According to various estimates, the total number of cryptocurrency users worldwide is approaching one billion, while the number of active monthly traders reaches tens of millions. Most newcomers enter with one goal: to buy a promising coin, wait for it to rise, and lock in profits several times over. However, the harsh reality is that the overwhelming majority of altcoins (alternative cryptocurrencies excluding Bitcoin) eventually lose 80–99% of their value or become completely worthless over time. In this article, we will examine in detail why this happens, how altcoins fundamentally differ from stocks, what a typical coin lifecycle looks like, and the mistakes almost all beginner investors make. We rely on statistics, historical data, and market mechanics to provide an objective picture.

According to various estimates, the total number of cryptocurrency users worldwide is approaching one billion, while the number of active monthly traders reaches tens of millions. Most newcomers enter with one goal: to buy a promising coin, wait for it to rise, and lock in profits several times over. However, the harsh reality is that the overwhelming majority of altcoins (alternative cryptocurrencies excluding Bitcoin) eventually lose 80–99% of their value or become completely worthless over time. In this article, we will examine in detail why this happens, how altcoins fundamentally differ from stocks, what a typical coin lifecycle looks like, and the mistakes almost all beginner investors make. We rely on statistics, historical data, and market mechanics to provide an objective picture.

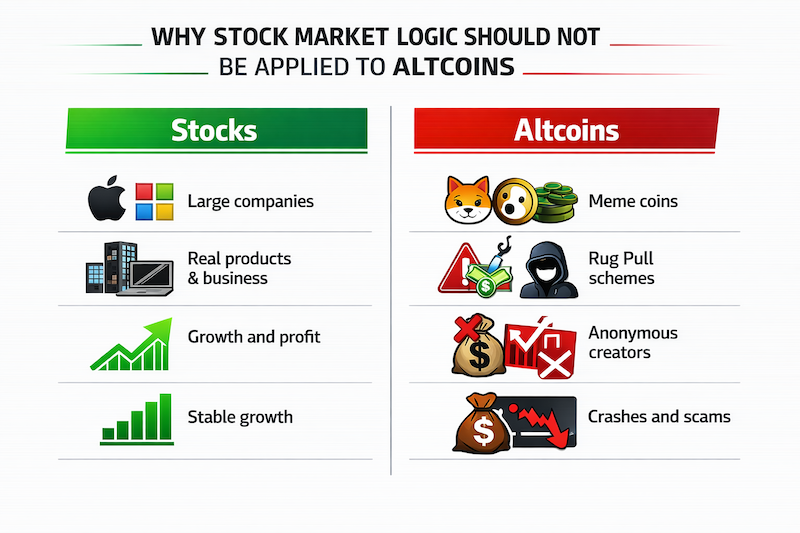

Why newcomers compare crypto to stocks — and why this is the main mistake

Many people come to crypto with experience in the stock market and apply the same logic: “If a company is good, you should buy more during dips — the price will eventually rise over time.” This strategy works for Apple, Microsoft, Google, or NVIDIA because real businesses with products, revenue, financial reporting, shareholders, and long-term management interests stand behind those stocks.

In the vast majority of cases, altcoins tell a completely different story. Most of them have no working product, no team with a reputation, and no regular reporting. Anyone can launch their own token in just a few hours (on Solana via Pump.fun, on Ethereum, or Base) without any investment in development, marketing, or legal setup.

As of early 2026, the total number of created tokens exceeds 30 million, with the bulk being memecoins and speculative tokens. Several million new projects appeared in 2025 alone. The overwhelming majority are launched with a single purpose: to quickly gather liquidity (attract buyers), pump the price through hype, and allow creators to exit with profits (the so-called “rug pull” or gradual sell-off).

The real lifecycle of an altcoin: 5–10% growth and 90–95% decline

Here is the most important statistic that is rarely mentioned publicly:

- A typical altcoin spends only 5–10% of its time in a strong growth phase.

- The remaining 90–95% is either sideways movement or deep decline.

A coin can rise 3–10x in 1–4 weeks amid hype, a major exchange listing, viral meme effect, or a general bull market. After that comes a long distribution phase (when early investors and the team sell off) followed by a collapse.

