Ethereum cryptocurrency is currently the most popular digital currency, mined through POS mining (Proof-of-Stake or staking). Anyone who decides to transition from POW mining to POS or is considering getting into mining primarily looks at Ethereum for these purposes. Since POS mining of ETH involves more complex constructs than traditional cryptocurrency storage on a running node, we will delve into the components of a miner's (validator's) earnings and calculate the ROI to help you make an informed decision about launching your Ethereum validator.

Ethereum cryptocurrency is currently the most popular digital currency, mined through POS mining (Proof-of-Stake or staking). Anyone who decides to transition from POW mining to POS or is considering getting into mining primarily looks at Ethereum for these purposes. Since POS mining of ETH involves more complex constructs than traditional cryptocurrency storage on a running node, we will delve into the components of a miner's (validator's) earnings and calculate the ROI to help you make an informed decision about launching your Ethereum validator.

We previously discussed how Ethereum POS mining works in this article: How POS mining works on the Ethereum 2 network. Synchronization committee and light clients after the Altair hardfork. . In that article, we explained the terminology and the earnings validators received before Ethereum fully transitioned to POS. Currently, after the merge of the ETH1 and ETH2 networks into one, that material has become obsolete. Nevertheless, we recommend acquainting yourself with it, as it clarifies the concepts of validators, committees, slots, and other terms used in ETH staking.

Our primary tool for analyzing validator ROI will be the website beacoincha.in (Open Source Ethereum Explorer).

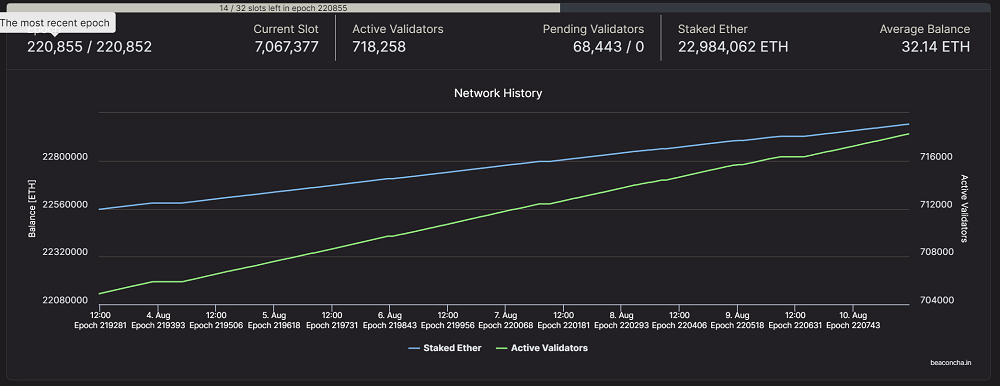

Let's start analyzing the current Ether mining situation from the main page.

The first thing to note is the number of validators already operational. As of the creation of this guide, there were already 718,258 validators in the network.

The second important value is Pending Validators. This parameter represents the number of validators waiting in line to enter or exit Ether mining. The queue arises because the Ethereum network keeps track of validators, and merely turning on or off a computer with an installed ETH node is insufficient. To begin mining, you'll need to wait for your turn to be included in the validator list if the network can't process all those interested in participating in Ethereum mining. The ETH network accepts or removes a little over 2000 validators from the network each day. In the given example, 68,443 validators are awaiting their turn, meaning you can start mining only after 34 days!

The exit queue is currently 0, so the number of validators continues to rise, as indicated by the green line on the graph.

While having a large number of validators is positive for the stability and popularity of the Ethereum cryptocurrency, it's a negative factor for individual miners looking to earn from ETH POS mining. With the increasing number of validators, the earnings for each of them gradually decrease.

In the initial year of operating POS mining in test mode (when income was generated solely from the consensus layer), the yield was around 8% (Investments in Ethereum 2.0 for the year yielded a profit of 8% per annum). However, currently, with the addition of block discovery income and execution layer income to the consensus income, the yield is only 3% per year.

