Bitcoin (BTC) continues to solidify its position in the global financial system, reaching a new historic milestone: its market capitalization has hit $1.7 trillion, equivalent to 1.3% of the global money supply. This achievement underscores the growing adoption and increasing influence of Bitcoin in the market, making its long-term outlook even more bullish.

Bitcoin (BTC) continues to solidify its position in the global financial system, reaching a new historic milestone: its market capitalization has hit $1.7 trillion, equivalent to 1.3% of the global money supply. This achievement underscores the growing adoption and increasing influence of Bitcoin in the market, making its long-term outlook even more bullish.

A New Milestone for Bitcoin

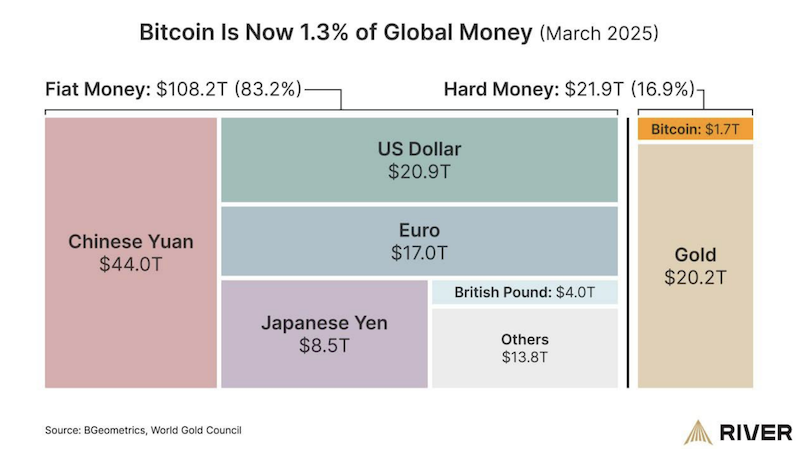

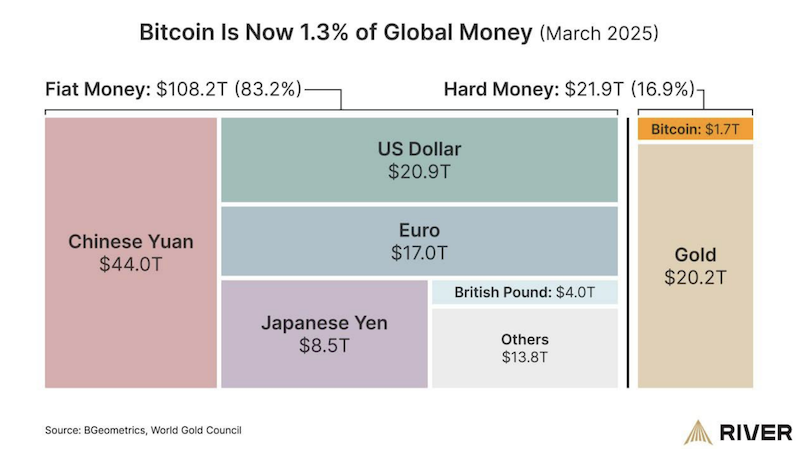

According to recent data, Bitcoin’s total market capitalization has reached $1.7 trillion, representing 1.3% of the global money supply, which is estimated to exceed $130 trillion (including cash, deposits, money markets, and other financial assets). This growth has been driven by a rise in BTC’s price, which in March 2025 fluctuates between $85,000 and $90,000, as well as an influx of institutional investors and the expanding use of cryptocurrency across various economic sectors.

The increase in Bitcoin’s share of the global money supply highlights its growing recognition as a legitimate financial asset. Back in 2013, Bitcoin accounted for just 0.001% of the global money supply, but by 2025, this figure has surged over 100-fold, reflecting exponential growth in interest in the cryptocurrency.

Why This Matters

Reaching 1.3% of the global money supply is not just a symbolic milestone but also an indicator that Bitcoin is becoming an increasingly significant player in the global financial system. The larger its share compared to traditional financial assets like gold, stocks, or bonds, the stronger its potential as a store of value and a hedge against inflation.

- Growing Adoption: The rise in market capitalization reflects increasing trust in Bitcoin from both retail and institutional investors. Major companies like MicroStrategy continue to accumulate BTC, while countries, including the U.S., are beginning to establish strategic Bitcoin reserves.

- Bullish Outlook: Analysts note that Bitcoin’s growing share of the global money supply makes it more resilient to volatility and strengthens its long-term bullish trend. The more BTC integrates into the global economy, the less likely it is to experience the sharp crashes seen in its early years.

- Competition with Traditional Assets: With a market cap of $1.7 trillion, Bitcoin has already surpassed many major corporations and is approaching the market value of gold, which stands at around $14 trillion. If this growth continues, Bitcoin could become a serious competitor to traditional assets.

Outlook and Challenges

Achieving 1.3% of the global money supply is a significant step, but Bitcoin still faces numerous challenges to become a fully integrated part of the global financial system:

- Regulation: Increased scrutiny from regulators in the U.S., EU, and other regions could slow Bitcoin’s adoption, especially if strict restrictions on its use are introduced.

- Volatility: Despite its growth, Bitcoin remains a volatile asset, which may deter conservative investors.

- Competition: Other cryptocurrencies, such as Ethereum (ETH) and Solana (SOL), continue to evolve, offering alternative solutions for decentralized finance (DeFi) and smart contracts.

Nevertheless, the current growth in market capitalization and share of the global money supply makes Bitcoin increasingly attractive to long-term investors. Many experts predict that by 2030, Bitcoin’s share could reach 5% of the global money supply if the adoption trend continues.

Conclusion

Bitcoin’s rise to $1.7 trillion in market capitalization and 1.3% of the global money supply is a crucial signal for investors and market participants. The cryptocurrency continues to prove its relevance as a global financial asset capable of competing with traditional instruments. This milestone reinforces bullish sentiment and highlights Bitcoin’s long-term potential.

What do you think of Bitcoin’s growth? Can it reach 5% of the global money supply in the coming years? Share your thoughts in the comments — your opinion matters in discussing the future of cryptocurrencies!