Futures trading is fairly considered the riskiest type of earnings in cryptocurrencies, given the high leverage coupled with the high volatility of the cryptocurrency itself. Margin calls and liquidation of positions are not uncommon here, but rather the rule, so it's easier for novice crypto investors to lose their entire deposit in futures trading. However, there are strategies for making money using futures, in which you earn money with any market movement, and losses, even under the most unfavorable conditions, are minimized or completely absent. Such strategies are called delta neutral, and in this article we will look at 3 such strategies using cryptocurrency futures that will help you earn up to 16% per annum without risk.

Futures trading is fairly considered the riskiest type of earnings in cryptocurrencies, given the high leverage coupled with the high volatility of the cryptocurrency itself. Margin calls and liquidation of positions are not uncommon here, but rather the rule, so it's easier for novice crypto investors to lose their entire deposit in futures trading. However, there are strategies for making money using futures, in which you earn money with any market movement, and losses, even under the most unfavorable conditions, are minimized or completely absent. Such strategies are called delta neutral, and in this article we will look at 3 such strategies using cryptocurrency futures that will help you earn up to 16% per annum without risk.

What is a Delta neutral trading strategy?

The main idea of delta neutral trading strategies is to choose positions that will balance each other. That is, when the value of an asset increases, one position increases and the other falls to a comparable level, and when the market falls, on the contrary, the position that grew with an increase in price begins to fall. And the position that was falling, on the contrary, begins to grow. Thus, with any market movement, such a delta neutral trading strategy will compensate for all losses, but the income will also be zero. However, we will consider several options on how to use a delta neutral strategy to make money on cryptocurrency futures and, most importantly, without risk.

1 Make money on futures without risk

To begin with, let's consider the simplest option using urgent futures, i.e. futures where, after a certain time, the futures are closed and cryptocurrency is credited to your account. In another way, this process is called futures expiration. For such futures, the expiration date is always indicated.

The main idea of making money on futures is:

Find the maximum delta (difference) in the price of a futures contract and the price of the same asset on the spot market. This difference will be our income at the time when the futures expire. Accordingly, the closer the futures close is and the greater the delta between the futures and spot markets, the greater our income will be, and using a delta neutral strategy will minimize all risk with any change in the price of the asset itself.

