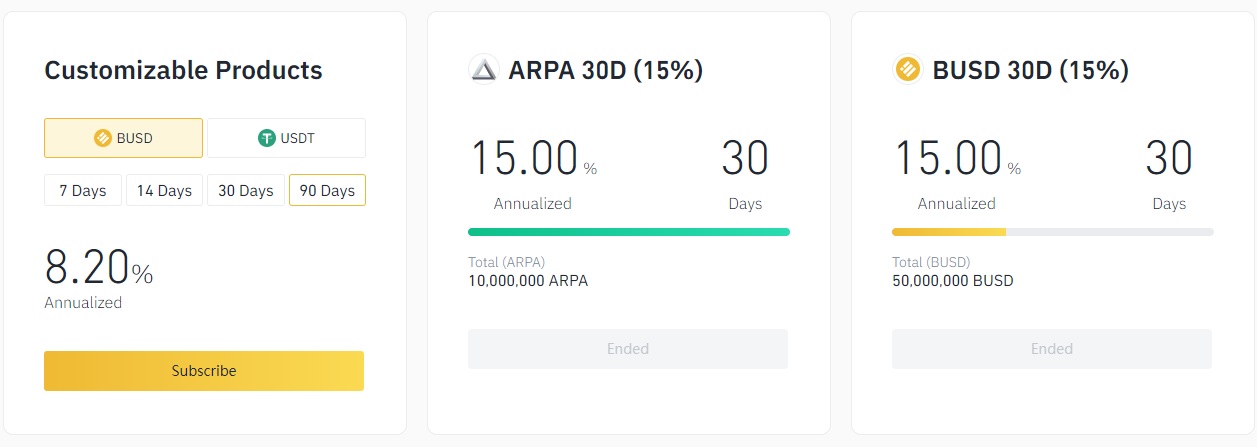

Against the backdrop of the coronavirus pandemic, Binance is actively introducing new cryptocurrency products, so after the release of debit cryptocurrency bank cards, Binance launched another banking product - these are USDT and BUSD deposits for a fixed term with an income of up to 8.2% per annum (USDT and BUSD are stablecoins, whose price is tied to USD 1 to 1). The cryptocurrency placement period can be selected for 7, 14, 30 or 90 days. The longer the term, the higher the interest on the deposit, i.e. as a regular deposit to the bank.

Against the backdrop of the coronavirus pandemic, Binance is actively introducing new cryptocurrency products, so after the release of debit cryptocurrency bank cards, Binance launched another banking product - these are USDT and BUSD deposits for a fixed term with an income of up to 8.2% per annum (USDT and BUSD are stablecoins, whose price is tied to USD 1 to 1). The cryptocurrency placement period can be selected for 7, 14, 30 or 90 days. The longer the term, the higher the interest on the deposit, i.e. as a regular deposit to the bank.

In addition to fixed deposits, Binance also offers perpetual deposits, i.e. without time limit (flexible deposit). It is possible to put not only stablecoins on such deposits, but also the usual cryptocurrency Bitcoin, Etehreum and others. The usual return on such deposits does not exceed 2% per annum.

The deposit service on the Binance website is called Binance Lending.

Binance, offering “bank deposits” and convenient buying and selling of cryptocurrency using conventional Visa and Mastercard cards, is becoming more and more like a classic financial institution providing banking services.

Because Binance can be considered an offshore company, therefore keeping your savings is at a greater risk than in your country's bank, but your money will be outside the jurisdiction of the government and will not be taxed. Plus, deposit income is much higher than banks in Europe or the United States can offer.