On November 8, 2021, the cryptocurrency market began to experience a decline, which later turned into a full-fledged bearish trend. Making money in a growing market is much easier than in a falling one, so long-term downturns are often accompanied by bankruptcies of various participants. The current cycle has seen the collapse of major players such as FTX, Celsius, BlockFi, Hodlnaut, Voyager, and the depreciation of seemingly fundamentally strong projects such as Terra Luna and UST. These events unfolded recently, were noted by all market participants, caused stress, nervousness and significantly undermined confidence in the main players, in particular in funds, exchanges and the cryptocurrency industry as a whole. Many participants chose to withdraw their assets to cold wallets, anticipating the possible bankruptcy of other exchanges. Obviously, a continuation of the trend with the scam of large institutional players could easily cause a cascading panic effect, potentially ending the short history of cryptocurrencies.

On November 8, 2021, the cryptocurrency market began to experience a decline, which later turned into a full-fledged bearish trend. Making money in a growing market is much easier than in a falling one, so long-term downturns are often accompanied by bankruptcies of various participants. The current cycle has seen the collapse of major players such as FTX, Celsius, BlockFi, Hodlnaut, Voyager, and the depreciation of seemingly fundamentally strong projects such as Terra Luna and UST. These events unfolded recently, were noted by all market participants, caused stress, nervousness and significantly undermined confidence in the main players, in particular in funds, exchanges and the cryptocurrency industry as a whole. Many participants chose to withdraw their assets to cold wallets, anticipating the possible bankruptcy of other exchanges. Obviously, a continuation of the trend with the scam of large institutional players could easily cause a cascading panic effect, potentially ending the short history of cryptocurrencies.

How it all started

Crisis phenomena constantly arise in the cryptocurrency industry and, ultimately, become apparent. This is not a normal process, since everything develops cyclically. In the current situation, the FTX exchange scam initiated the crisis. The situation unfolded in a fascinating way and deserves special attention, so we will not consider it in this article. It should be noted that I am intentionally calling the FTX incident a scam and not a bankruptcy. FTX's investigation revealed and many details of the case remain to be revealed. The involvement of high-profile individuals, including members of the US Congress and foreign governments, adds further interest to the story.

However, among the known facts that cannot be hidden is the systematic manipulation of client funds.

A typical client transferring their crypto funds to an exchange expects them to end up in the exchange's cold wallet and remain there as reserves until withdrawal. This usually happens on an honest and transparent exchange. However, things were different at FTX; client funds were spent on extravagant advertising campaigns. The goal was to create hype around the FTX exchange and its founder Sam Bankman-Fried in order to inflate the value of the FTT token. Funds were also used to bribe American politicians, participate in corrupt financial transactions around the US Democratic Party, and some of the funds were simply siphoned off and directed to certain pockets.

Various scams occur regularly in the cryptocurrency market, but large-scale fraud is rare even in the cryptocurrency space. After the collapse of FTX, the public suddenly realized that the operation of any centralized exchange (CEX) is extremely opaque, and clients do not have the tools for even minimal control. Capital outflows from centralized exchanges have begun, threatening to wipe out liquidity from trading platforms, collapse markets, and bury all participants.

The fall in the FTT exchange rate (FTX exchange token) due to a scam on this exchange.

To stabilize the situation, Binance proposed introducing the concept of Proof-of-Reserve as an industry standard for centralized exchanges.

What are Proof-of-Reserves?

When a user deposits 1 BTC into their account on a centralized exchange, that bitcoin actually moves from their cold wallet to the exchange's cold wallet. From this moment on, the exchange becomes the owner of this bitcoin from the point of view of the blockchain, and the client “trusts” his cryptocurrency to it. By making this transaction, the exchange's wallet should increase by 1 BTC, and this Bitcoin should remain there until a possible withdrawal back to the client's wallet. For those who are just starting their journey in the world of cryptocurrencies, it is worth clarifying that trading on the exchange is carried out within the platform between participants without turning on the blockchain, and funds (reserves) are kept in cold wallets of the exchange all this time without movement.

But how can we ensure that the exchange is not tempted to manipulate clients’ funds or even steal them? Binance proposed the concept of Proof-of-Reserves, which provides for regular audits of the exchange's reserves, which, in essence, represent customer funds. It is expected that these audits will be conducted by disinterested third parties, which will increase the transparency of the operations of each specific exchange and strengthen customer confidence. It should be noted that during the audit, the exchange discloses the addresses of its cold wallets, and any user who has downloaded the blockchain can independently check the audit results.

