blockchain technology remains the foundation of decentralization. But what happens when a network needs an upgrade? This is where forks come into play - changes to the protocol that can be either evolutionary or revolutionary. In this article, we'll break down the differences between a soft fork and a hard fork, why they occur, the risks they pose, and how historical examples have shaped the industry. This isn't just a technical overview - it's an in-depth analysis to help investors, miners, and enthusiasts understand how forks are shaping the future of digital assets.

blockchain technology remains the foundation of decentralization. But what happens when a network needs an upgrade? This is where forks come into play - changes to the protocol that can be either evolutionary or revolutionary. In this article, we'll break down the differences between a soft fork and a hard fork, why they occur, the risks they pose, and how historical examples have shaped the industry. This isn't just a technical overview - it's an in-depth analysis to help investors, miners, and enthusiasts understand how forks are shaping the future of digital assets.

What is a Fork in Blockchain and Why is it Important?

Blockchain is a decentralized database where each block is linked to the previous one, forming an immutable chain of transactions. Cryptocurrencies like BTC and ETH run on open-source code maintained by thousands of nodes (nodes) worldwide. These nodes validate transactions, ensuring consensus - the shared agreement on the network's rules.

A fork is an update to the blockchain protocol. It can be initiated by developers, the community, or even accidentally. For a fork to take effect, node operators must update their software. Without this, the network risks splitting. Forks are divided into two types: hard fork (radical change) and soft fork (soft, compatible). The key difference lies in compatibility: a hard fork breaks old rules, while a soft fork does not.

Every fork affects security, scalability, and even asset prices. For example, Bitcoin Cash (BCH) at $484 was born from a hard fork, and Ethereum Classic (ETC) at $15.54 emerged from debates over blockchain immutability. Let's dive deeper.

Hard Fork: A Radical Revolution with Split Risks

A hard fork is a complete overhaul of the rules. New blocks under old rules become invalid, and all nodes must upgrade. It's not backward compatible: the old version simply doesn't recognize the new chain.

Imagine blockchain as a road: a hard fork is when the path splits permanently. One branch follows the old rules, the other - the new ones. Token holders on the old chain automatically receive equivalents on the new one, as the history up to the fork is shared.

Why are hard forks dangerous? They often lead to a permanent chain split. If miners and validators divide, the network weakens. The risk of a 51% attack increases: a group with the majority of hashrate can rewrite history and double-spend coins. Many forked networks have suffered from this - attackers reorganized blocks, stealing funds.

Another threat is replay attacks. An attacker intercepts a transaction on one chain and replays it on the other. Without protection, both transactions go through, allowing theft of others' assets without private keys.

But hard forks aren't always bad. They're essential for evolution:

- Adding features: New capabilities not possible in the old protocol.

- Fixing vulnerabilities: Closing security holes.

- Resolving community conflicts: When compromise is impossible.

- Reversing transactions: Rarely, to return stolen funds.

Accidental hard forks happen too. In Bitcoin, they occur when two miners find a block simultaneously. The network chooses the longest chain, discarding the short one. The miner loses rewards, but transactions remain valid. In 2013, a bug with too many inputs in a block caused a split - resolved by downgrading software.

Soft Fork: Safe Upgrade Without Breaks

Unlike a hard fork, a soft fork is a "soft" evolution. New rules are stricter than old ones, but old nodes see the new chain as valid. Non-upgraded nodes continue working, just ignoring new features.

The analogy is simple: a soft fork is like an OS update on a smartphone - all apps still work. A hard fork is switching to a completely new OS, breaking old software.

Soft forks are ideal for adding features at the code level: new opcodes, privacy improvements. They activate gradually, often via BIP (Bitcoin Improvement Proposal). Example: SegWit in Bitcoin softly boosted capacity without a split.

Advantages: no split risk, higher security. Drawbacks: slower implementation, requires majority hashrate.

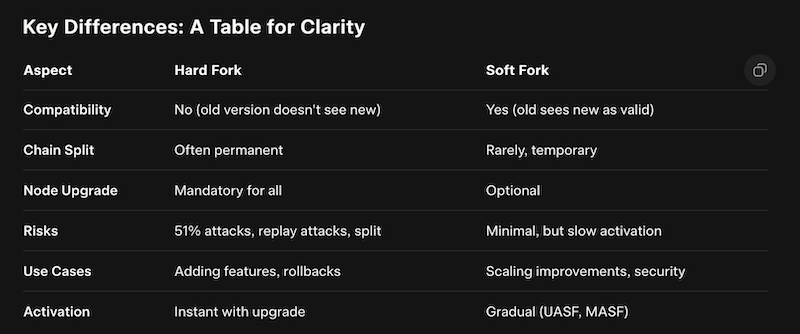

This table shows: soft fork - for conservatives, hard - for revolutionaries.

Historical Hard Forks That Changed the Crypto World

Forks aren't theory - they're reality. Here are standout examples.

SegWit2x and the Birth of Bitcoin Cash

In 2017, Bitcoin faced a scaling crisis. Transactions grew expensive, the network slowed. The "New York Agreement" (May 2017) - a closed-door meeting of businesses and miners (85% hashrate) - proposed SegWit2x: soft fork SegWit + hard fork to 2 MB blocks.

The community rebelled: this is centralization! Small-blockers feared big blocks would complicate nodes. Big-blockers worried fees would kill growth. Activists launched UASF (BIP 148) for pure SegWit.

Big-blockers forked on August 1, 2017: Bitcoin Cash was born with 8 MB (now 32 MB). BCH supporters see it as Satoshi's "true Bitcoin" - cheap transactions for the masses. This opened the floodgates: later Bitcoin Gold, Bitcoin Diamond, and dozens of clones.

The DAO Hack: Ethereum's Ethical Dilemma

2016: The DAO on Ethereum raised $150M ETH (14% of circulation). A hacker stole $60M. Vitalik proposed a soft fork with blacklisting, but the hacker threatened to bribe miners.

Solution: hard fork rolling back history. Stolen funds returned to investors. Controversy! Immutability violated? Part of the community rejected it: thus Ethereum Classic (ETC) emerged. Lesson: blockchain isn't always "immutable" - the community decides.

Hashrate Wars: BCH ABC vs BSV

2018: Bitcoin Cash split itself. BCH ABC (tech improvements) vs BCH SV (Craig Wright, "Satoshi," blocks to 128 MB). At block 556767 - split. "Hashrate war": miners spent millions trying to 51%-attack rivals.

ABC won, claimed the BCH ticker. SV became BSV. This showed: forks are not just tech, but politics/ego.

Why Forks Continue in 2025?

Even with BTC over $100k, evolution hasn't stopped. Forks solve issues: scalability (Layer-2 vs on-chain), privacy, DeFi integrations. But risks remain: new chains vulnerable to attacks.

For investors: fork = airdrop (free coins). But sell wisely - many forks die (BTG, BCD).

Soft fork - a safe path of evolution, hard fork - a risky revolution birthing new worlds. From Bitcoin Cash to Ethereum Classic—forks shape the crypto landscape. In 2025, with institutional growth, consensus will be key. Follow BIPs, proposals, and the community - the next fork could double your portfolio or wipe it out. Stay informed – crypto is constantly evolving! Subscribe to our channel on Telegram.