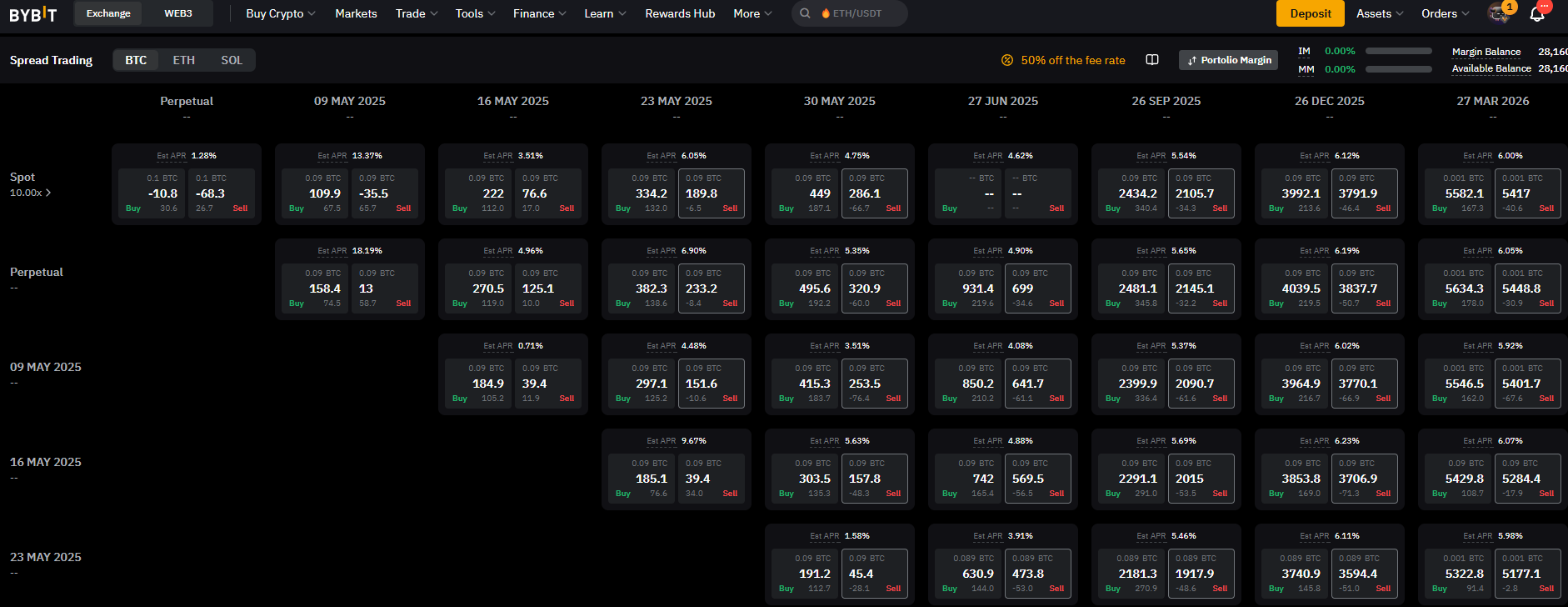

Let's take an example of how to implement this strategy on the Bybit exchange.

- Find an urgent futures asset (for example, Bitcoin), where the difference with the price on the spot market is maximum.

- Select the margin mode for the futures contract: PORTFOLIO MARGIN (IMPORTANT)

- Open a Short on futures with a minimum leverage (X2-X10) (for example, for 1000 USD with a leverage of X10, i.e. our money is only 100 USD)

- Buy the SAME amount of assets on the spot market (we need to buy for 1000 USD as in paragraph 3) .

- Put the purchased asset on the spot to provide margin for futures (full hedging)

- At the expiration of the futures, we sell the asset purchased on the spot (at this point, the futures price = the spot price)

- Receive the initially invested USDT for purchase on futures and spot, PLUS the USDT that were in the price difference between spot and futures at point 1 and minus the USDT fees paid to the exchange.

Now learn more about how to calculate profitability.

To find a suitable futures for our strategy, we first need to understand the mathematics of this strategy. That's where we'll start.

For example, let's take BTC futures with expiration on June 27, 2025 at a price of 97380, while the spot price of BTC on May 03, 2025 is 96580.

The price delta between the futures and the spot is 800 USDT or 0.82%. The time until the expiration of the futures (indicated on the futures page) is 56 days.

Let's calculate the annual return from this data.:

APR = (0,82%/56)*365 = 5,34%

Let's take for comparison the second longer futures on December 25, 2025, its value is 100,700 USDT. The delta in this case will be 4.26% or 6.54% per annum.

APR = (4,26%/238)*365=6,54%

Unfortunately, this is not the final result, because it is necessary to take into account investments in the futures contract and commissions.

The percentage above is calculated from the spot transaction, i.e. the spot price is taken as 100%, but we do not take into account our costs for opening a futures contract. Let's do this.

The greater the leverage on futures, the smaller our invested amount, so for example, with a leverage of X10, the result obtained above should be reduced by 10%, with a leverage of X5, the total return will be 20% less. If you don't use your shoulders at all, then the result should be divided in half.

For the calculation, let's take the leverage of X10

APR = (1-1/10)*(4,26%/238)*365=5,88%

Now let's calculate the fees:

The following fees apply on Bybit for a regular user without a VIP level: On the spot, the maker's commission is 0.1%, the taker's commission is 0.18%, for futures, the maker's commission is 0.036%, and the taker's is 0.1%.

That is, if you create limit orders (maker), rather than hitting the glass by creating market orders (taker), then there will be a minimum commission of the maker.

Commission fee=0,1%*2+0,036%= 0,236% ( No commission is charged upon expiration of futures, only for opening a position and for closing)

The final yield of our delta neutral strategy using futures futures will be as follows:

APR = (1-1/10)*(4,26%/238)*365-0,236%=5,65%

Of course, you can't become a millionaire with such a return, but if you compare it with the same EARN programs on exchanges where the return on the USDT deposit is 1%, then using such a delta neutral strategy gives a noticeably higher return.