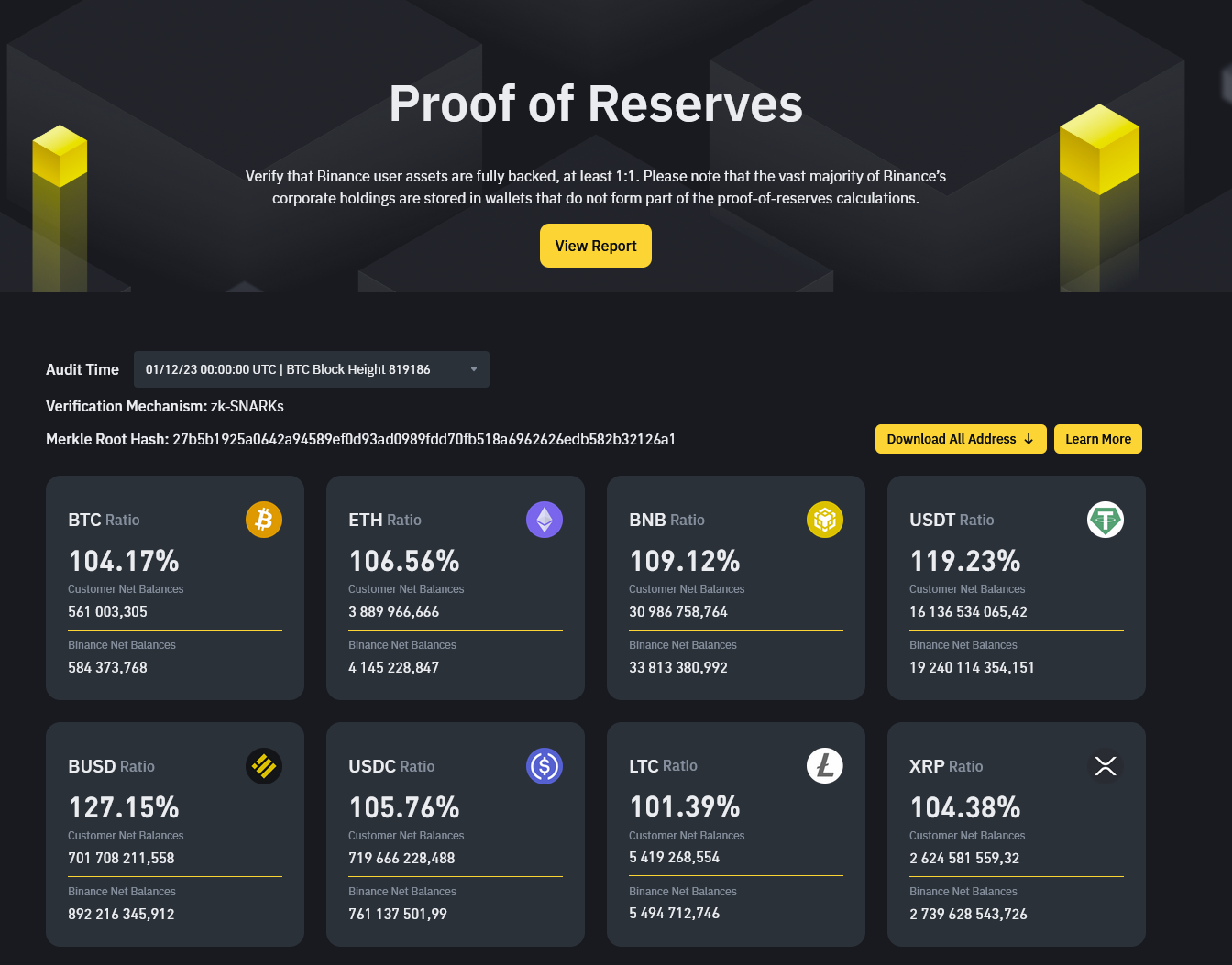

Audits of Proof of Reserves on the Binance exchange. The current status of reserves can be viewed here.

