If you’re looking for a platform to trade perpetual contracts (perps) with high leverage, deep liquidity, and minimal bureaucracy, AsterDEX is your go-to choice. This decentralized exchange (DEX), built on a multi-chain architecture, allows trading of crypto and even U.S. stocks with up to 100x leverage, all settled in crypto without bridging. With a total trading volume of $162 billion, a TVL of $96 million, and support for over 70 symbols, AsterDEX combines speed, security, and innovations like hidden orders and grid trading bots. In this detailed guide, we’ll break down every step, from connecting your wallet to withdrawing profits. Ready to dive into the world of decentralized trading? Let’s go!

If you’re looking for a platform to trade perpetual contracts (perps) with high leverage, deep liquidity, and minimal bureaucracy, AsterDEX is your go-to choice. This decentralized exchange (DEX), built on a multi-chain architecture, allows trading of crypto and even U.S. stocks with up to 100x leverage, all settled in crypto without bridging. With a total trading volume of $162 billion, a TVL of $96 million, and support for over 70 symbols, AsterDEX combines speed, security, and innovations like hidden orders and grid trading bots. In this detailed guide, we’ll break down every step, from connecting your wallet to withdrawing profits. Ready to dive into the world of decentralized trading? Let’s go!

Key Features of AsterDEX

- Wide Range of Tradable Assets: Over 75 assets available, with new ones constantly added.

- Fully Decentralized Derivatives DEX: A robust platform for trading perpetual contracts.

- Tasks and Rewards Section: Motivates new traders with incentives.

- Multi-Chain Support: Compatible with BNB Chain, Ethereum, Arbitrum, and Solana.

- Perpetual Contracts Trading: Trade perps with ease.

- Hidden Orders: Traders can create limit orders without revealing their size or existence until execution. Hidden orders mask large trades, keeping intentions private and protecting against front-running, where other traders exploit information about upcoming large orders to trade ahead and profit. Despite being hidden, these orders still tap into the shared liquidity pool, ensuring execution at the target price.

- Leverage Up to 1001x: Available in the "1001x" section for high-risk traders.

- Native ASTER Token: Used for contests and airdrops. Post-TGE, the token has already delivered multiple “x” returns and continues to grow.

- Spot Trading: Supported on 9 trading pairs.

- Referral Program: Earn up to 10% through referrals.

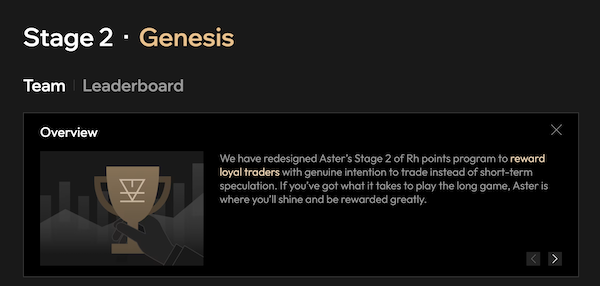

- Ongoing Airdrops: Rewards for trading volume, asset holding, and PnL. Currently, the second stage of the Genesis Airdrop is live, with a $400 million pool.

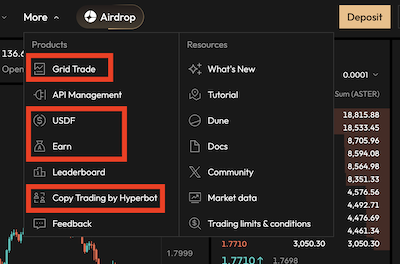

- Grid Trading Bots: Automated trading for volatile markets.

- API Trading: Available for advanced users.

- Stocks and Forex Trading: Trade assets like AAPLUSD, AMZNUSD, EURUSD, JPYUSD, and more.

- Stablecoin Staking: Up to 15% APY for USDF staking.

- Other Token Staking: Up to 23% APY, depending on the chosen token.

- Copy Trading: In collaboration with https://hyperbot.network.

- Portfolio Analytics: User-friendly portfolio with income tracking.