IMPORTANT: the profitability of this strategy can increase to 10-15% per annum when the value of cryptocurrencies in the spot market decreases sharply, and long futures tend to respond to this decrease with a delay, which can lead to a higher delta between the spot and futures markets.

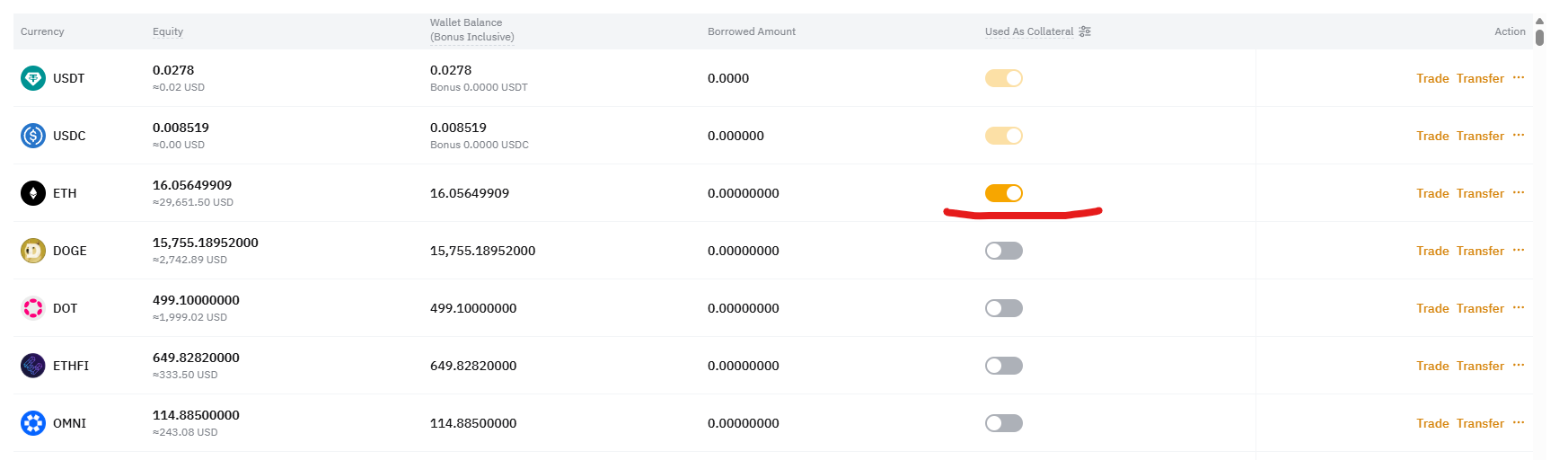

How to put a certain cryptocurrency to ensure margin on Bybit

Go to the ASSETS -UNIFIELD TRADING menu The crypto asset that you want to secure must be stored in a Unifield Trafing account.

Next to the desired asset, turn on the "Used as collateral" switch

Useful tips:

In a calm crypto market, an annual delta of 5%±1% is considered common. If you have found a much higher return of 10% or more, then you should take advantage of this opportunity.

Use USDT-M futures (settlement and payment is in USDT). If you have found an excellent delta in the price in COIN-M futures, then they can also be used, only the calculation and payment will be in the cryptocurrency in which the futures are taken, which is less convenient.

First, open a futures contract, and then make a purchase on the spot, because the liquidity of futures is much lower.

Do not open trades with a price delta of less than 0.5%, even if there are 1 or 2 days left before the expiration of futures, because the commission will eat up half, and with large amounts there may not be enough liquidity in the futures market to open a position at the right price.

For more volatile cryptocurrencies, it is better to limit yourself to X5 leverage on futures

You can close a futures position without waiting for expiration, but you will lose some or all of your income.

It is not necessary to calculate the annual profitability yourself because the exchange does it for you in real time and for all possible options on this page: bybit.com/liquid-marketplace/future-spread

2 Earn money on perpetual futures without risk

From the name "perpetual futures", you can immediately understand that the previously considered method will not work, because such futures simply do not have an expiration date when the futures price is compared with the spot price.