How it works

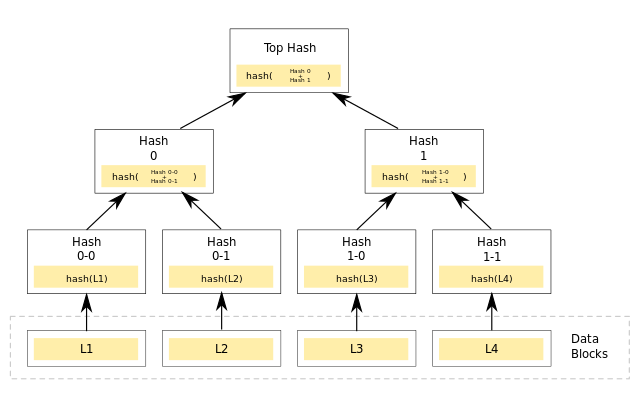

The Proof-of-Reserves (PoR) process converts each account's balance information into what is known as a Merkle tree. A Merkle tree is a structure used for efficient data integrity checking, proposed by cryptography scientist Ralph Merkle in the early 80s. The user's data balance is hashed into a "sheet". The data of a group of users, i.e., "leaves", is then hashed to form a "branch", and the group of "branches" is in turn hashed to form a "root". The auditor then verifies that the corresponding exchange addresses (i.e. public keys) belong to the blockchain.

There are several verification algorithms, but one of the simplest is “instructed funds transfer”. The exchange, at a set point in time, transfers a certain balance of cryptocurrency from one wallet to another, providing the corresponding transaction hashes, thereby confirming that the funds are at its disposal. An example of such a transaction was observed on November 28, 2022, when 127,351 bitcoins were transferred (USD 2.06 billion at the time of the transaction). From an algorithmic point of view, there are other verification concepts besides the Merkle tree, such as zk-SNARK or zk-STARK.