- Binance and CZ Support: Backed by Binance and its former CEO, CZ.

- Low Fees: Maker fees from 0.01%, taker fees from 0.035%.

Prerequisites: Get Ready to Start

Before trading, ensure you have:

- Crypto Wallet: Recommended options include Metamask, Binance Wallet, or any WalletConnect-compatible wallet. Install the browser extension (Chrome/Firefox) or mobile app.

- Funds for Trading: USDT, BNB, or other tokens on supported networks (BNB Chain, Ethereum, Arbitrum, Solana). For gas fees on BNB Chain, 0.001 BNB is sufficient.

- Basic Knowledge: Understand the risks of leverage (up to 1001x in Degen Mode!), margin calls, and volatility. AsterDEX is non-custodial, so you control your wallet keys, but transaction errors are irreversible.

- No KYC Required: Trade anonymously!

Step 1: Accessing the AsterDEX Platform

- Open your browser and visit the official AsterDEX website.

- The homepage displays key metrics: trading volume, user count, open interest, and TVL. Scroll down to the "Launch App" button to enter the trading interface.

- Choose a network: AsterDEX is multi-chain, so select BNB Chain for low fees or Arbitrum for speed. No need to bridge assets—liquidity is aggregated across chains.

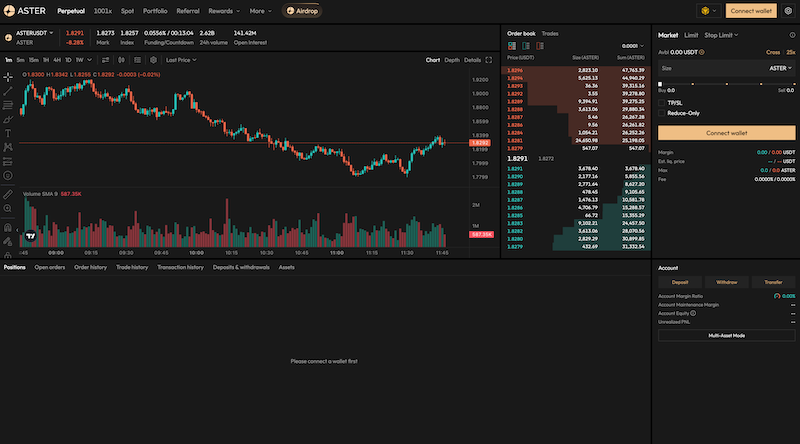

Interface Overview: You’ll see a candlestick chart (powered by TradingView), a sidebar for orders, an order book, and a positions panel. New users can switch to Simple Mode for a streamlined view without the order book, enabling one-click trading.

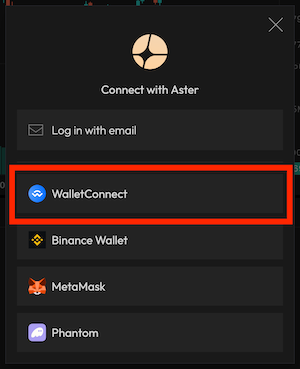

Step 2: Connecting Your Wallet

- Click "Connect Wallet" in the top-right corner.

- Select your provider: MetaMask, Binance Wallet, or WalletConnect (for mobile/other wallets). Confirm the signature request in your wallet. This grants the platform access to view your balance and interact, but not control your funds.

- Verify: Your wallet address will appear in the interface. If there’s an error, ensure the selected network matches the platform’s.