To make money on perpetual futures, they use another tool called Funding Farming. Another name for funding is the funding rate.

What is funding or the financing rate?

In order to balance the perpetual futures market, they came up with a special tool when the market is skewed, for example, towards an increase in the value of an asset and everyone is trying to open LONG positions accordingly, which makes the price of perpetual futures higher than in the spot market, and at this moment, in order to motivate traders to open more SHORT positions, they came up with a financing rate. The greater the discrepancy between the futures price and the spot price, the higher this rate is, and MOST IMPORTANTLY, LONG position traders pay SHORT position holders this percentage of their LONG position from their account. Holders of SHORT positions earn money by simply holding a SHORT position open. In this case, the financing rate has a positive value.

If, on the contrary, the value of perpetual futures is lower than in the spot market, then the opposite happens, i.e. holders of SHORT positions pay the financing rate to holders of LONG positions. In this case, the funding rate or Funding has a negative value.

This mechanism of perpetual futures does not allow the futures price to significantly break away from spot prices on the market.

Such payments between LONG and SHORT traders occur automatically every 8 hours, and it is on this feature of perpetual futures that you can earn money without risk using the delta neutral strategy.

An example of implementing a risk-free strategy for perpetual futures:

The basic earnings scheme is similar to the first option, when we open a SHORT position on futures and take the same amount of asset on the spot to fully hedge the futures. Of course, there are times when it is better to open a LONG position, but this is more for experienced traders, because futures prices are often higher than spot prices.

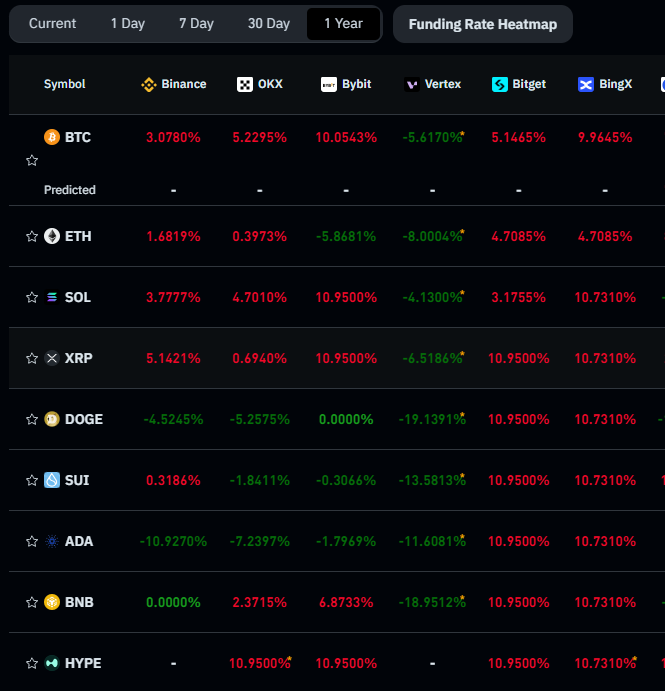

- Go to the Coinglass website. For our exchange, we find a cryptocurrency with the maximum POSITIVE funding over the past month or year. Let's choose SOL with monthly funding of +0.9% or +10.95% for the last year.

- Select the margin mode for the futures contract: PORTFOLIO MARGIN (IMPORTANT)

- Open a Short on futures with a minimum leverage (X2-X10) (for example, for 1000 USD with a leverage of X10, i.e. our money is only 100 USD)

- Buy the SAME amount of assets on the spot market (we need to buy for 1000 USD as in paragraph 3)

- Put the purchased asset on the spot to ensure margin for futures (full hedging)

- Hold a SHORT position and earn interest on funding (farm funding)

- Close positions if necessary. We receive the initially invested USDT for purchase on futures and spot, PLUS the USDT that was earned on the funding farming and minus the USDT paid commissions to the exchange.

The main tool here is the Coinglasswebsite, which allows you to find the most profitable cryptocurrencies for farming and funding on perpetual futures, but also do not forget to monitor the market, because the situation may change and instead of earning money, you will on the contrary lose money on the financing rate (funding).

