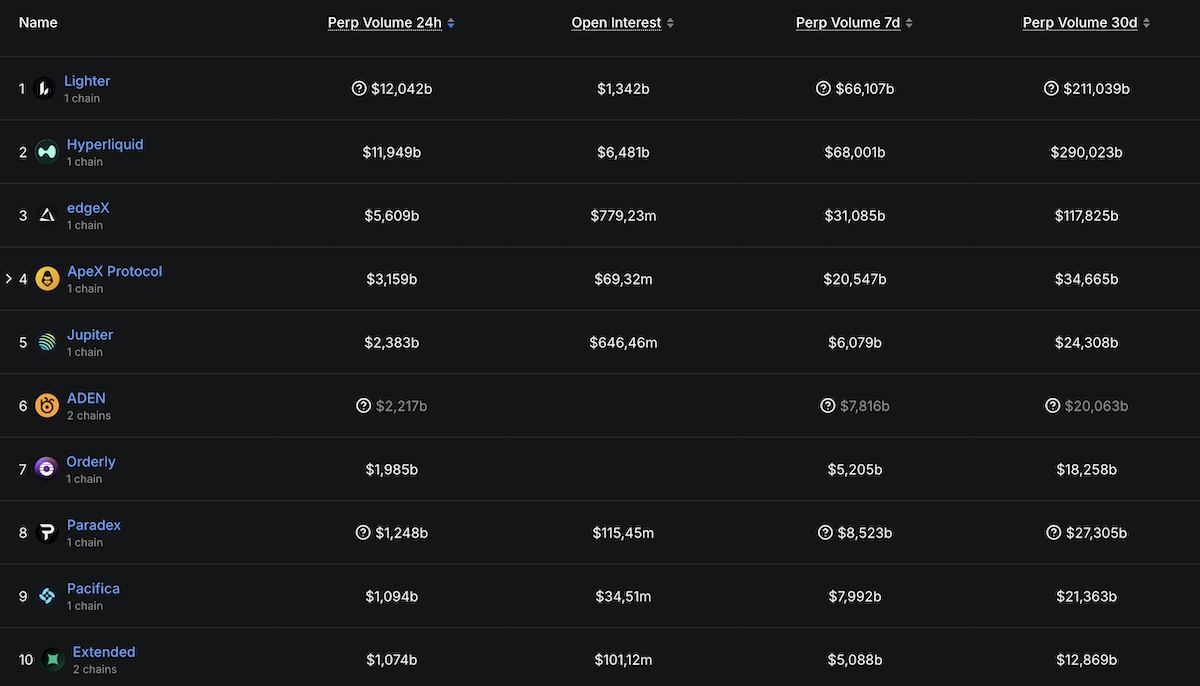

On October 1, Justin Sun announced SunPerp on TRON. On October 2, Lighter on Arbitrum launched its mainnet with zero-knowledge proof (ZKP) for verification. Lighter’s second-season points traded at $100.

Pacifica on Solana, in testnet, offers AI tools, a six-month points program, and invite-only access.

The Dark Side: Risks and Manipulations in Perp-DEX

Despite the hype, on October 5, Aster faced accusations of fake volumes, echoing earlier claims against Hyperliquid. The community often ignores these issues as long as profits flow, but the risks are significant:

- Centralized Matching: Many processes are off-chain, lacking transparency. If a node fails or order manipulation occurs, it’s unverifiable.

- Liquidations and Funding Rates: Proprietary algorithms risk cascading liquidations during high volatility.

- Toxic Incentives: Bonuses create artificial liquidity, and volumes often collapse after programs end.

- Regulatory Risks: The CFTC views perp-DEXs as derivatives. The dYdX case shows that high volumes attract regulatory scrutiny.

Conclusion: A New Era for DeFi with Challenges and Opportunities

In 2025, decentralized derivatives exchanges (perp-DEXs) have become not just a part of the DeFi ecosystem but its primary driver, rewriting the rules of the crypto market. With trading volumes exceeding $1 trillion in September, they demonstrate immense potential, blending innovative technology with proven marketing tactics. From pioneers like BitMEX, which laid the groundwork for perpetual swaps, to modern leaders like Hyperliquid and Aster, perp-DEXs have evolved from niche experiments into infrastructure rivaling centralized giants like Binance Futures. However, behind the dazzling figures and hype lie challenges that demand heightened caution from traders and investors.

The technological progress of perp-DEXs is impressive: hybrid models with off-chain order books and on-chain settlements, the use of Cosmos SDK-based L1s like Hyperliquid, and returns to Ethereum, as seen with Synthetix, reflect a pursuit of balance between speed, usability, and security. New platforms like Aster, with its 1001x leverage, or Pacifica, with AI tools, push the boundaries of what’s possible, promising traders high returns, anonymity, and autonomy. Airdrops and points programs, as seen with Hyperliquid and Lighter, have revived faith in farming, attracting millions of users and creating billion-dollar token market caps in days.

Yet, the successes of perp-DEXs come with significant risks. Centralized order matching, opaque liquidation algorithms, reliance on incentives creating artificial liquidity, and the threat of regulatory pressure, as in the dYdX case, remind us that this market is far from perfect. Traders must stay vigilant, choosing platforms with transparent mechanisms and sustainable economics while avoiding hype traps. Investors should assess projects’ long-term potential, recognizing that the end of points programs can lead to sharp drops in activity.

The future of perp-DEXs hinges on their ability to overcome current limitations while preserving their decentralized nature. Integration of AI for automated strategies, development of L1 blockchains focused on anonymity, and improvements in on-chain order books are just some of the directions shaping the next phase of evolution. At the same time, the community must balance innovation with responsibility to avoid repeating past mistakes, such as manipulated metrics or bridge vulnerabilities.

Perp-DEXs in 2025 are a story of opportunities and challenges, where developers’ ambitions meet market realities. For those willing to dive into the details and act wisely, this sector offers unique prospects. Stay informed, study projects, and remember: in the world of DeFi, the pace of change outstrips all predictions, and the next breakthrough may be closer than it seems.