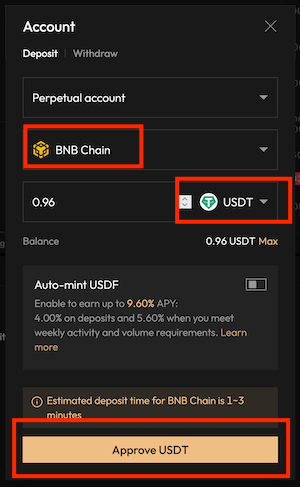

Step 3: Depositing Funds

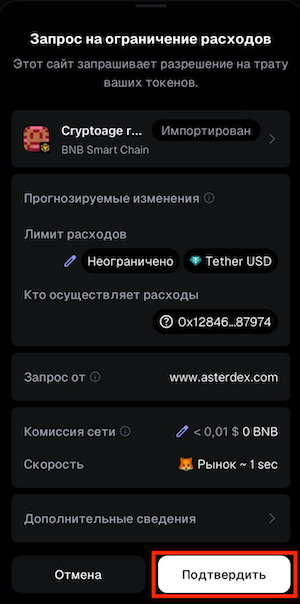

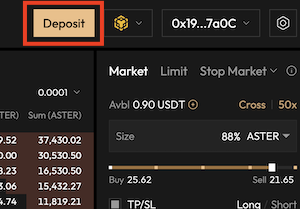

- In the left sidebar, next to your wallet and selected network, click "Deposit."

- Choose a token: USDT (recommended for perps), BNB, or USDF/asBNB for earning.

Select the network (e.g., BNB Chain), enter the amount, and click "Approve."

- Confirm the approval in your wallet/app, then click "Deposit."

- Confirm the transaction, accounting for gas fees.

- Wait for confirmation: Your balance will update in 1–5 minutes, depending on the network. Check your balance in the Portfolio or Assets section.

- Limits and Fees: No minimum deposit, but ensure at least 0.001 BNB for gas. The platform charges no deposit fees, only network gas fees.

Step 4: Choosing a Trading Mode

AsterDEX offers several trading modes:

- Simple Mode: For beginners—fast market orders with no slippage, using the shared liquidity pool.

- Pro Mode: For advanced traders—full order book and tools like hidden orders and grid bots.

- Degen Mode: Ultra-high leverage (up to 1001x), no opening order fees, but dynamic closing fees and high risk.

- Dumb Mode: Bet on price movements (5–60 minutes, long/short)—a simplified binary options implementation.

In settings (gear icon), select Pro Mode to start. Choose Margin Mode: Isolated (risk limited to one position) or Cross (shared margin across positions—capital-efficient but riskier). Enable Multi-Asset Mode for USDF/asBNB earnings (in Settings).

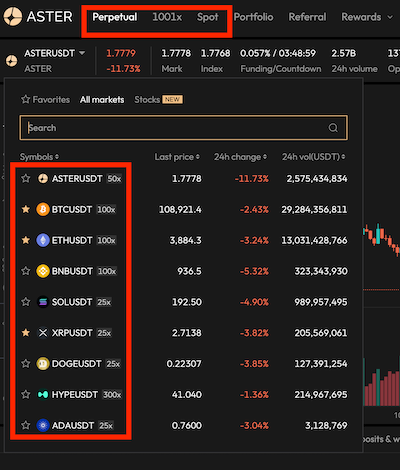

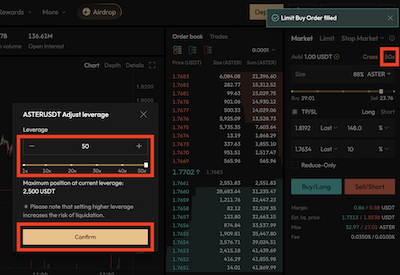

Step 5: Selecting a Trading Pair and Leverage

- In the top panel, choose a pair: BTCUSDT, ETHUSDT, AAPL (stocks!), or any of the 75+ symbols.

- Set leverage: Use the slider from 1x to 100x (or 1001x in Degen Mode). For stocks, leverage up to 100x, settled in USDT.

