The Fear and Greed Index is a number from 1 to 100, is a trading indicator and displays the probability of the crypto market rising or falling in the future. If the index value is low: from 1 to 25 - this means that Bitcoin and the entire crypto market will fall, as people are experiencing strong fear and selling their assets. Conversely, with a high index value (75-100), traders and investors are experiencing strong greed and excitement, so they buy cryptocurrency.

The Fear and Greed Index is a number from 1 to 100, is a trading indicator and displays the probability of the crypto market rising or falling in the future. If the index value is low: from 1 to 25 - this means that Bitcoin and the entire crypto market will fall, as people are experiencing strong fear and selling their assets. Conversely, with a high index value (75-100), traders and investors are experiencing strong greed and excitement, so they buy cryptocurrency.

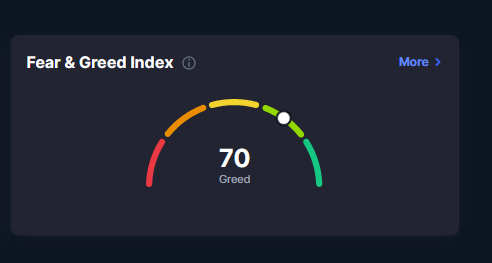

Main values of the fear and greed index:

From 1 to 25 - extreme fear.

From 26 to 50 - fear.

From 51 to 75 - greed.

From 76 to 100 - extreme greed.

The crypto market is highly dependent on people's emotions. When users are afraid, see bad news and a drop in cryptocurrency rates, they prefer to sell their assets, following a momentary impulse, and vice versa, when rates rise, traders are afraid of missing out on profits and, following the syndrome of missing out (FOMO), buy cryptocurrency.

How the fear and greed index is calculated:

What the Fear and Greed index depends on:

- The index depends on market volatility by 25%. That is, current cryptocurrency prices are compared with price changes over the past 90 days. Volatility is mainly used as an indicator of fear.

- The fear and greed index is 15% dependent on social media. Mentions and hashtags in popular social media are taken into account for greed.

- Bitcoin dominance is 10% dependent: the higher the percentage of Bitcoin dominance to all other cryptocurrencies, the less people are interested in altcoins. A decrease in the BTC dominance percentage indicates an increase in greed, since in this case more people invest in a riskier asset - alternative cryptocurrencies.

- The index is 15% dependent on user surveys, and the more people participate in surveys and questionnaires, the higher the greed indicator.

- The Fear and Greed index is 25% dependent on market momentum. Momentum in this context is the market's ability to maintain a price trend as long as possible. This signal helps determine the state and direction of the market.

- The index is 10% dependent on search phrases in search engines and various aggregators. The more people search for words related to Bitcoin and cryptocurrencies, the higher the greed indicator.

Can the Fear and Greed Index be used for trading?

In fact, the FnG index is more of an indicator of the current state of the market at a particular point in time (the index is updated once a day). In fact, the Fear and Greed index can help you choose the right time to enter the cryptocurrency market. For example, with a low index, you can expect that the cryptocurrency will grow. And vice versa, a high index may indicate an imminent fall in the market. The closer the index gets to its extreme values, the more likely the market will reverse in the near future. The index is ideal for long-term market analysis.

However, the FnG index does not provide reliable insights into the future price of assets, since it simply tracks the mood and emotions of users, and is not any kind of fundamental technical analysis.

This material is purely informational in nature and is not a trading recommendation or a call for investment. Trading in any markets, and especially in cryptocurrency, is associated with high risks and you should make your decisions based on your financial capabilities and analytical data.

You can monitor the current indicator, as well as the history of the fear and greed index on our mining calculator website Profit-mine.com in the pop-up widget in the right corner of the site header or on the CoinMarketCap website.