The cryptocurrency market is experiencing a deep correction in early 2026. Bitcoin, the leading asset, has plunged to lows not seen since 2024, wiping nearly $1 trillion from the industry's total market capitalization since the start of the year. As of February 6, 2026, Bitcoin has lost over half its value from its October 2025 peak, with its price tumbling to around $60,000 per BTC. The primary drivers behind this sharp crypto market and Bitcoin collapse are:

The cryptocurrency market is experiencing a deep correction in early 2026. Bitcoin, the leading asset, has plunged to lows not seen since 2024, wiping nearly $1 trillion from the industry's total market capitalization since the start of the year. As of February 6, 2026, Bitcoin has lost over half its value from its October 2025 peak, with its price tumbling to around $60,000 per BTC. The primary drivers behind this sharp crypto market and Bitcoin collapse are:

- A Hawkish Fed Nomination. A four-day sell-off was triggered by news of Kevin Warsh—a known advocate for tight monetary policy—being nominated as the next Federal Reserve Chair.

- Massive Outflows from Bitcoin ETFs. U.S. spot Bitcoin ETFs have seen sustained capital flight: over $7 billion in November, about $2 billion in December, and more than $3 billion in January.

- Loss of Institutional Interest. Analysts report that traditional investors are losing appetite for cryptocurrencies, shifting focus back to stocks and gold.

- Regulatory Gridlock. The legislative process for the CLARITY Act, designed to establish clear rules for digital assets, has stalled in Congress.

Key Market Consequences

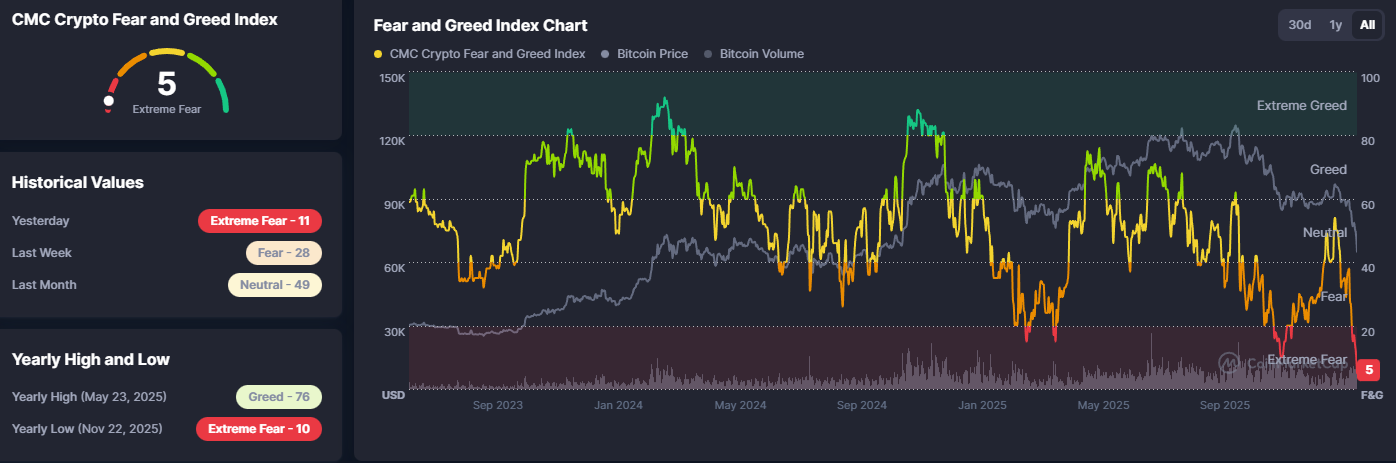

The Crypto Fear & Greed Index has plummeted to an "Extreme Fear" level of 5—a reading not seen in years and potentially the lowest in the index's history.

Bitcoin has broken its traditional correlations. It no longer moves in tandem with gold (its "digital gold" narrative) and has decoupled from major stock market indices.

Surveys indicate crypto adoption in the U.S. has fallen to ~12%, down from 17% in the summer of 2024.

Analyst Predictions

Deutsche Bank analyst Marion Laboure suggests the current sell-off marks the end of the "Tinkerbell effect" - the transition from a speculative phase to an institutional one. She argues Bitcoin will not replace gold or fiat currencies, and its volatility will remain a core feature.

Analysts agree that a key condition for market recovery is the passage of the CLARITY Act, which could provide crucial legal clarity. Without it, a sustained return of investor confidence is unlikely.

Despite the crash, Bitcoin is still trading approximately 370% higher than at the start of 2023. As Laboure summarizes, Bitcoin will "not replace traditional assets, but is unlikely to disappear." Its future now hinges on a regulatory breakthrough.