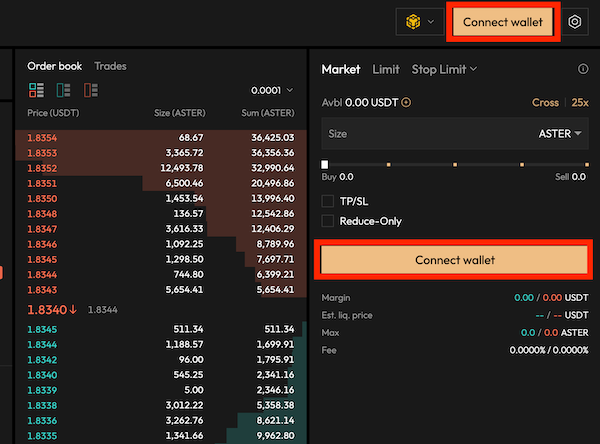

Step 6: Placing Orders

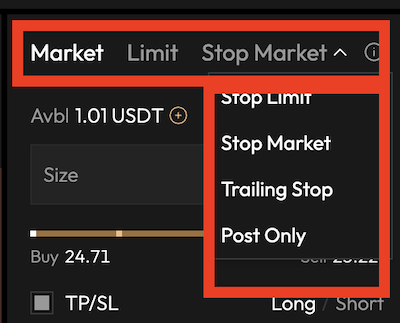

AsterDEX supports market, limit, hidden, and other order types:

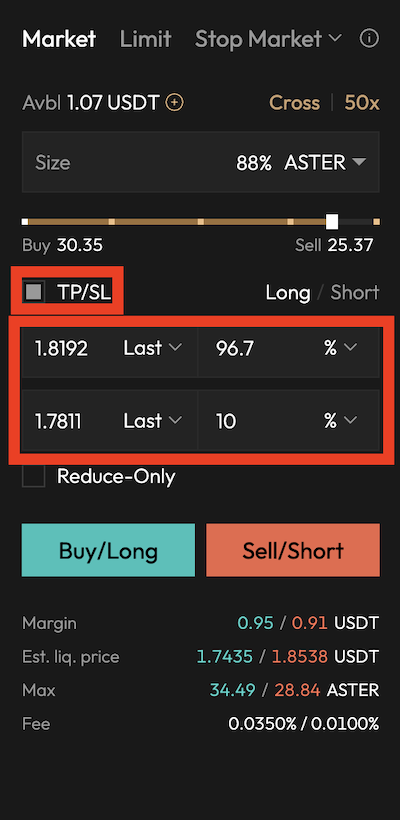

- Market Order: Instant execution. Enter the amount or % of balance, select Long/Short, and click Buy/Long or Sell/Short.

- Limit Order: Executes at a specified price.

- Hidden Order: In Pro Mode, hides order size and direction from the order book, ideal for large trades to avoid front-running (a scalping tactic where smaller orders are placed ahead of large ones to exploit support/resistance levels).

- Stop Limit/Stop Market Orders: Market or fixed-price orders with Stop Loss settings.

- Trailing Stop Order: Keeps a position open while the market moves in your favor, closing it at the optimal point upon reversal.

- Post-Only Order: Ensures a limit order is added to the order book without matching existing orders. If it would match, it’s canceled.

Before trading, enable trading for the selected pair and confirm the signature in your wallet. You can also set Take Profit (TP) and Stop Loss (SL) when opening a position by enabling the TP/SL checkbox and specifying the percentage price change for each.