In our example, SOL pharming on the Bybit exchange with an open SHORT position has generated revenue of almost 11% over the past year, and 0.9% of the open SHORT position over the past month, which is a fairly good indicator. But it should be borne in mind that the results in the past do not guarantee them in the future and you need to keep your finger on the pulse.

Because our futures position is completely hedged by the purchased asset on the spot, so we don't have to worry about the price of the asset itself.

Real profitability

In order to calculate the real profitability from farming on perpetual futures, we need to take into account our investments on the spot for hedging and on futures, which depend on the chosen leverage. With a leverage of X10, the percentage obtained should be reduced by 10%. With a leverage of X5, the resulting yield is reduced by 20% and so on.

Plus, you need to deduct at least 0.272% of the exchange's commission from the result obtained (for users without VIP level)

As a result, the real profitability of pharma funding on SOL over the past year will not be 10.95%, but slightly less.:

APR = 10,95%*0,9- 0,272% =9,58% ( with X10 leverage on futures)

How can we compare the second strategy with the use of perpetual futures potentially gives a higher yield of about two times than with the use of fixed-term futures in option 1. But at the same time, the second option is slightly more risky, since the financing rate can be either positive or negative.

Useful tips:

If the profitability of strategies 1 and 2 gives plus or minus the same profitability, then it is better to choose the first option as the most stable.

3 Increase income from futures without risk

Earlier, we discussed two ways to make money on futures without risk, using 100% hedging of futures positions or using a delta neutral strategy.

Now we will consider how to increase the profitability for both considered options by about 7% more, but the truth is only for the Solana cryptocurrency.

The main idea of increasing profits:

The BSOD cryptocurrency is traded on the Bybit exchange, and if you look at the chart paired with BBSOL/SOL, the price of BBSOL relative to SOL is always rising. This is explained very simply, because BBSOL is a derivative instrument and is a token of the Bybit exchange, which is obtained by staking the Solana cryptocurrency itself. Since the profitability of Solana staking is approximately 6.8% per year, therefore the BBSOL token itself in relation to the SOL cryptocurrency is also growing by the corresponding percentage, i.e. by 6.8%.

Now, knowing about the existence of such a token as BBSOL, when hedging a futures position in the SOL cryptocurrency, you can buy not the SOL cryptocurrency itself, but its derivative BBSOL on the spot and also use it to ensure margin.

There is a similar token on the Binance exchange, it is called BNSOL.

Thus, we will not only receive profit from pharming funding, but also income from staking the SOL cryptocurrency at the same time.

When using perpetual futures (strategy No. 2) and the BBSOL token, we will get the following profitability::

APR=9,58+6,8%= 16,38%

For 1 strategy using futures, the yield will be correspondingly lower.:

APR = 5,65%+6,8%=12,45%

The use of derivative tokens such as BBSOL can significantly increase revenue for our risk-free strategies for making money on futures

Important: When calculating, we believe that the value of the SOL cryptocurrency itself will not change, since the yield of BBSOL at 6.8% per annum is indicated in relation to SOL. If the value of SOL increases, our yield relative to USDT will also increase, and if the price of SOL decreases, the yield will decrease, but in any case it cannot be less than zero.

Useful tips:

If you look at the BBSOL/SOL chart, you can see sharp drops in the price of BBSOL for short periods of time due to a lack of liquidity, which may lead to the liquidation of your futures position due to a decrease in the price of BBSOL and a lack of margin, respectively. Therefore, if you decide to use BBSOL as a margin security, then use X5 or even lower leverage to open a futures position in order to exclude such a development. The profit will decrease by 10-20%, of course, but I think this is an adequate price for your restful sleep at night.

Conclusion: The resulting returns from 5% to 16% in the examples considered for making money on cryptocurrencies with minimal risk deserve to be noticed. Especially if you already use various EARN programs on centralized exchanges. This approach will increase the profitability of your investments at least 2-3 times.

P.S. The strategies presented above cannot be called completely risk-free because at least there is a risk of hacking the exchange, blocking an account on the exchange, or hacking the cryptocurrency itself. Therefore, try to choose reliable crypto exchanges (Bybit, Binance) and proven cryptocurrencies (Bitcoin, Ethereum, Solana, XRP, DOGE) for such long-term investments