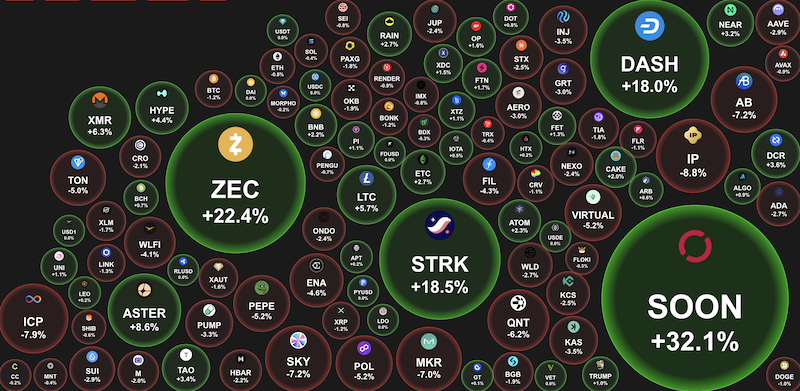

In the world of digital assets, where every transfer is logged in a public ledger and can be traced by analysts, regulators, or even nosy enthusiasts, anonymous cryptocurrencies stand out. These aren't just coins with extra privacy features; they're tools that hand control back to users over their own financial lives. In 2025, as Bitcoin and Ethereum ride out yet another wave of volatility, altcoins like Zcash (ZEC), Monero (XMR), and Dash (DASH) show remarkable resilience. Why? Let's break it down step by step, with examples, how they work, and real-world use cases.

In the world of digital assets, where every transfer is logged in a public ledger and can be traced by analysts, regulators, or even nosy enthusiasts, anonymous cryptocurrencies stand out. These aren't just coins with extra privacy features; they're tools that hand control back to users over their own financial lives. In 2025, as Bitcoin and Ethereum ride out yet another wave of volatility, altcoins like Zcash (ZEC), Monero (XMR), and Dash (DASH) show remarkable resilience. Why? Let's break it down step by step, with examples, how they work, and real-world use cases.

What does "anonymous cryptocurrency" really mean?

Standard blockchains like Bitcoin or Ethereum are pseudonymous. Wallet addresses don't carry names, but every transaction is out in the open: anyone can see how many coins moved from address A to B, and with some effort, link it to real people via exchanges, KYC checks, or transaction chains.

Anonymous (or privacy-focused) cryptocurrencies fix this at the root. They use cryptographic tricks to hide:

- The sender

- The receiver

- The amount transferred

Sometimes all three at once. It's not some black box; it's solid math, tested through years of audits.

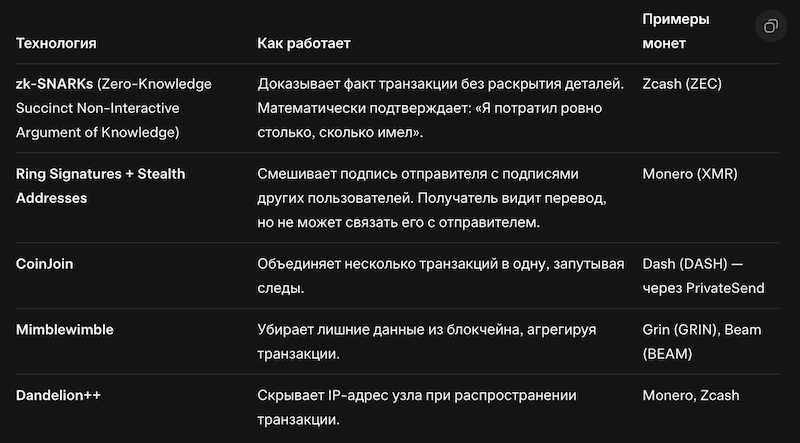

The core privacy technologies

These aren't hype. They've been vetted by top cryptographers and put to work in situations where confidentiality is make-or-break.