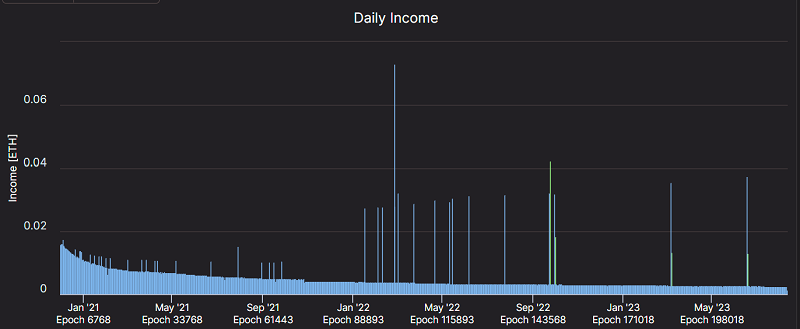

Let's consider the statistics of validator number 10,000, operating since the genesis block, i.e., from the very beginning of ETH2's operation in December 2020.

In the graph below, you can observe how the validator's earnings decrease over time as the number of validators increased.

Infrequent long lines on the graph represent block discovery income. Green lines depict commission income in the ETH network, which emerged only after Ethereum's complete transition to POS.

Now, let's take a closer look at all the sources of income in Ethereum mining.

5 Sources of Income for an ETH Validator:

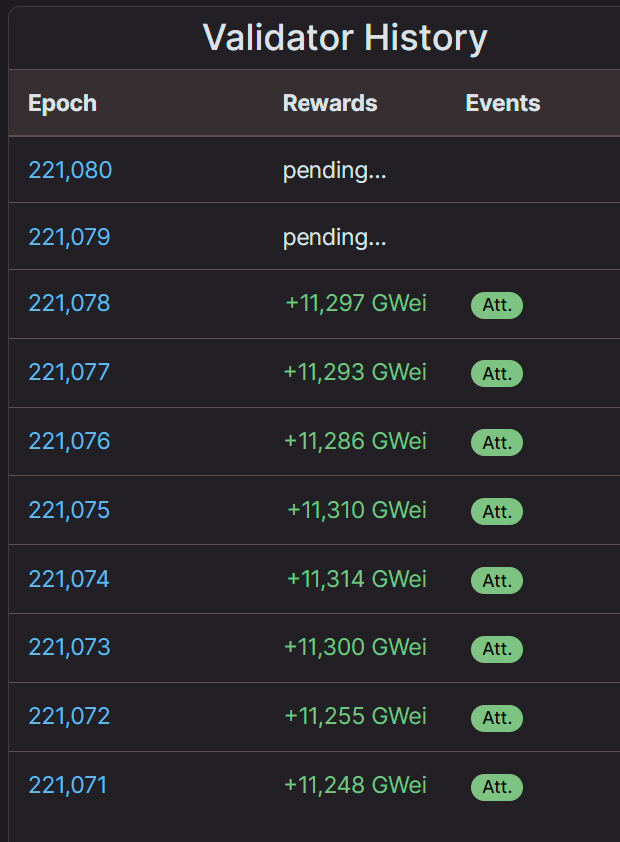

1 Regular Earnings for Consensus Layer Validation:

During operation, a validator consistently participates in slot (block) validation and receives a small reward for this activity. The more validators there are, the smaller the individual rewards become. Validators are grouped into committees for validating discovered blocks; each committee verifies specific blocks, meaning your validator doesn't validate every block. This guaranteed payout is independent of whether your validator finds a block or not. This predictability in Proof of Stake (POS) mining reduces the need for pooling, unlike Proof of Work (POW) mining where rewards were only for finding blocks.

The total payout for slot validation may vary due to different factors, often decreasing due to your validator's delay in submitting results to the network. This delay could be caused by internet issues or insufficient information processing speed on your computer.

If your ETH validator server goes offline for any reason, instead of regular earnings, you will face continuous losses. The penalty for being offline is around 75% of the reward for work.

