The Fear and Greed index is probably familiar to all cryptocurrency fans, as many specialized media outlets like to refer to it during the most tense moments in the cryptocurrency market. If we recall the famous phrase of Warren Buffett "Buy when everyone is selling, sell when everyone is buying", then the Fear and Greed indicator, if we follow Buffett's advice, just tells us when to buy or sell. To test this statement, we found an interesting chart with the indicator color superimposed on the cost of the first cryptocurrency Bitcoin over a long period of time. According to which we can draw certain conclusions and find out whether or not to follow such advice.

The Fear and Greed index is probably familiar to all cryptocurrency fans, as many specialized media outlets like to refer to it during the most tense moments in the cryptocurrency market. If we recall the famous phrase of Warren Buffett "Buy when everyone is selling, sell when everyone is buying", then the Fear and Greed indicator, if we follow Buffett's advice, just tells us when to buy or sell. To test this statement, we found an interesting chart with the indicator color superimposed on the cost of the first cryptocurrency Bitcoin over a long period of time. According to which we can draw certain conclusions and find out whether or not to follow such advice.

If you are not familiar with this index, read this article: Fear and Greed Index - what is it and how is it calculated?

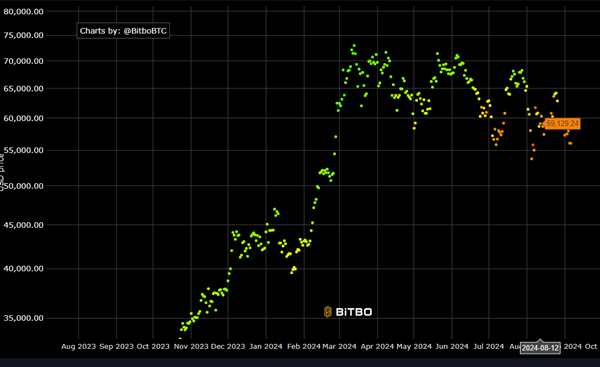

The Bitcoin price chart combined with the Fear and Greed Index looks like this:

You can see this chart yourself on the Bitbo.io website

As you can see from the chart, at its peak or minimum values, the chart has the appropriate color, as Buffett bequeathed. That is, at the peak of the maximum price, the chart is green, which signals maximum greed in the market, when the majority is buying. It is at this moment that it is most profitable to sell your assets. And the minimum values are colored red, when there is maximum fear and the majority is selling. When buying an asset for further speculation will give the maximum profit.

That is, one can fully agree with Buffett's statement that you need to buy when everyone is selling, and sell when everyone is buying.

But between the maximum and minimum price values, there is some uncertainty for a fairly long time, when the chart is red, but continues to fall, and vice versa, long-term price increases are visible with an unchanged green color.

Actually, during this period, the fear and greed indicator does not work properly, because the duration of the growth or decline cycle is difficult to predict. Therefore, relying solely on this indicator in your decisions on the market will not be the most correct strategy, so experienced traders use additional tools for analysis, for example, the Hash Ribbons indicator (What is the Bitcoin Hash Ribbons indicator), and their own sense of the market, which is also important.

Conclusion: Fear and Greed Index is a useful tool for understanding the general state of the market and it really works when a turning point occurs, which is clearly visible in historical perspective. But in intermediate states, when there is a growth or decline phase, it serves more as an auxiliary tool and you should definitely not rely entirely on it in your decisions.

In short, the Fear and Greed Index, like all similar tools, does not provide a 100% guarantee, but only helps to assess the current state of the market.