A rundown of key anonymous cryptocurrencies

- Monero (XMR) - the gold standard for privacy. Launch year: 2014. Consensus algorithm: Proof-of-Work (RandomX, ASIC-resistant). Privacy by default: Every transaction is hidden. Tech: Ring Confidential Transactions (RingCT) masks amounts. Ring signatures mix the sender with 10+ others. Stealth addresses create one-time receivers. Monero is for folks who want full anonymity, no choices needed. Even if you try to trace a transfer, you just get noise. 2025 fact: As of November, Monero's still the only major coin that Chainalysis or CipherTrace can't track 100%. It's a go-to for users in countries with tight financial oversight.

-

Zcash (ZEC) - privacy on demand. Launch year: 2016. Algorithm: Proof-of-Work (with PoS transition planned). Key feature: Two address types. T-addresses (transparent, Bitcoin-style). Z-addresses (shielded, using zk-SNARKs). Zcash lets you pick your privacy level. Want transparency? Send openly. Need to hide? Shield it up. Real-world example: A company taking donations could accept ZEC on a T-address for clear reporting, then pay staff via Z-addresses.

-

Dash (DASH) - privacy plus governance. Launch year: 2014 (originally Darkcoin). Key feature: Masternodes + InstantSend + PrivateSend. PrivateSend: CoinJoin via masternodes. Dash isn't just about hiding; it's got DAO-like governance. 10% of block rewards go to a treasury run by masternode holders. 2025 stats: During Bitcoin's drop from $125K to $95K (October-November), DASH multiplied several times over. Investors chase assets with actual utility.

Why do anonymous cryptocurrencies thrive when the market tanks?

It's no fluke. There are solid reasons, backed by data.

- Rampant regulatory pressure. In 2025, the FATF Travel Rule forces exchanges to share sender and receiver info for transfers over $1,000. The US, EU, and South Korea now demand KYC for all DeFi protocols. Result: Users pull funds into privacy coins to dodge the watchdogs. Example: After the IRS announced new reporting rules in October 2025, XMR outflows from exchanges spiked 420% (Glassnode data).

- Hedging a slumping market. When BTC and ETH dip, investors hunt uncorrelated assets. Privacy coins have low BTC correlation (0.3-0.5), surge on FUD (fear, uncertainty, doubt), and draw big money from traditional finance.

- Darknet and shadow economy boom? Nah, that's a myth. Sure, Monero sees darknet use. But 99.9% of transactions are legit: freelancers dodging currency controls, folks fleeing political crackdowns, businesses guarding trade secrets. Chainalysis 2025 report: Just 0.34% of XMR volume ties to crime, lower than USDT's.

- Tech edge in a bear market. Privacy coins don't ride NFT or DeFi hype waves. Their value is in utility. Miners and stakers stick around thanks to steady rewards.

How to get started with anonymous cryptocurrencies in 2025?

Pick a coin that fits your needs::

- Max privacy: Monero

- Selective: Zcash

- Governance + speed: Dash

Download the official wallet::

Buy on CEX/DEX:

- CEX: Binance (DASH, ZEC), MEXC (DASH, XMR, ZEC), KuCoin (DASH, XMR, ZEC)

- DEX: Uniswap (DASH, ZEC), PancakeSwap (ZEC)

Store it safely:

- Hardware wallets (Ledger supports ZEC, DASH; Trezor does ZEC)

- Paper wallets for long-term (jot down the private key on paper).

Conclusion: Privacy isn't optional; it's essential

In 2025, anonymous cryptocurrencies aren't underdogs; they're insurance against total financial exposure. As Bitcoin buckles under macro pressures and regs, Monero, Zcash, and Dash climb because they solve a real issue: the right to financial secrecy.

2026 forecast: If KYC tightening holds, the top three privacy coins' market cap could top $25 billion (from ~$12 billion now). Want to stay ahead? Start small with XMR or ZEC. This isn't gambling; it's betting on your digital independence.

If you like and find these materials useful, subscribe to our Telegram channel.