Back in 2025, we discussed liquidity vaults on the DEX exchanges HyperLiquid and Edgex, where investors earn from trader liquidations but can also lose part of their investments when traders close their leveraged positions in profit.

This time, we won't revisit how it works or how to invest in these crypto products. Instead, we'll only summarize the personal experience of investing in the HLP Vault on Hyperliquid and the eLP Vault on Edgex throughout 2025.

Investment in the HLP Vault on Hyperliquid

Let's start with the more well-known and popular exchange, Hyperliquid.

The deposit into the HLP vault on Hyperliquid was made on August 28, 2025.

As of today, 11.3% has been earned on the deposit.

Since 132 days have passed from August 28, 2025, to January 6, 2026, one could say that investments in the HLP pool yield about 31% APR. However, this calculation would be incorrect, as the majority of the return during this period, specifically 10%, was accrued in just one day on October 10, 2025. This was when the cryptocurrency market experienced a collapse with massive trader liquidations amounting to tens of billions of dollars.

Given that such events are unlikely in the future, this 10% return should be excluded when considering the future annual yield of the HLP Vault.

As a result, we get 1.3% over 132 days, or 3.6% per annum.

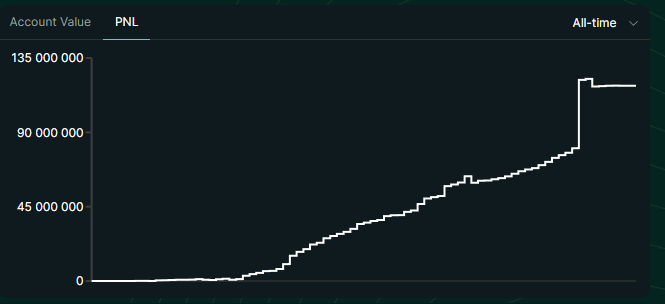

Looking at the HLP yield chart over the entire period, one can notice a stagnation in the pool's yield after the sharp spike on October 10, 2025. To be precise, the pool's yield over the last two months has actually shown negative returns of more than 1% of the deposit.

HLP revenue chart for all time

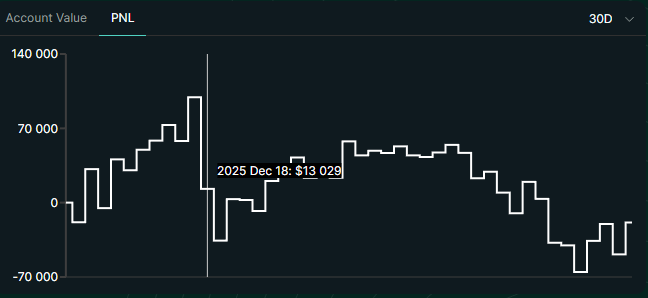

HLP revenue chart for the last month

The situation with the decreasing HLP pool yield after October 10, 2025, can be explained by the departure of a large number of speculative and "casino" traders from the market, who lost all their assets in the October crypto crash. The remaining traders on Hyperliquid are more pragmatic and experienced, closing their trades in profit more often compared to the "crypto gamblers," most of whom have left this market until the next bull rally.

This is precisely why, instead of the expected 10% per annum, we are getting no more than 3% or even negative returns in the near future from investments in such vaults on futures DEX exchanges.

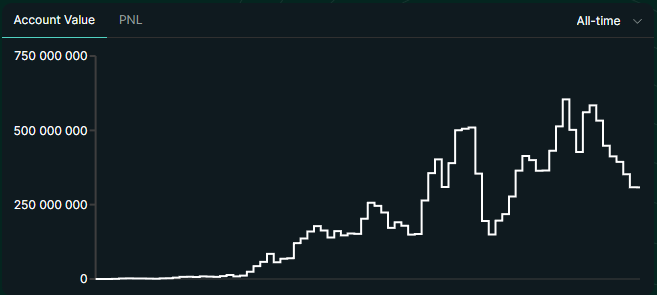

The decline in the total value locked (TVL) in HLP directly tells us that most investors do not believe in high future returns from investing in HyperLiquid's liquidity pool.

Chart of the drop in the volume of USDC in HLP from 600 to 300 million dollars

Investment in the eLP Vault on Edgex

The investment in the eLP Vault on Edgex began on November 6, 2025.

