On our website, we have repeatedly discussed the revolutionary decentralized exchange (DEX) Hyperliquid. This time, we will look at using this exchange not as a trading tool, but as an opportunity for passive income through a special liquidity pool called Hyperliquidity Provider, or HLP for short. This pool is necessary to provide liquidity for the margin positions that traders open on the exchange itself; in other words, this pool provides the loans for leveraged trading. How much and in what way one can earn from this will be explained further in this article.

As we mentioned, the Hyperliquidity Provider pool is needed to facilitate leveraged margin trades, meaning traders trade on credit, and the credit funds are provided precisely from the HLP pool. For using these credit funds, a trader is charged an opening fee for such a trade and ongoing payments as long as their leveraged position remains open. All these inflows increase the HLP pool and are distributed evenly among the contributors to this liquidity pool.

When a trader makes a mistake and closes their trade at a loss or their position is completely liquidated, the HLP pool profits from it.

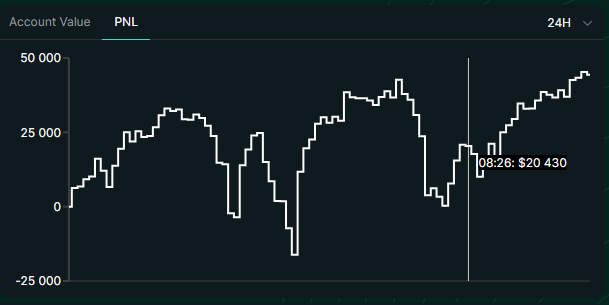

However, the opposite also happens: when a trader closes a deal in profit using leverage, i.e., earns money, then in this case, the trader is paid their profit from the HLP pool, and accordingly, the pool's yield decreases or can even become negative if many trades with positive PNL are closed on the exchange.

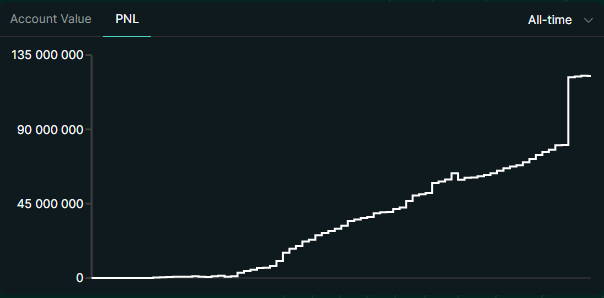

But since 95% of traders lose their money in the long run, the HLP pool ultimately tends to increase at the expense of the "losing" traders.

This statement is confirmed by the statistics of the HLP pool itself for the entire period of its existence.

Hyperliquidity Provider Statistics for All Time

As you can see, the chart is ascending, although if you look at the daily or weekly chart, it might show negative returns. This means that considering investments in the HLP pool should only be done with a long-term perspective.

Return on Investment in Hyperliquidity Provider

The yield of the HLP pool depends on many factors, primarily the number of traders on the exchange and the size of the pool itself. The more traders and the smaller the pool size, the higher its yield.

The second most important factor is the market condition itself. When the market is rising or bullish, traders more often close trades in profit, unlike in a declining market.

Yield is also influenced by events such as the sharp drop in the crypto market on October 10-11, 2025, when positions worth $20 billion were liquidated. On that day alone, HLP earned over 10% for its contributors.

If we take the average value of the HLP pool's yield, one can expect around 10% per annum in the USDC stablecoin.

Instruction: How to Earn with the Hyperliquid Liquidity Pool

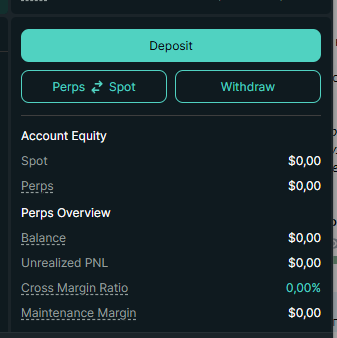

1 Go to the Hyperliquidexchange and connect your Web3 wallet (Metamask, Trust Wallet, Safe Pal, and others).

2 Your wallet must have USDC cryptocurrency on the Arbitrum network.

Transfer from a CEX exchange or use DeFi exchange protocols and bridges.

3 On the main screen, find the DEPOSIT button (lower right corner). Make a deposit in USDC, Arbitrum network. The deposit to the exchange is credited within 10-15 minutes.

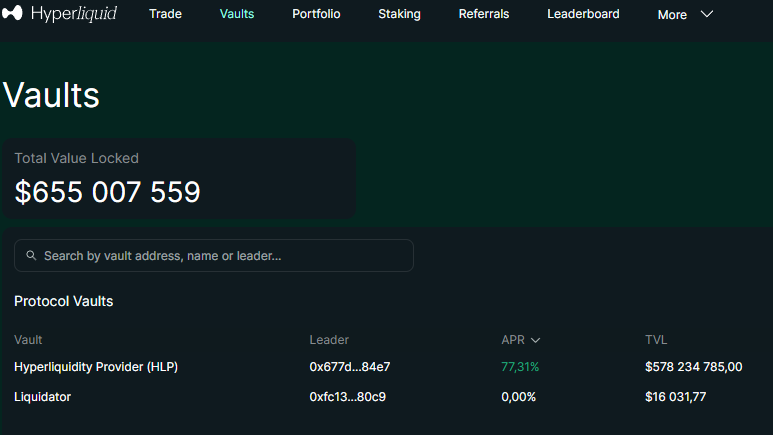

4 Go to the Vaults section and select Hyperliquidity Provider (HLP).

5 In the HLP pool window, click the DEPOSIT button (upper left corner) and specify the amount available in USDC on the exchange.

6 Observe how the balance of your deposit in HLP changes.

7 ПIf necessary, you can withdraw your funds from the HLP pool at any time.

You can read more about the Hyperliquid DEX exchange in this article: Hyperliquid: A Revolutionary DEX Exchange for Crypto Traders of the Future

Conclusion: The yield of the HLP pool on Hyperliquid is not a stable positive value, like, for example, in lending protocols such as AAVE, but you get a yield approximately twice as high in the long run. At the same time, you can sometimes receive significant bonuses, as was the case on October 10, 2025. Yes, investing your USDC in HLP is noticeably riskier than in the time-tested AAVE protocol, so it is not a magic "MONEY" button that everyone is looking for, but just another DeFi tool where the risk-reward ratio, in my opinion, is one of the most optimal for passive investments in crypto assets.