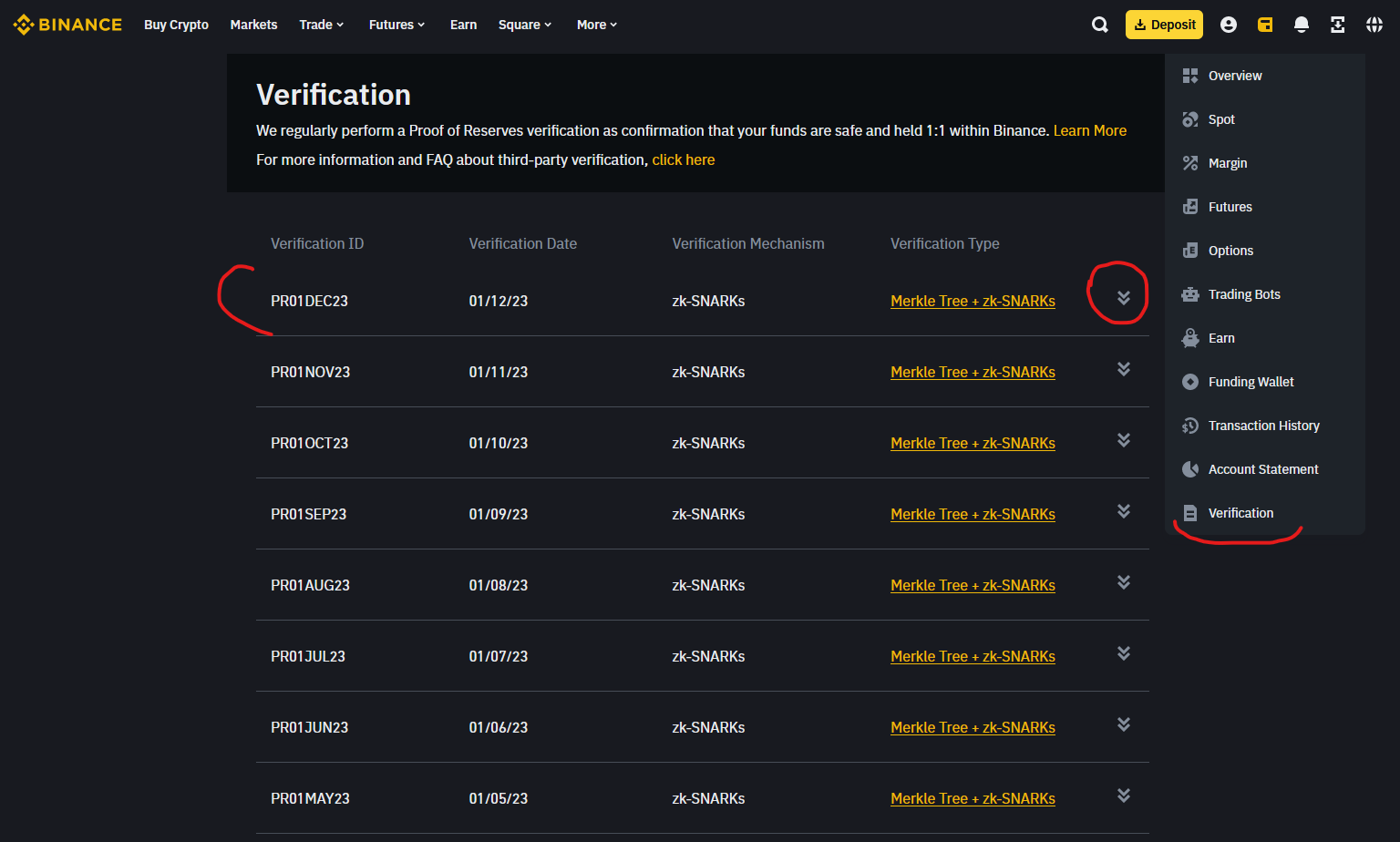

Some exchanges provide their customers with the opportunity to verify that their account was included in the PoR verification. For example, on Binance, you can select “Verification” in your account and check whether your account participated in the construction of the Merkle tree.

Types of Proof-of-Reserves

The adoption of Proof-of-Reserves (PoR) is an initiative of each exchange. Some market participants do not consider it necessary to confirm their reserves. However, it is clear that an exchange using PoR will gain more trust from its customers. At the moment there are no uniform standards and industry regulation. There are several main PoR techniques:

- Partial unaudited confirmation of resources: The exchange independently publishes data without the involvement of an independent auditor and without disclosing public keys.

- Partially Audited Proof of Resources: The exchange provides reserve data and all public keys are verified by an independent auditor.

- Full unaudited confirmation: The Exchange independently matches reserves with aggregated liabilities to clients.

- Full auditable confirmation: Reconciliation of public keys with obligations using an independent auditor (described in the article above).

Disadvantages of the Proof-of-Reserves concept

Despite all the obvious advantages of the Proof-of-Reserves concept, it also comes with some disadvantages:

- Partial confirmation does not provide information about the exchange's liabilities, so reserve data does not provide a complete picture of the financial strength of the exchange.

- Full confirmation audits with independent audit may create privacy concerns because such audits require access to customer account information.

- PoR does not take into account all assets, including those involved in lending.

- Exchange balances change regularly, so any PoR check reflects the situation only at a certain point in time.

- Audited confirmations involve independent players and there is always the possibility that they may act in the interests of competitors or regulators.

- There is always the possibility of an error by the auditor or the risk of collusion between the auditor and the exchange to distort the results of the audit. As a reminder, even bankrupt FTX was audited.

Which exchanges have already supported the PoR concept?

After Binance proposed the Proof-of-Reserves concept, many major players in the cryptocurrency industry joined the initiative. Below is a table of exchanges that, at the time of writing, have passed PoR verification using various methods. It should be noted that the information in the table is current at the moment, and the list is expected to grow as new participants join.