2 Block Finding Rewards in Consensus Layer:

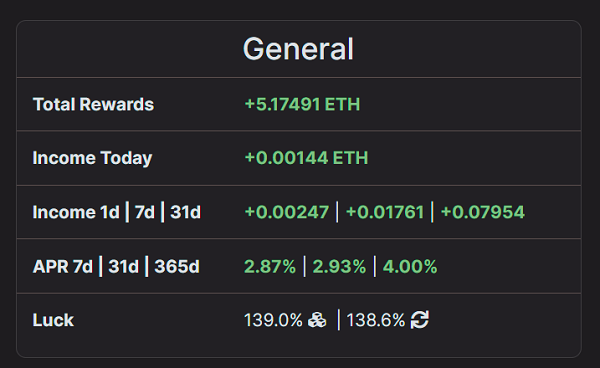

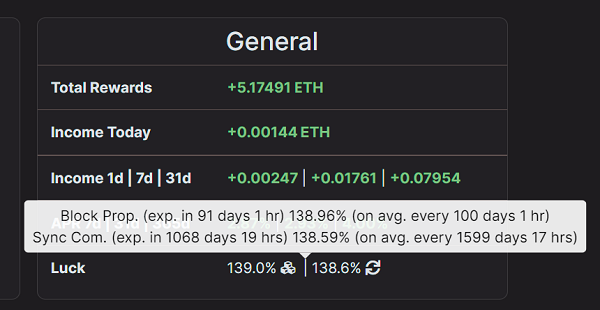

A validator can propose a block to the network, receiving a much higher reward than for block validation. Since only one validator can propose a block, the chance is much lower. As of today, the likelihood of finding a block for a single validator is approximately once every 100 days. The probability of finding a block and your luck can be seen in each validator's statistics. This payout replaces the block reward in POW mining and is equal to 0.036 ETH.

To determine the current chance of finding a block, hover over the "Luck" metric in the General window.

The validator under consideration, numbered 10,000, is quite lucky, as it has luck above 100%, meaning it finds blocks 39% more often than average. It's also fortunate in terms of committee synchronization.

3 Commission Earnings for Block Finding in Execution Layer:

When a validator finds a block, they receive increased rewards in the Consensus Layer, along with commissions from the Execution Layer. These commissions are paid by regular Ethereum blockchain users during ETH transfers, DeFi exchanges, and smart contract creations. The validator owner has two options: burn this commission or receive it in any wallet, which can be changed at any time. (All other payouts in the Consensus Layer are only paid to the initially designated address for the ETH validator and cannot be changed.) Similar to POW mining, a miner can use an additional program called MEV-BOOST, not included in the validator's standard settings, to include transactions with higher fees in a block, resulting in a higher block reward. This payout also depends on Ethereum network load and gas prices. The higher the gas price, the more users pay in fees, and the higher the block reward for miners. Overall, this operates similarly to traditional mining with graphics cards.

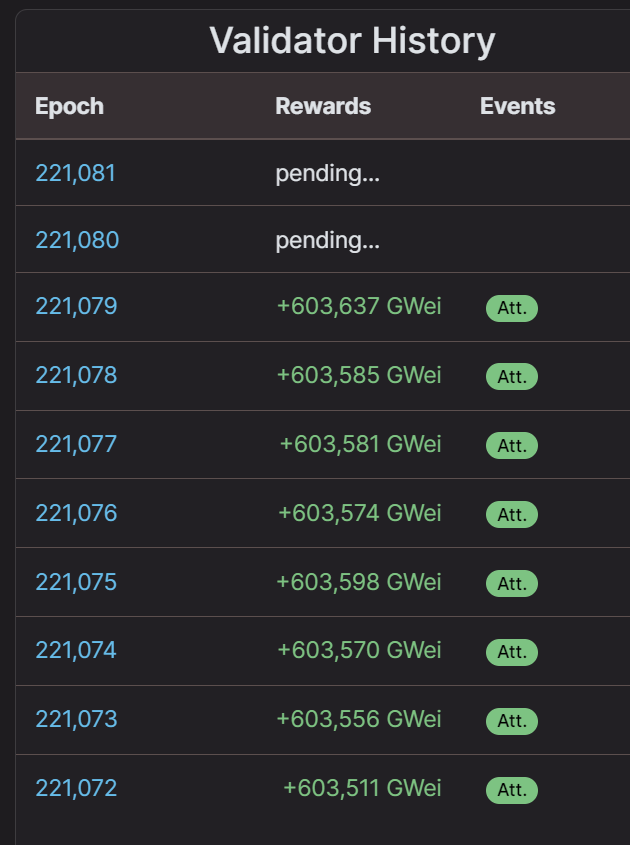

4 Payments for Participation in Synchronization Committees:

Apart from regular committees, there are synchronization committees, with a fixed number of validators (512), unaffected by the total validator count as in regular committees. Therefore, payments for participation in synchronization committees are not contingent on the number of validators; each participant in a synchronization committee slot receives around 600,000 GWEI compared to 11,000 GWEI in a regular committee slot. Similar to regular committee work, payments in synchronization committees may decrease due to slow responses from your validator.