Examples:

- Many memecoins from 2024–2025 (various dog, cat, political, or celebrity tokens) rose dozens of times in days, then lost 90–99% over months.

- The classic case is Terra (LUNA) in 2022: a drop of more than 99.9%.

- Even relatively successful projects like Shiba Inu or PEPE have gone through several cycles where the price fell 80–95% from peaks.

Analysis of hundreds of altcoin futures shows that only about 10–20 coins out of 500+ managed to hold gains above 100% from local highs over a long period. Just a few percent of projects sustained more than 30% growth. Hundreds of tokens lose 80–99% of their value within 1–2 years after launch.

Failure statistics: 95% of altcoins become worthless

According to CoinGecko and other analytics platforms, more than 53% of all tokens launched since 2021 have become “dead” (trading ceased, volume fell to zero, or the project was abandoned). In 2025, this figure broke all records: about 11.6 million tokens failed, accounting for over 86% of all failures in the past five years. Many sources claim that 99% of all tokens ever created will eventually go to zero — only a handful with real utility, strong community, and team survive.

Reasons for death:

- Lack of a real product and development.

- Full token allocation to the team/investors (high unlocks).

- Lack of liquidity after the initial pump.

- Regulatory risks, loss of community interest, rug pulls.

Why most losses occur on longs (even in a bull market)

Paradoxically, historically the largest losses for traders come from long positions. In 2025, the total liquidation volume exceeded $150 billion. The largest single-day incident (October 10, 2025) — $19 billion, of which 85–90% came from longs.

Why does this happen?

- During growth, people go all-in on their deposit + use high leverage (10–50x and higher).

- They forget about stop-losses or set them too far away.

- They believe in “endless growth” and hold through drawdowns.

- They buy at highs after FOMO (fear of missing out).

As a result, even if a coin rises 300–500%, most participants do not take profits in time due to greed and end up with losses after the pullback.

What really happens in “altseason”

Everyone waits for Altseason as a period when altcoins outperform Bitcoin and deliver huge multiples. In reality, a typical altseason looks like this:

- A short impulsive pump (often 2–6 weeks).

- Followed by a long dump (80–95% drop for most coins).

In 2025, there was practically no classic prolonged altseason: altcoin rallies were very short (on average about 20 days vs. 45–60 in previous cycles), and Bitcoin dominance remained high. Altseason indices (Blockchain Center, CoinMarketCap) rarely rose above 75 points and quickly fell back.

Main psychological mistakes of traders

- Buying at highs after strong growth (FOMO).

- No profit-taking plan.

- Holding losses in hope of recovery.

- Ignoring risk management (position >1–2% of deposit, high leverage).

- Belief that “this coin will definitely 100x,” based on hype rather than analysis.

How to properly approach altcoin trading in 2026

Altcoins are not long-term investments in the classic sense. This is a market of short-term speculative impulses and opportunities for trading both up and down.

Practical recommendations:

- Never allocate more than 1–2% of your deposit to a single coin.

- Always use stop-losses (5–15% below entry, depending on volatility).

- Take profits in parts: 30–50% at +50–100%, the rest with a trailing stop or at specific levels.

- Study token distribution, unlocks, team, and real project activity.

- Trade both directions: short weak hyped projects after a pump (with a tight stop).

- Monitor overall market structure: alts perform best when Bitcoin is stable or slowly rising.

- Develop discipline and keep a Trader’s Journal.

Conclusion

The overwhelming majority of altcoins are not created to become the next Ethereum or Solana, but to quickly collect money. 95% of them lose value over time — this is not a bug, but a feature of the market. Earning here is possible, but only for those who treat altcoins as a high-risk speculative instrument, not as “new Apple stocks.”

If you’re a beginner — start by studying basic risk management and crowd psychology, not by hunting for the “next 100x.” The market rewards discipline and cold calculation, not emotions and greed.

Successful and profitable trading in 2026! This is not investment advice.

(The material is based on analysis of market data from CoinMarketCap, CoinGecko, CoinGlass, and historical patterns of the crypto market. All figures and statistics are current as of early 2026.)