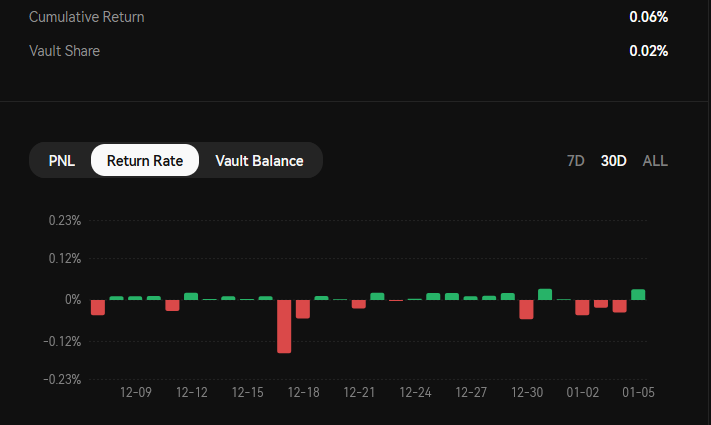

As of today, January 6, 2026, 0.06% has been earned.

Simple calculations show that the annual yield at this rate would be about 0.36%.

Return on investment and the investment return schedule for the last month.

As you may have noticed, 0.36% per annum in USDC is not the kind of return one seeks in cryptocurrencies. Even if this yield were 10 times higher, i.e., around 3% per year, considering the risks of such investments (the possibility of negative returns or complete loss of the vault), they are clearly not worth it. It is much safer to place your USDC in a lending protocol for the same or even a higher percentage.

For the eLP vault on Edgex, the same events are occurring as for HLP: the yield is not increasing but remains around zero after October 10, 2025, and investors are gradually withdrawing their funds from the pool. This further increases the risks of negative returns or complete loss of the vault due to insufficient liquidity to pay traders for their profitable positions on the futures market.

Conclusion: As an investor, I expected to earn 10% per annum or more from investing in liquidity pools on DEX exchanges. However, given current market realities, such returns cannot be expected in the next six months to a year. At least not until the crypto market revives again and traders with ultra-risky earning strategies return.

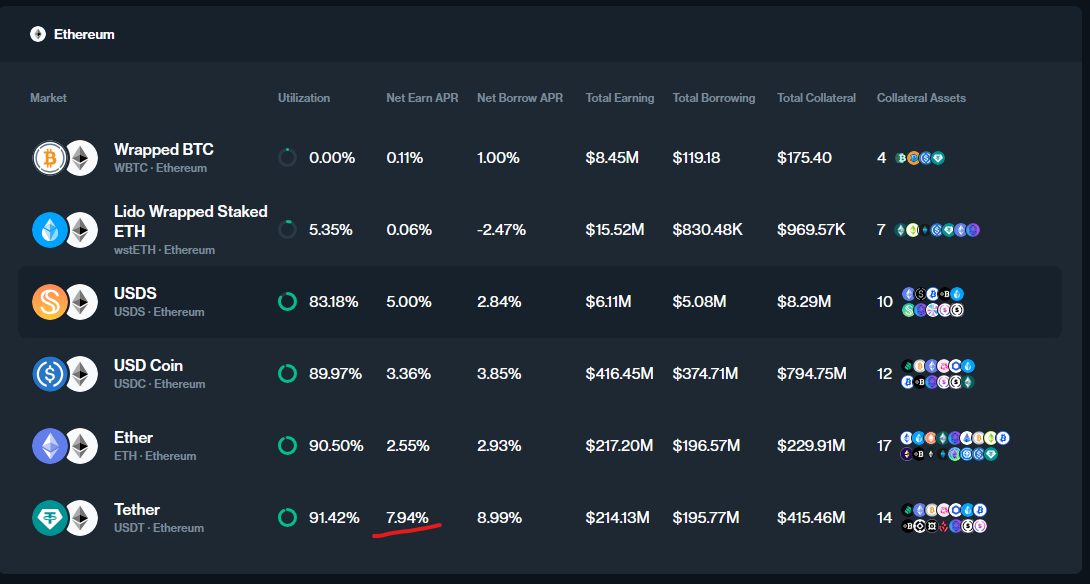

For this very reason, I am also moving my funds from HLP and eLP to lending protocols like AAVE or Compound, where stablecoins can be invested for 5-9% per annum.