The chance of participating in a synchronization committee today is once every 1600 days, meaning you shouldn't rely on entering this committee and receiving increased rewards for your validator. However, if it does happen, consider it hitting the jackpot. As the number of validators increases, the chance of entering a synchronization committee decreases.

Validator's payments for participating in a synchronization committee:

If your validator becomes a part of the synchronization committee but remains inactive, be prepared to receive similar penalties for your validator's absence from the network.

5 Slasher Offender Validator Rewards

With specific settings enabled for your validator (by default, this functionality is disabled), your validator will also search for other validators violating the rules and receive the highest possible reward for identifying them, up to 1 ETH. However, this capability comes with the requirement for a more powerful computer and significantly larger SSD storage, as you'll need to store and process much more information. Since the search for offenders occurs only during block validation (currently around once every 100 days), and the number of offenders is limited, the chance of receiving a Slashing reward tends towards zero. The frequency of catching offenders can be checked here.

Validators most often get into Slashing for transferring to another server without disconnecting the old one. In other words, one validator operates simultaneously on two servers, which is prohibited.

Hardware for Ethereum POS Mining

The software for Ethereum POS mining places significant demands on server system requirements.

Firstly, you need a fast and capacious SSD storage with a capacity of no less than 2TB. Currently, a validator occupies 1.3TB. So, it's better to consider an even more capacious storage of 4TB if you plan for long-term Ethereum POS mining.

A second important aspect is a powerful central processor, as the speed of initial blockchain synchronization depends on it. Your server should not only download 1.3TB of data but also process it. It's advisable to consider a processor with at least 8 cores for these purposes.

Internet speed is also crucial during the initial stage of synchronization. Later on, the focus shifts from speed to minimal delays (Ping) and internet stability. It's recommended to have a channel with a speed of 100Mbit or more.

You'll need 16 GB of RAM, and its stability is more important than its speed characteristics. Any memory errors can lead to your server freezing, causing you to lose time on additional blockchain synchronization (which was in RAM and got lost). During this time, instead of earning income, your validator will generate losses.

If you decide to enable the Slashing feature on your validator, you'll need to double the SSD capacity and RAM.

Validator Setup (Linux, Geth, Prysm)

There are several options for setting up a validator, starting with the choice of the operating system: Windows or Linux. Then, you need to choose a client for the Execution layer: Geth, Nethermind, Besu, Erigon. And for the Consensus layer: Prysm, Teku, Nimbus, Lighthouse, Lodestar.

The settings will differ based on the chosen software.

The most popular combination is GETH + Prysm. Detailed installation instructions for this combination on the Linux OS can be found at this link.

Conclusion: As you might have guessed, the profitability of Ethereum POS mining can vary significantly for each validator due to multiple factors and luck: how often your validator will find blocks, the current network fees, MEV-Boost settings, inclusion or exclusion from the synchronization committee. On average, at the moment, you can expect a profitability of around 3% annually. With a mandatory deposit of 32 ETH, your annual income would be approximately 1 ETH. However, since the number of validators is constantly increasing, your actual profit will be lower than calculated after a year. The situation is similar to regular mining, where predicting changes in network hashrate in the long term is challenging.

P.S. For POS mining, there are analogous services to mining pools in POW mining. These are various staking services on exchanges or standalone platforms where block rewards and rewards for participating in the synchronization committee are distributed among all participants, thereby increasing the overall income of each validator regardless of block-finding luck or committee inclusion. Additionally, you won't need to deal with software installation and maintaining the validator constantly online. However, the trade-off for this convenience is the potential closure of such a service (scam) or the blocking of your account if you haven't passed KYC or due to other reasons.