Over the past year, a new narrative has emerged in the world of cryptocurrencies: perpetual decentralized exchanges (perpDEXs) based on a novel principle. Instead of liquidity pools, they use special vaults that enable leveraged trading for traders. The first such project to gain widespread recognition was the Hyperliquid exchange. Over the past year, it has garnered many followers, and one such solution is the edgeX perpDEX, which currently offers passive income of up to 70% per annum to investors who deposit their stablecoins into the eLP vault.

Over the past year, a new narrative has emerged in the world of cryptocurrencies: perpetual decentralized exchanges (perpDEXs) based on a novel principle. Instead of liquidity pools, they use special vaults that enable leveraged trading for traders. The first such project to gain widespread recognition was the Hyperliquid exchange. Over the past year, it has garnered many followers, and one such solution is the edgeX perpDEX, which currently offers passive income of up to 70% per annum to investors who deposit their stablecoins into the eLP vault.

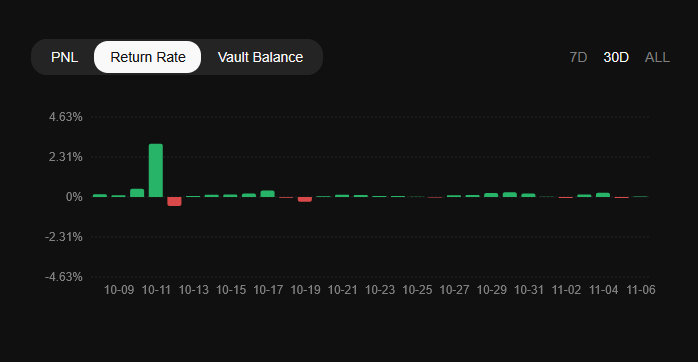

While investing in liquidity vaults on perpDEXs is a form of passive income - requiring no action other than depositing funds - this income is NOT guaranteed. This means that as an investor, you can not only earn income but also incur losses from such investments. Losses for liquidity vaults occur when traders collectively close their leveraged positions in profit, and the payouts are made precisely from the funds in the eLP vault. However, since most traders end up at a loss over the long term, the eLP vault generally shows positive performance, although there are days when the yield turns negative.

Daily eLP vault yield on edgeX over the past month

For more detailed information on earning through investments in liquidity pools on perpDEXs, you can read the article: Hyperliquidity Provider (HLP) - Earn from Traders' Mistakes.

When comparing the Hyperliquid and edgeX exchanges in terms of investments in liquidity vaults, the edgeX solution offers a higher yield compared to HLP, and the difference is quite substantial. The yield of the eStrategy in the ELP pool ranges from 20% to 70%, while HLP offers around 5-10% per annum.

The yield data is provided without accounting for the large-scale liquidations on October 10, 2025, when HLP earned 10% for its investors in a single day, and eLP earned 3%. Since such market events are relatively rare, this day should not be considered for long-term planning.

It might seem that the choice between Hyperliquid and edgeX for passive investments is obvious, and the 40-70% annual yield on edgeX has made the decision for us. However, one must also consider smart contract risks or simply the risk of the exchange being hacked. Since edgeX launched in April 2025, a year later than Hyperliquid, the risk of the EdgeX smart contract being hacked is significantly higher.

Despite being a young project, EdgeX competes on an equal footing with more well-known competitors in terms of trading volume, and the gap between 4th and 2nd place is approximately 50%.

Conclusion: We recommend considering the use of the ELP liquidity vault on the EdgeX exchange if you are seeking high yield for passive investments in stablecoins. Although such investments in liquidity vaults are considered safe, one should also account for systemic risks, such as the exchange shutting down or smart contracts being hacked, which are significantly higher compared to investments in AAVE or USDC/USDT liquidity pools on Ethereum (which yield around 2-5% per annum). Just as with traditional investments, you must accept the additional risks of loss, but the expected return will also be substantially higher compared to other, more proven methods of passive income in cryptocurrencies.