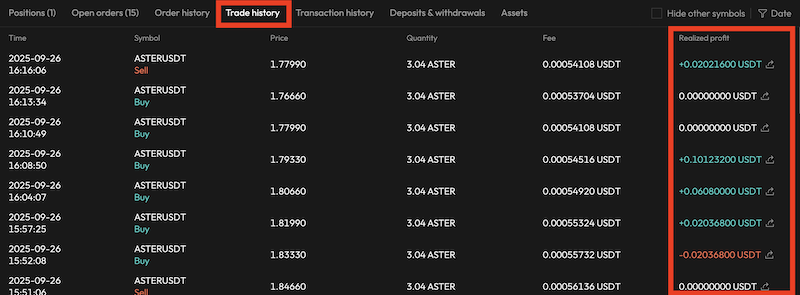

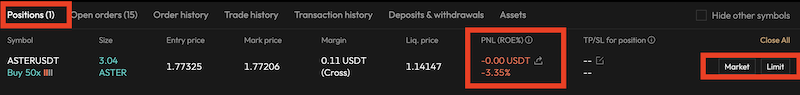

Step 7: Managing Positions

The positions and orders panel is located below the chart. Monitor open positions in the Positions tab and close them via Market or Limit orders based on the current PnL. The tab displays key details: trading pair, leverage, position size, mark price, liquidation price, TP/SL settings, and PnL (ROE%). Close positions instantly (Market) or at a fixed price (Limit). In Pro Mode, partial position closure is available. The Trade History tab shows all orders and their profitability.

Step 8: Withdrawing Funds

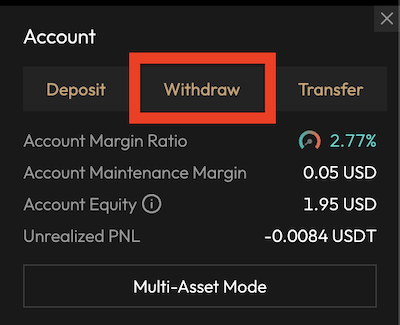

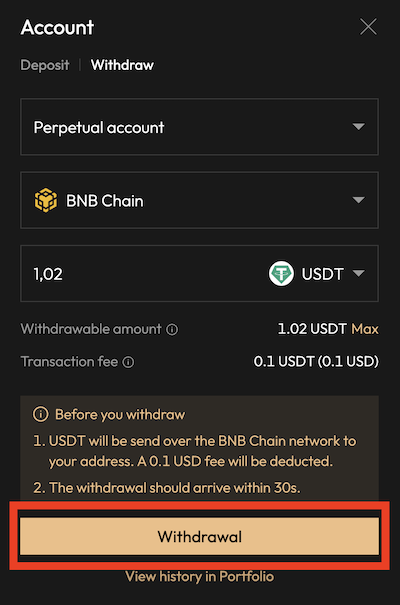

- In the account panel below the order form, click "Withdraw."

- Select the account (Perpetual or Spot), network, and withdrawal amount, then click "Withdrawal."

- Funds will arrive in your wallet within 1–5 minutes, depending on the network.

Advanced Features: Trade Like a Pro

- Hidden Orders: Hide order size/direction for a strategic edge.

- Grid Trading: Automated bots for volatile markets, profiting from price swings.

- Stock Perps: Trade U.S. stocks with up to 100x leverage.

- Degen/Dumb Modes: Degen for high-risk 1001x leverage; Dumb for simple price direction bets.

- Trade & Earn: Trade with USDF for 16.7% APY + weekly rewards (requires 2+ days of activity and $2,000+ weekly trading volume). For asBNB, participate in Launchpool and airdrops.

- Genesis Airdrop Stage 2: Earn Rh points through trading and holding assets to join the $400M airdrop (see rules for details).

Risks and Tips for Beginners

- Leverage Risks: High leverage, especially 1001x in Degen Mode, can wipe out your balance in seconds. Use cautiously.

- Capital Allocation: Risk only 5–10% of your capital per position.

- Stay Informed: Monitor news to anticipate market moves.

AsterDEX isn’t just a DEX—it’s an ecosystem for bold traders. With $63M in open interest and low fees (0.01% maker, 0.035% taker), you’re on equal footing with whales. Start small, scale smart.

Additional Resources on AsterDEX

Conclusion

AsterDEX is a powerful decentralized trading platform that blends innovation, flexibility, and high returns. With multi-chain support, hidden orders, up to 100x leverage, and unique features like U.S. stock trading on blockchain, it caters to both beginners and seasoned traders. Start with Simple Mode, experiment with Pro and Degen Modes, and leverage earning programs for passive income. Manage risks wisely, stay updated on airdrops and news, and take full control of your assets and trading. Dive into perpetual contracts and become part of the DeFi future today!