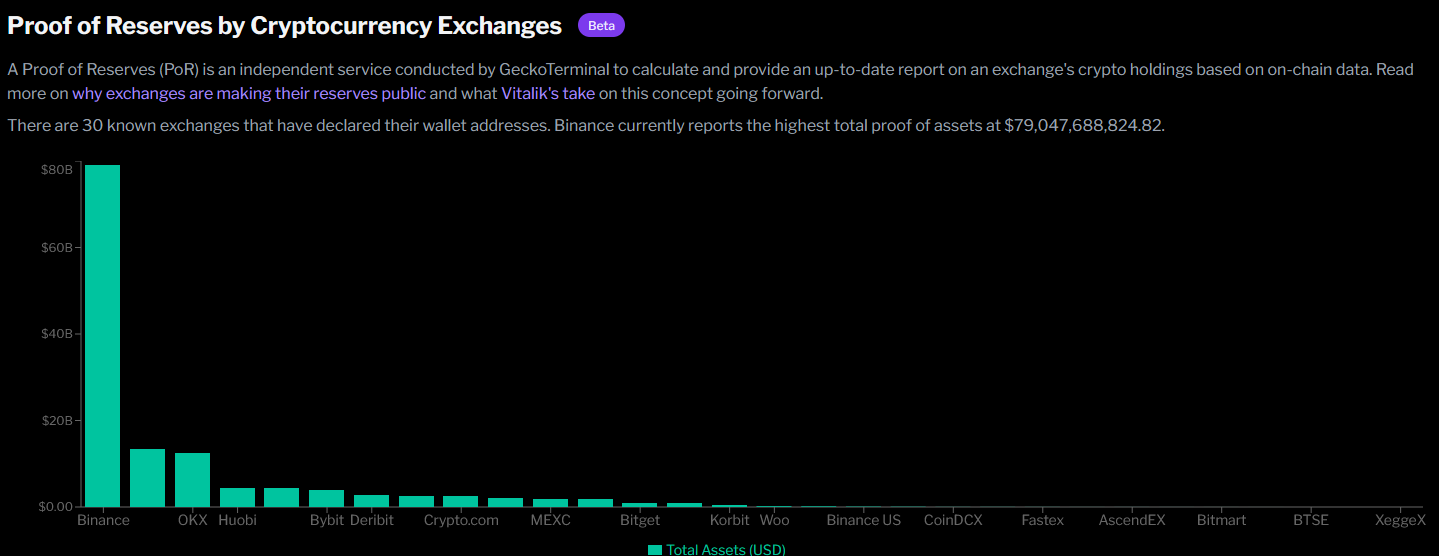

Data on PoR reserves at the time of writing:

- Binance: $78 938 372 770

- Bitfinex: $13 301 482 072

- OKX: $12 388 908 077

- Kraken: $4 382 524 216

- HTX: $4 365 170 758

- Bybit: $3 851 395 442

- Derbit: $2 733 023 832

- Kucoin: $2 555 296 864

- Crypto.com: $2 473 039 032

- Gate.io: $2 144 678 144

- MEXC: $1 763 660 465

- Bitstamp: $1 758 119 715

- Bitget: $1 006 789 204

- Bitmex: $884 310 121

You can view the current state of reserves of various exchanges on the GeckoTerminal aggregator. Also, usually exchanges that participate in Proof of Reserves display audit data on their websites.

Conclusion

The cryptocurrency market is on the verge of significant regulatory transformations. In various countries, legislators are actively working to develop an appropriate legal framework, seeking to take control of a relatively decentralized market with extensive capitalization. The inevitable introduction of strict regulation in the cryptocurrency sector is becoming a matter of time. In my view, significant legislative changes will begin as early as 2024 in the US and will likely spread to other jurisdictions.

However, the need for “regulation from below” is also growing. The influx of fraudulent schemes, scam projects and financial pyramids sweeping the market causes discontent in the community and emphasizes the relevance of internal regulation.

Proof-of-Reserve (PoR) is one of the internal regulation tools, which is reflected in the initiative of exchanges to confirm their reserves. Despite the lack of uniform industry standards today, many participants have actively joined the Binance-inspired concept. Proof of reserves regularly makes the market more transparent, increases user confidence and provides the cryptocurrency sector with much greater credibility potential compared to the traditional banking system. It is important to note that the checks are based on mathematical algorithms, which reduces the influence of the human factor.

Over time, with an increase in the number of exchanges participating in PoR, we can expect improvements in verification algorithms and the emergence of independent audit companies. This will provide necessary competition and increase transparency in the cryptocurrency market, encouraging small players to join the trend and confirm their reserves, otherwise risk losing their customers.

Regarding the question of which exchange is the safest in terms of storing user assets, at the moment it is undoubtedly the Binance exchange. Since the total size of Binance reserves is more than $78 billion, which is more than 6 times more than its closest competitors BitFinex and OKX. In addition, according to the audit data, Binance's reserves are greater than the total amount of funds of users who store money on the exchange. Depending on the cryptocurrency, Binance reserves cover user balances by 104-127%. From all of the above, we can conclude that Binance users can be confident that all their assets are backed 1:1.